Alcoholics Anonymous was founded in 1935 to help members achieve sobriety and stay sober. Gamblers Anonymous launched in 1957 with a mission to help compulsive gamblers stop gambling. Robinhood Traders Anonymous could be started by 2025.

Robinhood’s motto - democratize finance for all - is good PR. If you don’t like it, you’re anti-democratic. But perhaps not everything should be democratized. Weapons of mass destruction for instance. Or derivatives.

Where Are All The Customers Yachts?

Robinhood made trading free and easy, making it popular with consumers. But free products can have pernicious effects. What’s best for the product’s designer may not always align with what’s best for the consumer.

Online products that don’t charge usually monetize user engagement. For example, social media companies like Facebook and Twitter sell ads, so they seek to maximize time spent in their apps. More time equals more ads served. For Robinhood, engagement means trading. The company’s primary revenue stream is payment for order flow. Robinhood makes money by routing customer orders to trading firms like Citadel Securities and Two Sigma, who pay for the right to execute the trades. The more Robinhood users trade, the more revenue it generates and the faster it grows.

This is where incentives between Robinhood and its users could diverge. Regulators are starting to ask if what’s good for Robinhood is also good for its customers. On December 16, Massachusetts filed a complaint against the company. The state alleges that Robinhood markets aggressively to inexperienced investors, has inadequate controls, allows novice investors to execute complicated trades, and incentivizes frequent use through gamification. Robinhood denies the allegations, as you would expect.

This isn’t the company's first brush with regulators.

This week.

On December 17, Robinhood agreed to pay $65 million to settle a Securities and Exchange Commission (SEC) probe into its relationship with trading firms. The SEC claims that Robinhood failed to disclose payment for order flow and that it didn’t get the best prices for its customers, costing them $34 million between 2016 and 2019. Robinhood didn’t accept or deny the SEC’s allegations, as you would expect.

High expectations risk exacerbating this incentive mismatch. Founded in 2013, Robinhood has amassed 13 million accounts, about half the number of Charles Schwab which opened its doors in 1971. Investors have swooned over its growth. The company is rumored to be seeking an IPO at a $20 billion valuation in 2021. Robinhood generated about $270 million of payment for order flow revenue in the first half of 2020, so its valuation suggests that investors expect its lofty growth to continue.

From investment banks to retail brokerages, financial firms make money from getting clients to trade. However, most aren’t expected to generate blistering growth rates.

Are Options The Best Option?

Most of Robinhood’s revenue comes from options trading. Options accounted for $111 million of the company’s $180 million in payments for order flow revenue in the second quarter of 2020 according to Forbes:

Options are a type of derivative. Derivatives are financial instruments that derive their value from the performance of an underlying entity, like a stock or an index. If this sounds complex, it’s because it is.

To learn about the risks of trading options, Robinhood suggests that aspiring options traders read the 188 page Characteristics and Risks of Standardized Options. It’s a dense read. Here’s a taste:

The writer of an uncovered call (other than a binary call) is in an extremely risky position and may incur large losses if the value of the underlying interest increases above the exercise price. For the writer of an uncovered call (other than a binary call), the potential loss is unlimited.

The risk of catastrophic losses is one reason why Warren Buffett has spoken out against derivatives. In Berkshire Hathaway's 2002 letter to shareholders, Buffett wrote:

In our view, however, derivatives are weapons of financial mass destruction, carrying dangers that, while now latent, are potentially lethal.

Options are complex and potentially dangerous. They’re also lucrative. As Ranjan Roy points out in his excellent piece Robinhood and How to Lose Money, because options are illiquid and opaque they carry juicer margins than stocks. The more options people trade, the better it is for Robinhood.

Not surprisingly, the company makes it easy to trade options. In total, about 12% of Robinhood users do this, according to Vlad Tenev, its CEO. Not all of them are seasoned investors. For example, the Massachusetts complaint alleges that 340 state residents with no prior investment experience were approved for options trading, a violation of Robinhood’s own policies.

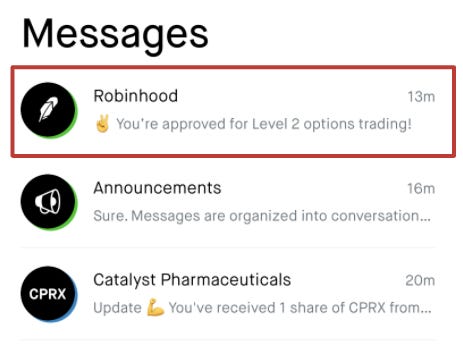

Not wanting the Massachusetts Securities Division to have all the fun, I decided to give applying to trade options on Robinhood a test drive. The verdict: fast and easy. After answering a few multiple choice questions gauging investment experience, income, and risk tolerance, I was approved for Level 2 options trading. The process took seven minutes:

For comparison, Charles Schwab wouldn’t let me apply for options trading through its app. Schwab users must apply online or IRL. There’s more friction in the process, including sometimes needing to talk to a person. This is a wet blanket for growth, but also a safeguard.

Options are also prominently featured in Robinhood’s trading flow. The button for trading options is the same size and color as the button for buying stocks. Internet companies obsess over details like button size, location, and color. For a company of Robinhood’s design prowess, the treatment of options is probably intentional.

Options are lucrative for Robinhood, so the company makes it easy to trade them. Not surprisingly, its users trade options more frequently than other retail brokerages, according to an analysis by The New York Times.

While no one is forcing Robinhood’s users to trade, product design can deeply influence user behavior, typically to the designer’s benefit. Behavioral cues like the company's trademark confetti could exacerbate behavioral biases and affect investing behavior according to researchers interviewed by The Wall Street Journal. For example:

Marshini Chetty, an assistant professor of computer science at the University of Chicago specializing in human-computer interaction, said Robinhood’s interface shares characteristics of what the software industry calls “dark patterns”—a design choice that steers users down a desired path. For instance, once you start a trade on Robinhood, it is easier to move forward than to back out of it. While confirming the purchase requires a swipe up, there is no clear cancel button.

Similarly, gamification is component of the Massachusetts complaint:

Once individuals become customers, Robinhood relentlessly bombards them with a number of strategies designed to encourage and incentivize continuous and repeated engagement with its application. The use of these strategies is often referred to as gamification: the application of typical elements of game playing to other activities, typically as a marketing technique to boost engagement with a product or service.

Dopamine hits are powerful drugs.

To its credit, Robinhood had done a number of things well. The company has shaken up the cozy retail brokerage industry, reducing commissions and fees. This is the internet at its best. It has also built a clever mouse trap for quickly and cheaply acquiring new customers. However, its success has elevated expectations for future growth, potentially mismatching incentives between what’s good for Robinhood and what’s best for its customers.

Reducing friction is great when you’re ordering toilet paper or sharing cute pictures of cats, but it’s less clear that this is the case with options trading. Investment decisions should be sober, thoughtful ones. Financial weapons of mass destruction may benefit from some guardrails.

For more like this once a week, consider subscribing 👇

👉 If you enjoyed reading this post, please share it with friends!