#28 - Concentration & Fragility

Evolutionary theory suggests that populations with high genetic diversity are better equipped to adapt to environmental changes. Conversely, low genetic diversity can lead to disaster. If this is true in the business world, then increasing concentration could mean that the US economy is becoming more fragile.

One gauge of concentration is the S&P 500. Alphabet, Amazon, Apple, Facebook, and Microsoft currently account for about 20% of the index’s total market cap. This is the highest level since 1980 according to Goldman Sachs research:

At the other end of the spectrum, OpenTable expects that 25% of restaurants shuttered by Covid-19 won’t reopen. Similarly, a recent study from the University of Illinois, Harvard Business School, and the University of Chicago found that the pandemic may permanently shut over 100,000 US small businesses.

Covid-19 is accelerating changes that were underway before the pandemic hit. While about 90% of US businesses have fewer than 20 employees, large businesses are the fastest growing cohort. Between 1990 and 2017, the number of firms with fewer than 20 employees grew 18% while the number of firms with over 500 employees grew 44%:

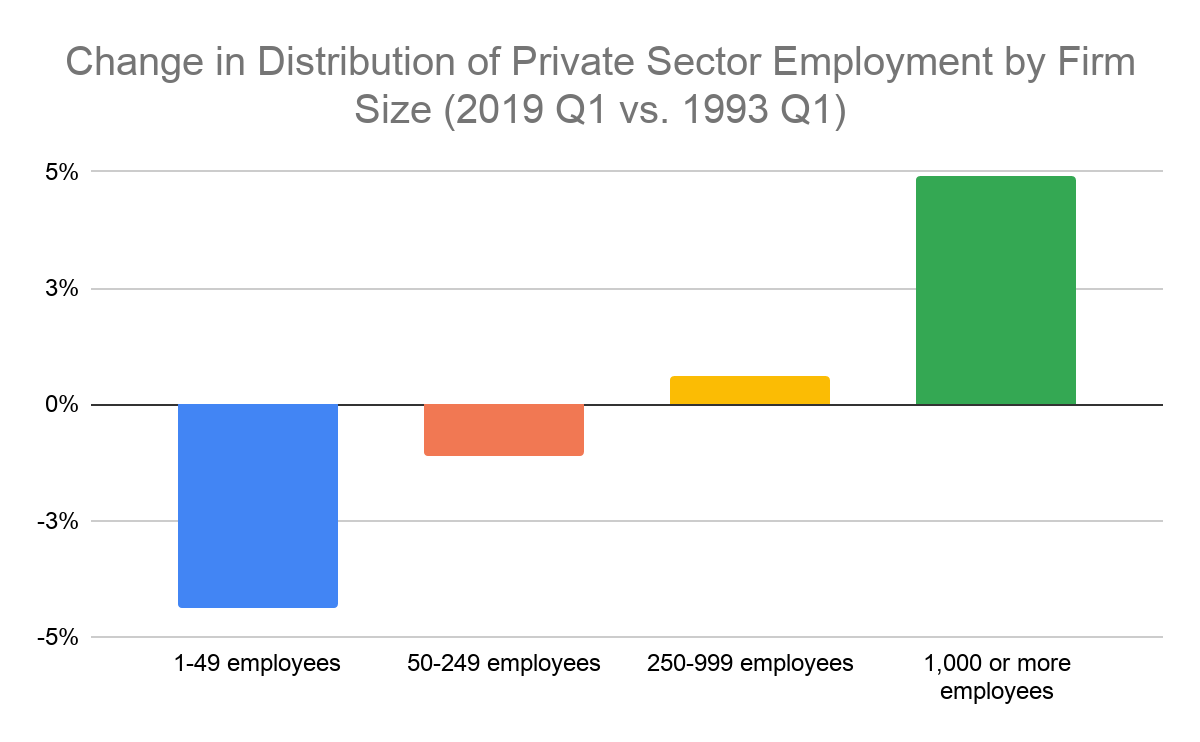

Looking at employment statistics makes increasing concentration clearer. Over time, large firms have accounted for a bigger piece of total private employment:

In the first quarter of 2019, businesses with 1,000 or more employees accounted for 41% of total private employment, up from 36% in the first quarter of 1993. Over the same period, the share of employees working for small employers declined:

On a variety of metrics, the US economy is becoming more concentrated and rising concentration increases fragility.

In Antifragile, Nassim Nicholas Taleb argues that:

What is fragile? The large, optimized, over-reliant on technology, over-reliant on the so-called scientific method instead of age-tested heuristics. Corporations that are large today should be gone, as they have always been weakened by what they think is their strength: size, which is the enemy of corporations as it causes disproportionate fragility to Black Swans. City-states and small corporations are more likely to be around, even thrive.

He makes a similar point in this interview with the International Peace Institute:

First, systems that are optimized or lack redundancies tend to blow up. For example, a system that has a lot of debt and then faces a crisis is usually out of business. It’s like nature gave us two kidneys. The second kidney is a buffer—you don’t have to constantly predict the chances of losing the first one, because you have a back-up. So systems that have such redundancies are less vulnerable. Second, systems that are highly concentrated or centralized cannot handle unpredictability.

The world is an unpredictable place.

The flip-side of higher concentration is lower diversity. In ecology, this is dangerous. The Irish Potato Famine provides an extreme example. In the 1800s, the potato was a staple of the Irish diet and these potatoes were overwhelmingly a single variety, the Irish Lumper. Lumpers were grown through vegetative propagation, a type of asexual reproduction. This meant that offspring were genetically identical to their parents. When disease struck all of the Lumpers were susceptible. The results was the cloned situation below:

This case study on the Irish Potato Famine concludes that:

Although planting a single, genetically uniform crop might increase short term yields, evolutionary theory and the lessons of history highlight an undesirable side effect. Planting genetically uniform crops increases the risk of “losing it all” when environmental variables change.

While businesses are not potatoes, a more concentrated business ecosystem may make the economy more susceptible to blight.

👉 If you enjoyed reading this post, feel free to share it with friends!

For more like this once every weekend, consider subscribing 👇