An old boss of mine used to say “when you’re talking, you’re losing.” By this he meant that in business and investing often numbers speak for themselves. It’s only when something goes wrong that things get verbose. Non-recurring this, community adjusted EBITDA that. For many young tech companies, and businesses that aspire to be valued like young tech companies, things are getting wordy.

To recognize a bad actor, it helps to understand what a good one looks like. Here’s how Amazon describes its consumer business in its 2018 annual report:

“We serve consumers through our online and physical stores and focus on selection, price, and convenience. We design our stores to enable hundreds of millions of unique products to be sold by us and by third parties across dozens of product categories. Customers access our offerings through our websites, mobile apps, Alexa, and physically visiting our stores. We also manufacture and sell electronic devices, including Kindle e-readers, Fire tablets, Fire TVs, and Echo devices, and we develop and produce media content. We strive to offer our customers the lowest prices possible through low everyday product pricing and shipping offers, and to improve our operating efficiencies so that we can continue to lower prices for our customers.”

Amazon wants to offer consumers a large selection of goods at low prices. This tracks.

Berkshire Hathaway is another good apple. Here’s a description from its 2018 annual report:

“Berkshire Hathaway Inc. (“Berkshire,” “Company” or “Registrant”) is a holding company owning subsidiaries engaged in a number of diverse business activities. The most important of these are insurance businesses conducted on both a primary basis and a reinsurance basis, a freight rail transportation business and a group of utility and energy generation and distribution businesses. Berkshire also owns and operates a large number of other businesses engaged in a variety of activities, as identified herein. Berkshire is domiciled in the state of Delaware, and its corporate headquarters are located in Omaha, Nebraska.”

From this you can understand that the company does a few things. It sells insurance to consumers and businesses as well as to insurance companies (reinsurance). It also moves freight over railroads and generates and sells electricity. Definitely not written by Hemingway. That’s the point.

Now on to a bad actor. Mattress-in-a-box company Casper recently filed its S1 in advance of an IPO. Here’s how the company describes its business:

“Our mission is to awaken the potential of a well-rested world, and we want Casper to become the top-of-mind brand for best-in-class products and experiences that improve how we sleep.

As a pioneer of the Sleep Economy, we bring the benefits of cutting-edge technology, data, and insights directly to consumers. We focus on building direct relationships with consumers, providing a human experience, and making shopping for sleep joyful. We meet consumers wherever they are, online and in person, providing a fun and engaging experience, while reducing the hassles associated with traditional purchases. We are building a universal, enduring brand that is already embraced by over 1.4 million happy customers…

…We believe great brands win over the long-term and have the ability to change the culture around them. We have endeavored to build a brand that is genuine, trustworthy, and approachable, as well as fun and playful.”

The overview goes on for another 292 words, but you get the gist.

Awakening the potential of the world, changing culture, and being fun and playful are probably not the first thing you’d associate with this:

Source: Casper

Casper’s word salad is an example of what NYU professor of marketing Scott Galloway calls yogababble, defined by UrbanDictionary as:

“Spiritual-sounding language used by companies to sell product or make their brand more compelling on an emotional level. Coined specifically about WeWork’s IPO prospectus in 2019, which was full of phrases like “elevate the world’s consciousness” and at the same time showed problematic financials. Yogababble is intended to disguise or compensate for practical or financial weaknesses in a business or product.”

Source: Yogababble, No Mercy/No Malice

So why the difference in phrasing between Amazon and Berkshire Hathaway on one hand and Capser on the other?

Perhaps it’s to help differentiate Casper from Allswell, Aviya, Avocado, Bear, Cocoon by Sealy, Ghost Bed, Helix, Leesa, Nectar, Parachute, Purple, Saatva, Signature Sleep, Tuft & Needle, WinkBeds, Zinus and 170 other companies who also sell mattresses in boxes.

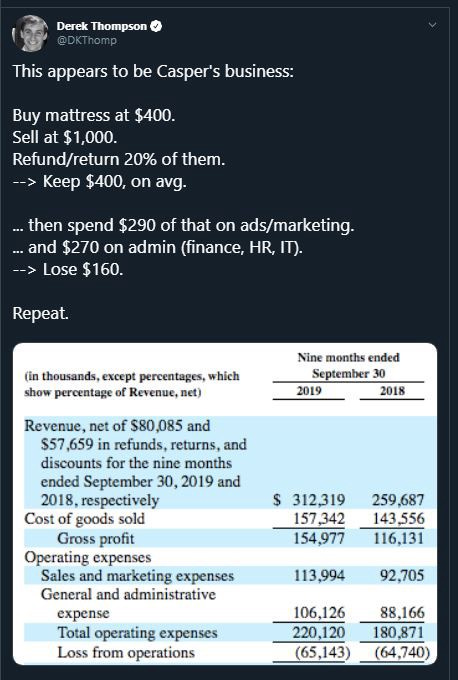

Or perhaps it’s to divert attention away from Casper’s financials:

Source: Derek Thompson via Twitter

“Numbers speak louder than words” is a business parallel to “actions speak louder than words.” With this in mind, a good rule of thumb is: the more yogababble there is, the longer you should spend scrutinizing the numbers.

👉 If you enjoyed reading this post, feel free to share it with friends!

For more like this once every weekend, consider subscribing 👇