#2— A Taxonomy of Moats, Uber Works Launches in Chicago & US Payroll Report

Hello and welcome to Weekend Reading Volume 2. A few things covered this week: systems rigidity, a new way to find work in Chicago, and US payrolls keep on chugging along.

A Taxonomy of Moats (Jerry Neumann’s Blog)

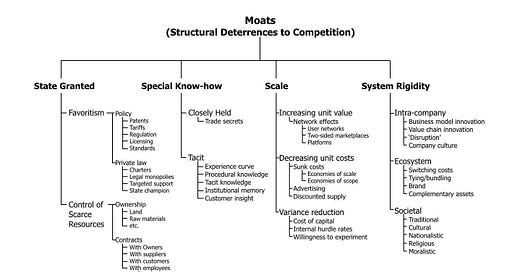

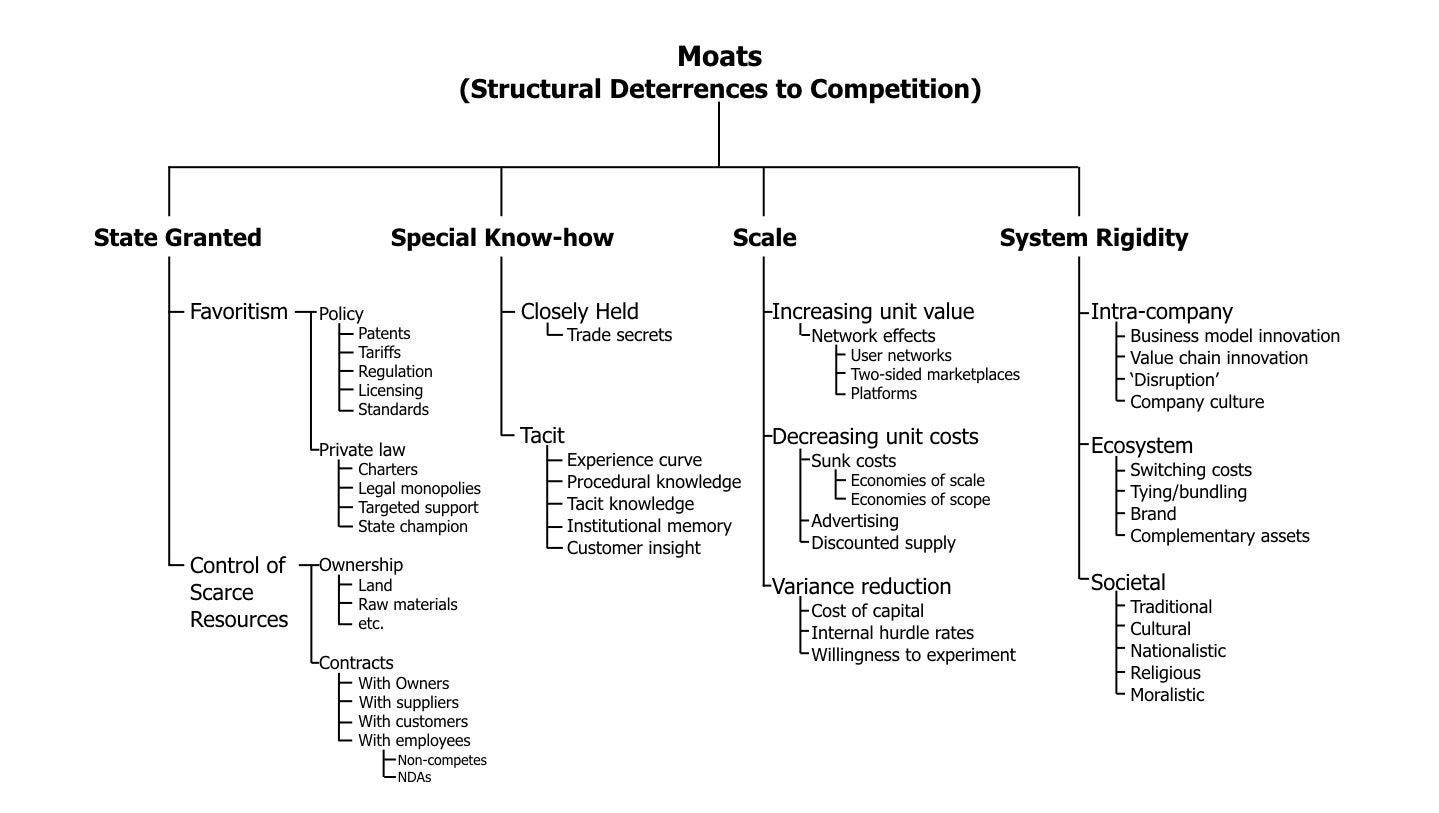

Value creation does not imply value capture. The ability to capture value is dedicated by a company’s moat. In other words, the unique advantages that a firm has over its competitors. These can come in many forms, as detailed below. For example, how disruptive would it be for Indeed to replace JIRA? High switching costs help build Atlassian’s moat. Similarly, every user that joins Facebook improves the company’s value both to other users and to advertisers: “Value is created through innovation, but how much of that value accrues to the innovator depends partly on how quickly their competitors imitate the innovation. Innovators must deter competition to get some of the value they created…The strategic job is to make that competitive advantage sustainable over time, to maintain the advantage as a bulwark against competition. Mechanisms to deter or slow imitation are called, colloquially, moats…Moats draw their power to prevent imitation from one of four basic sources: (1) the state, (2) special know-how, (3) scale, or (4) system rigidity…It is very rare for a high-growth-potential startup to have a competitive advantage that is sustainable from their very beginning…Returns to scale are advantages that appear or increase as a company gets bigger. They are a powerful barrier to entry because, by definition, they are not available to any entrant that starts out small (as most would have to.) They take several forms but generally either the cost per unit decreases or the quality of the product increases as more units are produced, sold, and used…Similarly, if a software company can spread the cost of development of the software over many customers, the cost per customer is lower…In addition to lowering costs, scale can also increase the value of a product. This is often called network effects (regardless of whether there is a ‘network’ or not.) Telephone service is worthless if you are the only one with a telephone. It becomes valuable when someone else also has one, and more valuable as more and more people get them. The key is that it becomes more valuable not just to you but to everyone on the network. This dynamic lends itself to monopolization, so long as different companies can’t interconnect…Two-sided marketplaces and platforms are often lumped into network effects, though they don’t really create networks. Marketplaces, like eBay or the New York Stock Exchange, create more value from scale because scale creates both more supply and more demand for the products sold through the marketplace. This creates a virtuous cycle — sellers want more buyers rather than fewer, buyers want more sellers rather than fewer — so a small advantage in scale can become self-reinforcing…Scale advantages are only durable to the extent they inhibit direct competition…System rigidity can be a quite durable source of advantage in an environment of incremental change. Products that are the same as existing ones, or even somewhat better, will not give the customer enough additional value for them to switch if the switching costs are high…If a startup is to become a valuable self-sustaining company it must eventually have a moat. Building one must be part of their strategy.”

Source: A Taxonomy of Moats, Jerry Neumann’s Blog

Uber launches a shift-work finder app, Uber Works, starting in Chicago (TechCrunch)

Uber’s $5.71 trillion “TAM” just got a little bigger. On one hand, having a well capitalized competitor enter your market is reason for concern. On the other, when applying the moats framework from above, it’s hard to see what Uber’s advantage is here. Access to capital is not a moat. On the other other hand, the moats framework states that “it is very rare for a high-growth-potential startup to have a competitive advantage that is sustainable from their very beginning.” Stay tuned: “Uber has just officially announced the launch of a new app for matching shift workers with shifts, called Uber Works, working in partnership with staffing agencies [TrueBlue and Talent Burst]…In a blog post about the Uber Works launch, which is starting in Chicago but slated to be expanding to more areas “soon”…Uber Works looks like an attempt to find a less bumpy path to profitability — via a matchmaking platform for workers who are employed by staffing agencies, which Uber’s blog post is careful to note “employ, pay and handle worker benefits”. Ergo Uber doesn’t have to. What it wants to be is a technology provider to staffing agencies, offering a platform that matches agency workers to available shifts — in roles such as prep cook, warehouse worker, commercial cleaner and event staff — while also carrying out time-tracking, tied to a carrot for workers of more “timely” payments…With Uber Works, Uber is again hoping to cast itself as a technology platform. Though by partnering with staffing agencies it’s hope will be that there’s less legal risk involved…The tech giant is certainly entering an already crowded field. There are a large number of shift, temp and blue collar work finder apps targeting a similar fast-paced, high turnover employment need in the the US and Europe — including the likes of Bacon, Catapult, Gig, JobToday, Limber, Rota, Shiftgig, Shiifty, Snag and Syft to name a few.”

Here’s Uber’s blog post announcing the Chicago launch: “We believe a new, technology-first approach can provide faster and easier means for people to get work, while offering greater insight into the many opportunities for work that are out there — improving the experience for workers and businesses alike. That’s why over the past year, we’ve studied and built tech solutions that can help positively impact a workers’ shift experience and eliminate bottlenecks to finding work.”

Uber Works highlights general labor, warehouse, back of house, customer service, front of house, and cleaning.

Wonder if there will be surge pricing?

U.S. Added 136,000 Jobs in September; Unemployment Rate at 3.5% (NYT)

The US payrolls report capped off a busy week of generally softer than expected macro data. The US unemployment rate hit a 50 year low of 3.5%. The jobs report shows that US manufacturers reduced jobs month-over-month in September, giving more evidence to a global slump in manufacturing: “Employers kept hiring at a steady if unremarkable pace…Last year, an average of 223,000 jobs were created each month, thanks in part to the temporary pick-me-up delivered by tax cuts and increased government spending. This year, the monthly average through September is 161,000…That falloff alone is not cause for alarm. A decline was expected now that the recovery has passed its 10-year anniversary, and there are more job postings than job seekers. The unemployment rate has remained below 4 percent for the last seven months. And many Americans who had dropped out of the labor force because they were too discouraged to look for work or couldn’t find sufficiently attractive offers have now rejoined…Friday’s report revised job figures for July and August, adding a total of 45,000…Nonetheless, that sector [manufacturing] is suffering the most from prolonged trade tensions. Companies in the business of making goods — as opposed to those that deliver services like hospitals and restaurants — are much more dependent on sales to other countries and supply chains that wend around the globe. The sector lost 2,000 jobs in September. Last spring, manufacturers were adding as many as 25,000 jobs a month. In recent months, the average has been a few thousand…With less than 13 million workers, the manufacturing sector accounts for about 11 percent of the country’s output, but it tends to loom larger when it comes to policy debates. The health and education sectors remain the economy’s most potent job creators. And wage growth over all has picked up in recent months, putting more money in consumers’ pockets.”