#46 - Lessons from Bessemer Venture Partners Investment Memos

A behind the scenes glimpse into the VC decision making process

A few weeks ago venture capital firm Bessemer Venture Partners (BVP) released investment memos for a handful of successful investments including LinkedIn, Pinterest, and Shopify. While often prolific on Twitter, VCs seldom make this type of document public. The memos provide a behind the scenes view into BVP’s investment and decision making process.

Surfing the Wave

To generate high returns, an investment must be non-consensus and right. Successful venture capital (VC) investments require seeing the future before others do. One of the bets that BVP got right was the consumerization of enterprise software. Their investment thesis was that the enterprise software stack would be recreated in an easier-to-use form for small and medium-sized businesses (SMBs). At the time, few investors thought that investing in software businesses serving SMBs was a good idea.

Historically, business software was developed for enterprises with deep pockets and large IT departments. It was expensive to purchase and complex to install and maintain. The product was sold by sales reps calling on accounts, the right hand side of the sales and distribution chart below:

Source: Daniel Li, Peter Thiel’s Zero to One: A book about secrets

BVP’s bet was that software would be developed to serve the smaller customers on the left hand side of that chart. Two factors enabled this. First, the SaaS delivery model allowed software and updates to be easily delivered over the internet. Second, online marking enabled small customers to be acquired profitably. These allowed companies to develop software for SMBs who couldn’t afford enterprise software.

When you find a good break, keep surfing it. BVP made several investments on the consumerization of enterprise software. In 2010 the firm invested in Shopify, an ecommerce platform. In a few hours, a non-technical merchant can set up an online shop using Shopify. Another example is Wix, a DIY website builder and 2007 BVP investment. Users with no web design experience could use Wix to create a professional website. Other BVP investments in this area include Zendesk, a customer service software, and Freshbooks, a tool for SMB accounting and invoicing.

Starting Small

Shopify is an example of another trend in BVP’s investments which is for companies to start low, then go upmarket. In 2010, Shopify cost as little as $24 per month and its average customer was paying $45 per month. Shopify initially focused on serving entrepreneurs and SMBs, but over time built out an offering for larger businesses. Today the company offers an Advanced plan for $299 per month and Shopify Plus for enterprises starting at $2,000 per month:

Source: Shopify Investor Relations, Q2 2020 Results Presentation, July 2020

Fiverr, an online marketplace for freelance business services, is another BVP investment playing on this theme. The company started out offering gigs that could be done for $5. Over time higher priced jobs were added as the company grew its user base and established trust. While jobs still start at $5, today they can cost over $100:

Source: Fiverr, Wordpress Customization Search, September 2020

The same dynamic was in play at Yelp, a local search and discovery website and 2005 BVP investment. Yelp initially focused on monetizing SMBs but in recent years has built out a salesforce dedicated to serving larger franchises and national accounts.

The start low then move upmarket trend is driven by two factors. The first is that SMBs are cheaper and less fussy to acquire. Enterprises can require a series of legal reviews, service level agreements, and a lot of handholding. This is difficult to provide if you’re an eight person startup. In contrast, SMBs could be acquired through online marketing or self-serve portals. They’re far less resource intensive. Additionally, not many established software companies were focused on them, creating a market opportunity. In a nod to The Innovator's Dilemma, BVP wrote in its Shopify memo that:

Incumbent enterprise software vendors have proven themselves unable to compete as they are fundamentally not oriented to sell to or serve SMBs. They would love to move down market. But doing so would disrupt their business models and cannibalize cash cows. Fundamentally, they know how to sell direct and by channel, but don’t know how to market online.

Think Probabilistically

The future is always uncertain. This is particularly true in venture investing where bets are made on fledgling companies and technologies. Elroy Dimson, professor of finance at London Business School notes:

Risk means more things can happen than will happen.

As such, the future is best thought of as a probability distribution rather than a fixed point. BVP incorporates this into their investment process by adding a scenario analysis to each memo, laying out projected returns under different conditions. This would make Nate Silver happy.

In general, the probability of a disaster was much higher than the probability of a successful investment. For example, the assessed probability of the Pinterest imploding was 10% compared to a 1% probability of an IPO:

Source: Bessemer Venture Partners, Pinterest Investment Memo, April 3, 2011.

Watch Out for Survivorship Bias

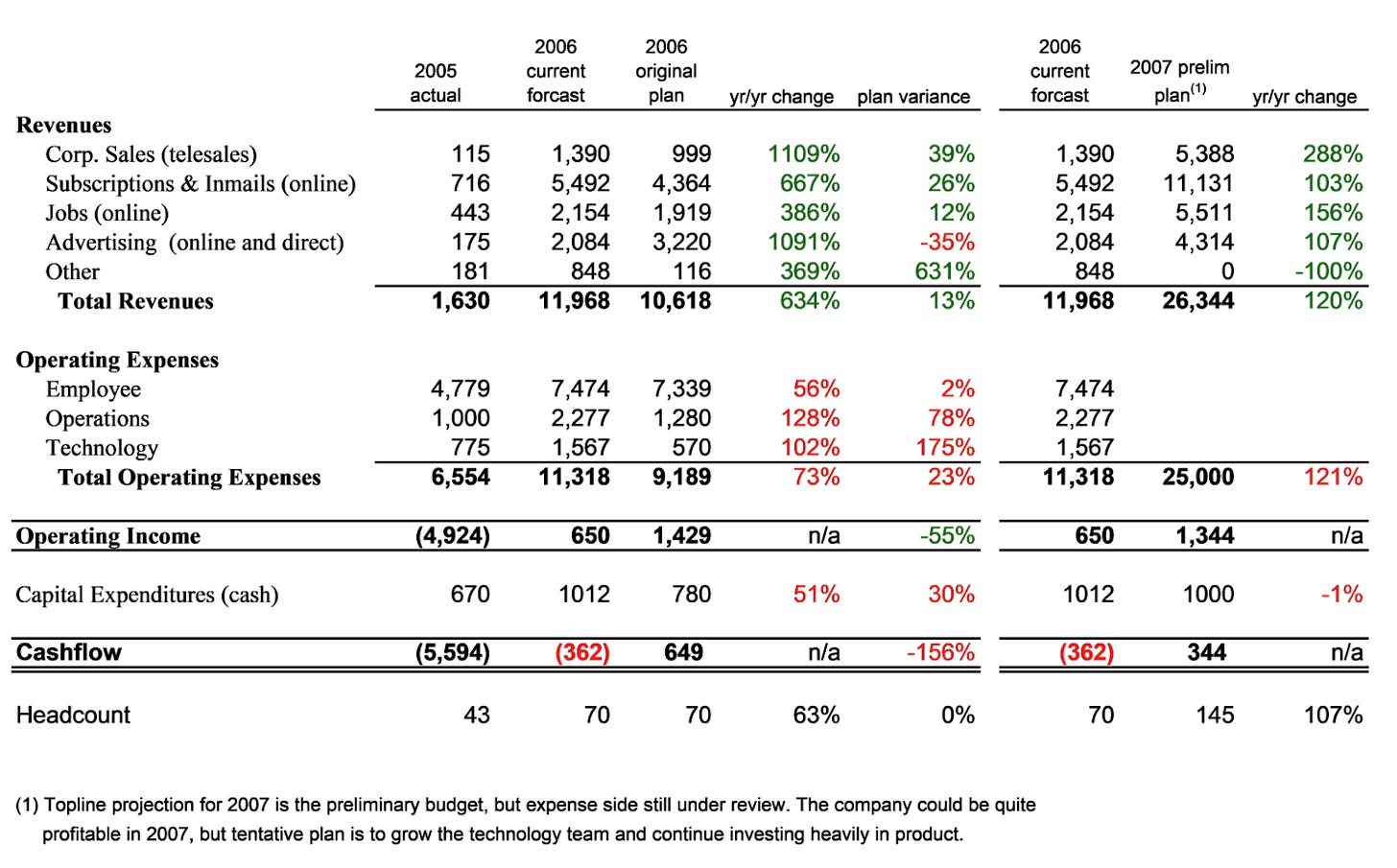

BVP’s investment memos are a good reminder that predictions are hard, especially about the future. For example, during its 2006 investment in LinkedIn, BVP sized the online jobs market at $2 billion. The market turned out to be much larger. In 2019 LinkedIn generated over $6 billion in revenue.

Similarly, in 2005 BVP feared Yahoo as the top competitor to Yelp. The Yelp investment memo notes that Google lacks local user generated content like photos and review and community engagement. Google would eventually add these features and commoditize Yelp. Yahoo now mostly offers Fantasy Football. Standing still in business is a good way to get run over.

BVP only released memos for companies that went public or were acquired, introducing the risk of survivorship bias. While LinkedIn ended up selling into a market that was much larger than predicted, BVP likely has hundreds of memos for companies where the product or market never developed. Few investors publicly trumpet their duds, but it’s worth remembering that for each venture winner there are likely many losers.

The Importance of Timing

Lastly, the memos point out the importance of timing (and luck). BVP landed a 20% stake in Wix for $4 million and 31% of Shopify for $7 million. Today those companies have market caps of roughly $14 billion and $118 billion. In 2010, the products and market were unproven. Wix didn’t even have a business model at the time of BVP’s investment. Getting in early is great if you’re right. Of course, this is easier said than done.

The early 2000s were a less frothy time for tech investment, meaning that BVP could invest at lower valuations and into already profitable business models. Both LinkedIn and Shopify were profitable when BVP invested in them:

Source: Bessemer Venture Partners, LinkedIn Investment Memo, December 11, 2006.

This is a far cry from many venture investments today. Recent tech IPO candidates like Asana, Palantir, Snowflake, and Unity are not profitable.

As markets have grown and investors have seen profitable exits, deals have become more competitive and multiples have expanded. For example, networked note taking tool Roam Research, rumored to have $1 million in annual recurring revenue, just raised a seed round valuing it at $200 million. In this environment returns like what BVP generated on LinkedIn and Shopify will be harder to come by.

Lastly, like most things in life, luck plays a role. For example, Shopify and ecommerce companies generally have benefited immensely from Covid-19 shuttering stores and forcing merchants to move online. While increasing ecommerce penetration was part of the investment thesis in Shopify, no one could have anticipated that a decades worth of ecommerce growth would happen in less than a year. Sometimes it's better to be lucky than to be good.

Additional Resources

If you’d like to learn more, here are the memos referenced above: Fiverr, LinkedIn, Pinterest, Shopify, Wix, and Yelp. Here’s the complete list.

For more like this once a week, consider subscribing 👇

👉 If you enjoyed reading this post, feel free to share it with friends!

This makes a lot of sense! BVP led the Series-A of Bread ($14.3M total round) which just exited for $450M. The probability table, and associated valuations, is a good view into how BVP is likely conducting their post-mortem.

Super interesting - Thanks for the analysis!

Source: https://www.crunchbase.com/organization/bread/company_financial

Source: https://www.pymnts.com/news/partnerships-acquisitions/2020/alliance-data-inks-450m-deal-for-fintech-bread/