In late May, Spotify announced it had exclusively licensed Joe Rogan’s podcast in a deal rumored to worth $100 million. In addition to producing notable moments like Elon Musk smoking weed, podcasts like Rogan’s provide the company a path towards a more profitable business model. Here’s a deeper look at why Spotify is moving into podcasts.

Mountains Versus Pebbles - Supply Dynamics

A company’s supplier base can dictate its profitability. In Competitive Strategy, Michael Porter defines a strong supplier group as one that:

Is dominated by a few companies and is more concentrated than the industry it sells to. Suppliers selling to more fragmented buyers will usually be able to exert considerable influence in prices, quality, and terms.

For music, Spotify is reliant on a strong supplier group. The company licenses music from record labels, which are highly concentrated. The big three - Sony BMG, Universal Music Group, and Warner Music Group - control 70% of the market.

On the other side of the market, music buyers are diffuse. This group includes Apple Music, Amazon Music, Pandora, satellite radio, terrestrial radio, and others. This gives record labels leverage.

In contrast to music, podcast suppliers are highly fragmented. While three record labels control 70% of the music market, there are hundreds of thousands of individual podcasters. This includes mega-hits like the Joe Rogan Experience and a very long tail. Record labels are mountains, podcasters are pebbles:

Boxed In: Spotify’s Business Model Limitations

Spotify’s profitability is limited by the power of record labels. Royalties to record labels and music publishers are the company's largest cost. For every $1 of revenue that Spotify generates, over $0.60 is paid out in royalties. This is a marginal expense that scales linearly with revenue. Said another way, the more revenue grows, the more royalties grow. If Spotify generates $100 in revenue, it pays out roughly $60 in royalties. If it generates $1 million, it pays out $600,000.

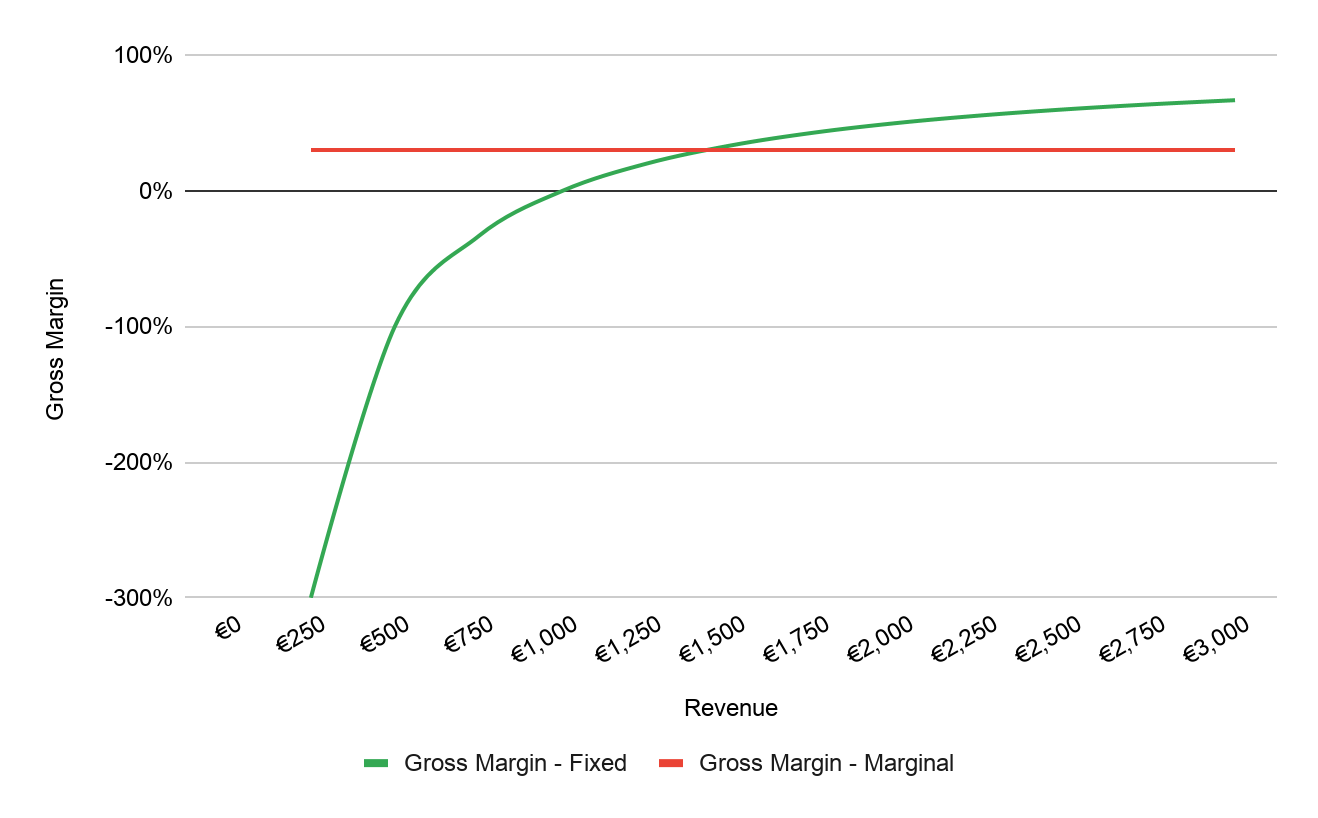

This marginal cost dynamic is illustrated below. With revenue and expenses moving in lockstep, margins - the red dotted line - are constrained:

Spotify’s actual financials look roughly similar to the chart above. The limitations imposed by the marginal expense nature of music are evident. Revenue and cost of revenue have moved in tandem while gross profit margins have varied in a narrow band between 25% and 27% from 2018 onward:

Breaking the Link: Podcasts & Fixed Costs

While music is a marginal cost, podcasts are a fixed cost. Adding fixed cost content has the potential to help Spotify decouple its existing relationship between revenue and expenses. This could translate into higher profitability.

Let's say that Spotify paid $100 million to license the Joe Rogan Experience. If Joe Rogan gets one listen or billions of listens the cost is the same. Of course, Spotify is rooting for the latter. The goal with a fixed cost is to spread it over as much revenue as possible. The more you can spread it out, the more profitable you can be:

With podcasts, more listeners and more revenue translates into higher margins. Loosely speaking, podcasts will look more like the green line below while music will look more like the red line:

Profitability is capped with music, but not with podcasts. Over time, adding podcasts (fixed cost content) helps Spotify decouple the existing relationship between revenue and expenses:

Music will likely remain the bulk of Spotify’s business, but even small shifts towards podcasts can improve the company's bottom line:

In addition to the cost benefit, podcasts provide other strategic advantages. For example, as a substitute for music, podcasts are a way for Spotify to surmount some of the record labels power. As audio streaming mix shifts from music to podcasts, Spotify’s negotiating position improves:

There’s evidence of this shift occurring, albeit off of a low base. In its first quarter of 2020 earnings release, Spotify noted that:

We continue to be excited by the growth trajectory and adoption of podcast content globally. While the current environment has shifted listening patterns temporarily, nothing we have seen changes our long-term view of the potential for Podcasts. Today, 19% of our Total MAUs engage with podcast content, up from 16% in Q4 2019, and consumption continues to grow at triple digit rates Y/Y.

Some of this will be done through acquiring more content, like the Joe Rogan Experience. There’s also a lot that Spotify can do from the product side to nudge users into listening to more podcasts:

In a music-only world, Spotify’s business model is constrained by the power of the record labels. Adding podcasts to the mix is a way for Spotify to loosen this constraint, improving its cost structure and long-term profitability.

👉 If you enjoyed reading this post, feel free to share it with friends!

For more like this once every weekend, consider subscribing 👇

Resources for Going Deeper

How Content Aggregators Pay for Content from Eric Stromberg and Screenshot Essays.