Hi👋 - Did you catch the last episode of Parental Guidance with Anderson Cooper? Neither did I. Today, a look at the brief life of CNN+ and some lessons from its failure. Thanks for reading.

If you’re finding this content valuable, consider sharing it with friends or coworkers. 🎬

For more like this once a week, consider subscribing. 🎬

No Mercy No Malice No More

Tragedies don’t need to be long. One of the saddest stories ever written is just six words: “For sale. Baby shoes. Never worn.” CNN’s stillborn streaming service, CNN+, is another brief tragedy. For sale. Scott Galloway tapes. Never aired.

Cable television is a business in secular decline. To combat cord cutting, legacy media companies like CNN have tried pivoting to streaming. Work on CNN+ began in the summer of 2020. CNN is owned by WarnerMedia which at the time was owned by AT&T. With full-throated support from executives at AT&T and CNN, the service was given a $1 billion budget and a 15-18 million subscriber target after four years of operation1.

In May 2021, AT&T announced the spin-off of WarnerMedia, including CNN, to Discovery for $43 billion. Strategically, Discovery was looking to beef up in streaming to better compete against Disney and Netflix by combining WarnerMedia’s HBO Max with its own Discovery+. Based on past experience, Discovery executives had doubts about the commercial feasibility of CNN+, preferring a consolidated streaming effort versus splitting their forces. However, communication between the two companies were limited by antitrust regulations until the acquisition closed.

Following two years of work, CNN+ launched on March 29, 2022. CNN invested $300 million into the service including content, product development, and talent. Originally slated to launch in January 2022, giving it runway to prove its worth before the acquisition closed, technical difficulties delayed the rollout.

Subscribers are the lifeblood of a streaming business. Backed by a multimillion dollar marketing campaign and prominent hires like Alison Roman, Chris Wallace, and Eva Longoria, CNN+ acquired 150,000 subscribers over its first three weeks2. Believing that the service was on track to achieve its first-year goal of two million subscribers, CNN executives deemed the launch a success3. Discovery, which would soon acquire CNN as part of a deal for WarnerMedia, thought otherwise.

On April 8, 2022, the acquisition closed, removing the Chinese wall between Discovery and WarnerMedia and saddling Discovery with $55 billion of debt. As part of the deal, Discovery CEO David Zaslav promised investors $3 billion in cost synergies. Zaslav now controlled the checkbook and the hatchet. He faced a defanged CNN executive team. In a Succession-worthy plot twist, Jeff Zucker, CNN’s longtime leader and a strong advocate of CNN+, resigned in February 2022 after not disclosing a work relationship, violating the network’s standards.

Discovery moved fast. In early April, leaks revealed that fewer than 10,000 people watched CNN+ daily. For comparison, about 770,000 people watch CNN’s cable network every day4. It's rumored that the leaks came from Discovery, to justify sinking the service5. On April 11, three days after the deal closed, Discovery suspended all marketing of CNN+, pending an internal business review.

The guillotine fell on April 21, when Discovery announced it was shutting down CNN+ on April 30, a month after launch. In an all hands meeting, incoming CNN President Chris Licht called the closure a “uniquely shitty situation.6” Some CNN+ content is likely to move to HBO Max or Discovery+, though probably not Jake Tapper’s Book Club. While high-profile anchors will be paid out on their contracts, CNN+ employed 400 people and sadly many gaffers, screenwriters, showrunners will be laid off.

What Went Wrong: Two Strategies, One Merger

Four issues sunk CNN+: strategy, content, costs, and personality. CNN and Discovery had fundamental disagreements over strategy. Discovery planned to consolidate its streaming assets into one giant platform including HBO Max and Discovery+, rather than having multiple stand-alone offerings. This strategy is informed by hard earned experience. Discovery’s previous niche streaming offers like the Food Network Kitchen App and GolfTV were costly failures7. CNN+ conflicted with this strategy.

Content was another strike. Reporting and breaking news are CNN’s strengths. Clarissa Ward’s gut wrenching reporting on residents fleeing the Ukrainian city of Irpin is an example of what CNN does the best. That’s the company’s competitive advantage.

Yet to avoid contractual conflicts with cable carriers, CNN+ featured little reporting or breaking news8. Instead, it housed original shows like Jake Tapper’s Book Club and Parental Guidance With Anderson Cooper. CNN has no advantage in entertainment and lifestyle content. The quality and quantity of streaming platform’s content drives acquisition, engagement, and retention. CNN+ couldn’t offer the company’s best content. That wasn't going to cut it in a field where leading players spend tens of billions of dollars a year on programming.

Costs were another issue. Post acquisition, Discovery’s debt load is $55 billion and Zaslav had committed to finding $3 billion in cost synergies (roughly equivalent to 15% of Netflix’s annual content budget). The $700 million remaining in CNN+’s $1 billion budget made a juicy target.

Lastly, business decisions are influenced by ego and personality as well as data and analysis. CNN+ lost its largest champion when Jeff Zucker resigned. While other CNN executives, like Andrew Morse, CNN’s Chief Digital Officer, backed the project, none had Zucker’s heft or gravitas. Counterfactuals are by definition unknowable, but Zucker might have been able to last longer in a staring contest with Zaslav, getting CNN+ more time to prove itself.

Strategic misalignment, soft initial subscriber numbers (from Discovery’s perspective), the need to cut costs, and management turnover at CNN sealed CNN+’s fate.

Lessons From CNN+

CNN+’s failure offers some lessons for investors and operators:

Focus & Core Competency: CNN is a global news network. Yet to avoid contractual conflicts with cable operators, CNN+ didn’t include news programming. That’s not a recipe for success in a crowded market. Jacob Donnelly’s analysis of the snafu nails it9:

The launch of CNN+ was a solution—having a streaming app—looking for a problem. Did users want this? No one knew or cared; they just wanted to have a streaming app because that’s what all media companies wanted to have. It was the height of “DTC Media,” which meant everyone needed to bypass the middleman and go direct to the user. The problem is that this is leading with a business model rather than leading with what the audience actually wants.

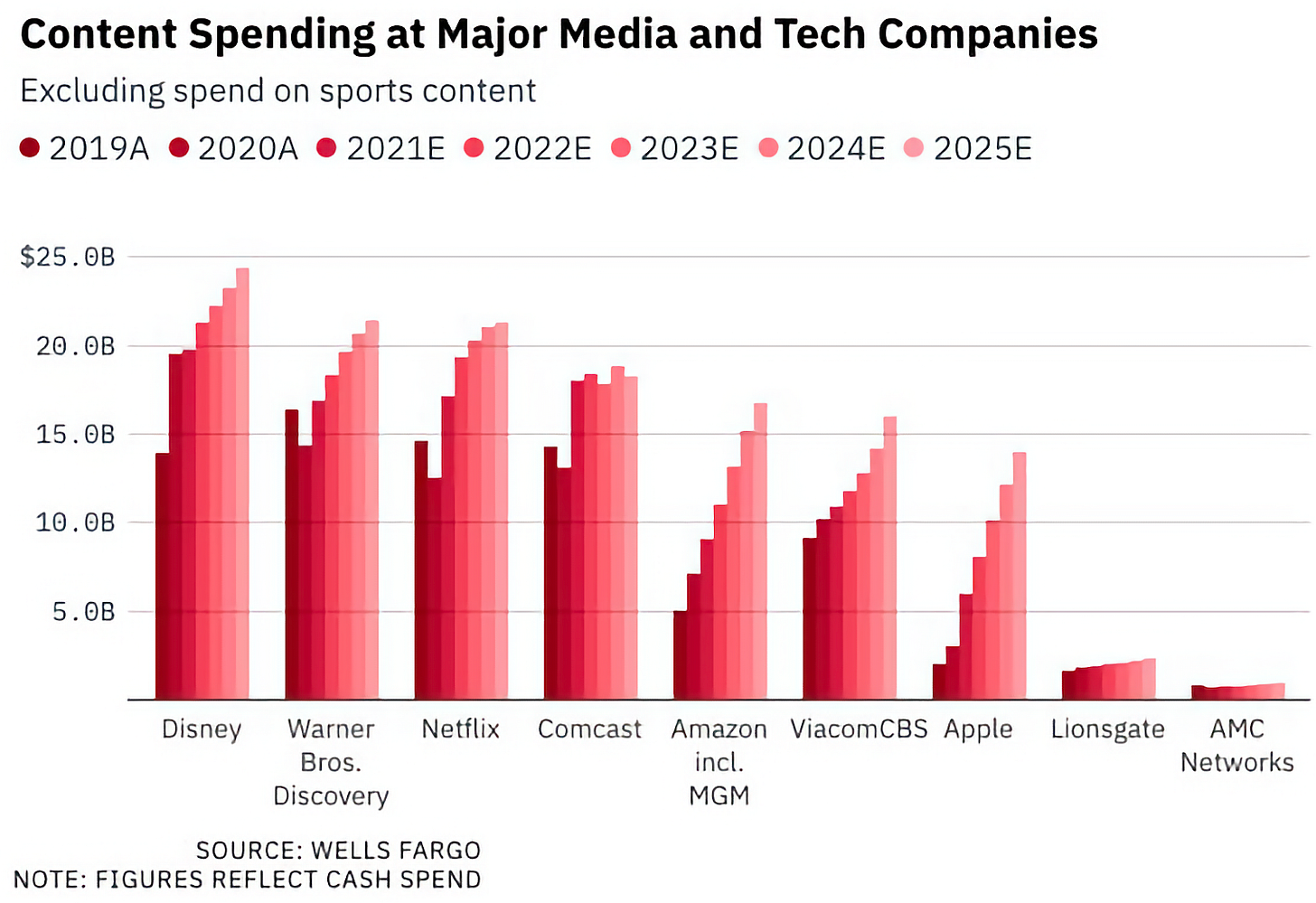

Digital No Man’s Land: A corollary of Ben Thompson’s Aggregation Theory is that digital markets bifurcate into a few large players at one extreme of the market, a long-tail serving infinite niches at the other extreme, and a barren wasteland in between. To be competitive at scale in streaming, you need to be able to spend tens of billions per year on content (the increment of the y-axis in the chart below is $5 billion). Disney and Netflix are fortifying themselves as the scale players. YouTube and TikTok serve the long-tail. With a $1 billion budget, CNN didn’t have the firepower to compete with the scale players. It showed up to a firefight with a squirt gun and was destined to no-man’s land. Discovery’s consolidation strategy gives it a better shot at success.

Sunk Costs: Get deep enough into an economics textbook and you’ll come across the sunk cost fallacy. Discovery deserves credit for taking decisive actions and quickly cutting its losses, despite CNN spending $300 million on the service. Based on the performance of its niche streaming offerings, Discovery knew these services weren’t likely to gain traction (to be fair, CNN hadn’t learned this lesson).

The Limitations of TAM & Secular Growth: Streaming is a massive market (though perhaps less massive than once thought following Netflix’s squishy Q1 2022 earnings). However, massive markets and secular tailwinds attract lots of capital and lots of competition. Streaming is a crowded, competitive market. Additionally, competition for wallet-share is intensifying. During lockdowns, streaming wasn’t competing for leisure time against bars, restaurants, and travel. Now it is. If you don’t have a strong competitive advantage, good luck. CNN’s edge is deep reporting and breaking news. CNN+ didn’t leverage the company's competitive advantage.

If you’re finding this content valuable, consider sharing it with friends or coworkers. 🎬

For more like this once a week, consider subscribing. 🎬

More Good Reads

A Media Operator on why closing CNN+ was the right decision. The New York Times on the implosion at CNN+. Below the Line on the big market delusion and the limitations of TAM.

Disclosure: The author owns shares of Netflix.

Axios, Scoop: CNN+ looks doomed, April 19, 2021.

Vanity Fair, “Surprised At The Speed”: Behind The Scenes Of CNN+’s Stunning Fall, April 21, 2022.

The New York Times, CNN+ Streaming Service Will Shut Down Weeks After Its Start, April 21, 2022.

CNBC, CNN+ struggles to lure viewers in its early days, drawing fewer than 10,000 daily users, April 12, 2022.

Vanity Fair, “Surprised At The Speed”: Behind The Scenes Of CNN+’s Stunning Fall, April 21, 2022.

The New York Post, Inside the collapse of CNN+: ‘A uniquely sh-tty situation’, April 25, 2021.

The New York Times, Inside the Implosion of CNN+, April 24, 2022.

The New York Times, CNN+ Streaming Service Will Shut Down Weeks After Its Start, April 21, 2022.

A Media Operator, CNN+ Was Doomed From the Start and Closure is the Right Move, April 26, 2022.