Hi 👋 – Trying out something new. The next two posts will recap key themes from first quarter e-commerce earnings. Love it? Hate it? Please let me know. As always, thanks for reading.

🛍 If you’re finding this content valuable, consider sharing it with friends or coworkers.

🛍 For more like this once a week, consider subscribing.

Facing Pressure From All Sides

From 2000 through 2019, US e-commerce sales and penetration advanced methodically. This changed abruptly in March of 2020, as Covid shuttered stores and shoppers stayed home making sourdough bread and wiping down canned goods with Clorox wipes. Consequently, 2020 and 2021 were banner years for e-commerce. A decade’s worth of adoption was compressed into 18 months. With Covid waning (🤞) and the sourdough going stale, trends are shifting again. E-commerce has gone from the party to the hangover.

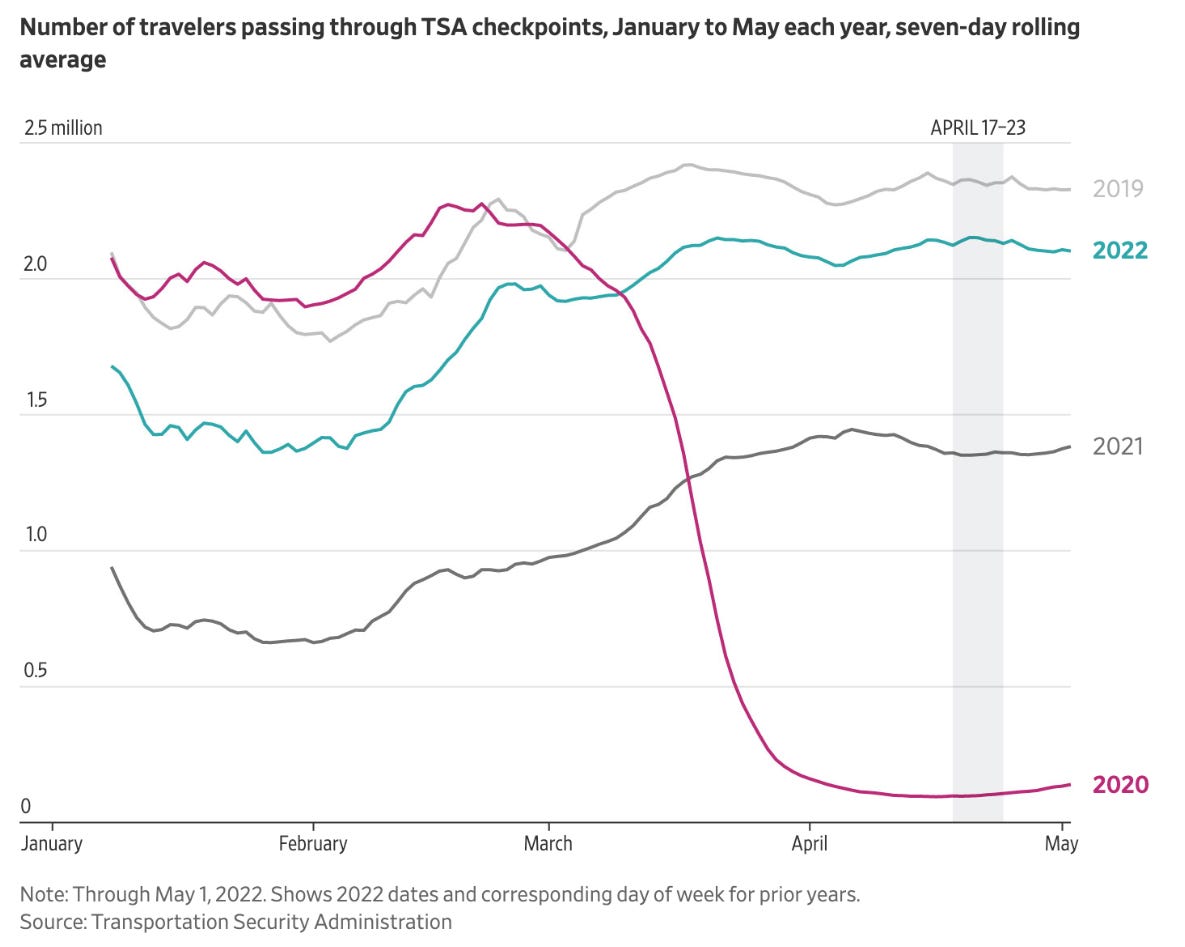

Competition for wallet share is intensifying. Relative to 2020 and 2021, consumers now have more options for where to spend their money. After two years of gym shorts (or less) and Zoom meetings, people want to get out of the house. A key theme from Q1 2022 results is that there’s pent-up demand for travel and experiences, a point reinforced by Philipp Schindler, Google’s Chief Business Officer1:

Retail was again, the largest contributor to year-on-year growth of our Ads business in Q1, followed by Travel. Speaking of travel. People are seemingly back on the move – whether they’re searching for planes, passports, or their next vacation destination, Q1 travel searches were above Q1 2019 pre-pandemic levels. Query growth in categories like “beaches and islands” were up 27% vs. 2019, while “vacation rentals” rose 37%. Compared to last year, global searches for “passport online” jumped 80%.

With lockdowns a thing of the past (ex. China), consumers are spending more time out and about and less time in front of computers. As a result, money is shifting from online to offline and goods to services, causing slowing growth rates across e-commerce. Sales at eBay, Wayfair, Amazon, and Etsy all shrunk relative to Q1 2021.

Changing consumer spending behavior amid reopening reverberated throughout the industry. For example, Shopify saw moderating online demand as consumers spent more dining out and traveling. With brick-and-mortar retail rebounding, the company’s offline GMV grew 80% y/y. Shopify is partially hedged here because it provides merchants omnichannel capabilities, like in-store POS terminals. Having some offline exposure was an asset for luxury resale marketplace The RealReal as well. Supply begets demand for online marketplaces. RealReal’s brick-and-mortar locations are hubs for onboarding supply, so higher retail foot traffic spurred supply growth, helping GMV increase by 31% y/y. Most e-commerce companies weren’t so lucky.

After two years of strong demand, online furniture store Wayfair was at the sharp end of the stick, with revenue falling 14% y/y. Like Shopify, Wayfair saw footloose consumers. It also saw a shift between goods and experiences and between e-commerce and brick and mortar. Here’s Wayfair’s CEO Niraj Shah on consumer behavior2:

With rising prices across the retail universe and amidst troubling geopolitical events, our mass customers in the US and internationally appear understandably more focused on where they are spending their next dollar, pound, or euro. Consumer spending is still climbing for retail overall. However, even with the relatively healthy individual balance sheets, shoppers are nonetheless diverting a larger share of their wallets to non-discretionary categories and reprioritizing experiences like travel.

Shah’s comments were echoed by executives at Etsy, an online marketplace for handmade and vintage items, and ThredUp, an apparel resale marketplace.

Revenge of the Comps

While declining sales fray nerves on Wall Street, the current situation feels more like air being let out of a taught balloon than a Thelma and Louise situation.

For e-commerce, 2020 and 2021 were gangbusters. Growth rates can only defy gravity for so long. The mathematical consequence of bigger denominators is that maintaining high growth rates becomes more difficult - the tough comps problem. Q1 2022 e-commerce results need to be understood in this context:

Amazon: During Covid, Amazon compounded revenue at 25% (including AWS and advertising), an acceleration from 20% y/y growth in 2019.

Etsy: Sellers grew over 110% to 5.5 million in Q1 2022 from 2.6 million in Q1 2020. Similarly, Etsy’s GMV grew over 130% to $2.8 billion in Q1 2022 from $1.2 billion in Q1 2020.

Shopify: Online GMV grew at a 51% CAGR from Q1 2020 through Q1 2022. Over the same period, total GMV, including offline sales, grew at 57% CAGR.

Wayfair: While revenue declined 14% y/y in Q1 2022, Wayfair’s sales grew from $9.1 billion in 2019 to $13.7 billion in 2021. Not too shabby.

Though growth rates are slowing or declining outright, public US e-commerce companies are much larger today versus March 2020. They have more buyers, more sellers, and more listings. Fundamentally, that’s a good place to be. The current debate on Wall Street is how much of the Covid surge will be retained versus what was temporary.

It Gets Worse

For now, macro is bolstering the bear argument. Another theme from e-commerce results was that demand deteriorated throughout the first quarter. The economic outlook is shakier today than in the fourth quarter due to persistent inflation, rising interest rates, Russia’s invasion of Ukraine, stock market volatility, and other factors. These macro trends exacerbate higher consumer mobility (more travel, fewer sourdough starter kits) and the lack of Covid stimulus, an e-commerce double whammy.

Etsy CFO Rachel Glaser’s comments are emblematic of broader industry trends3:

The deceleration we started to experience in February 2022 worsened throughout the quarter, which we attribute to headwinds related to increased reopenings, high levels of inflation weighing on consumer purchasing power, and consumer mindshare loss due to the crisis in Ukraine and its reverberations throughout the global economy.

Amazon was the odd man out, saying that consumer demand remains strong, especially from Prime members. It’s tough to square this with its online sales falling 3% y/y. While macro factors like higher shipping and labor costs are weighing on Amazon’s costs, they haven’t yet impacted demand. Here’s CFO Brian Olsavsky on the consumer landscape4:

So we're not seeing softness. We're cognizant of the current inflationary environment and the impact it has on consumer - or excuse me, the household budgets. A lot of times that is the time when people come to Amazon because they know we have great prices and selection and convenience. So it can go one of two ways. But we don't see any macroeconomic factors generally in this forecast on the demand side. We definitely see it on the cost side though.

It Gets Better

Relative to investors, e-commerce executives are sanguine. eBay, Etsy, Farfetch, Shopify, and Wayfair expect growth to rebound in the second half of the year, helped by easier comps. For example, Shopify expects that growth rates bottomed in the first quarter and will peak in the fourth quarter. Similarly, barring any change in macro, Etsy expects easier comps and holiday shopping to boost its second half. “Barring any change in macro” is a big if. Handicapping how the macro environment evolves is always difficult and more so today given crosscurrents like war in Europe, elevated inflation, and changing monetary policy as well as a lingering pandemic. Like rock beat scissors, macro beats easier comps. The risk here is a Lucy with the football scenario.

While near-term outlook is challenging, there’s little doubt that over time e-commerce will resume its methodical advance. Here there’s a disconnect between operators and investors. Companies think in timescales of years: annual budgets, multi-year product roadmaps, even longer strategic plans. Investors are more varied: some think in years or decades, some in quarters, some in milliseconds. With e-commerce growth slowing, the imperative for operators is balancing long-term promise against near-term headwinds.

That’s all for Part 1. Next week’s note will look at category trends, geographic trends, and how inflation is impacting the industry.

🛍 If you’re finding this content valuable, consider sharing it with friends or coworkers.

🛍 For more like this once a week, consider subscribing.

More Good Reads

Luttig’s Learnings on mean reversion. The Wall Street Journal on consumers partying like it’s 2019. Below the Line on Etsy’s booming face mask business.

Disclosure: The author owns shares of Shopify.

Alphabet, Q1 2022 Earnings Call, April 26, 2022.

Wayfair Q1 2022 Earnings Call, May 5, 2022.

Etsy, Q1 2022 Earnings Call, May 4, 2022.

Amazon, Q1 2022 Earnings Call, April 27, 2022.