#137 - Slimming Down - Part 1

Q2 2022 E-commerce Review – Part 1

Hi 👋 - The e-commerce Covid hangover continues. During the second quarter, industry growth decelerated broadly. This week, a look at key themes and macro trends from second quarter e-commerce results. Part two will look at how online marketplaces are reacting to slower growth, and will be published after Labor Day 🌭🏖🍺. Thanks for reading.

If you’re finding this content valuable, consider sharing it with friends or coworkers. 🛍 🛍 🛍

For more like this once a week, consider subscribing. 🛍 🛍 🛍

Medium-Term Optimistic

The Covid hangover continues. E-commerce mushroomed in 2020 and 2021, as lockdowns shut stores and people sheltered at home. Today, consumers have more options for where to spend their money: online or offline, goods or services. Travel is booming (recent security lines at JFK are some of the worst I’ve ever seen) and restaurants are full. Reopening is driving a shift in consumption from goods to services and from online to offline. Additionally, while competition for spending is increasing, persistent inflation is eating away at discretionary spending power. For e-commerce companies, that’s a double whammy.

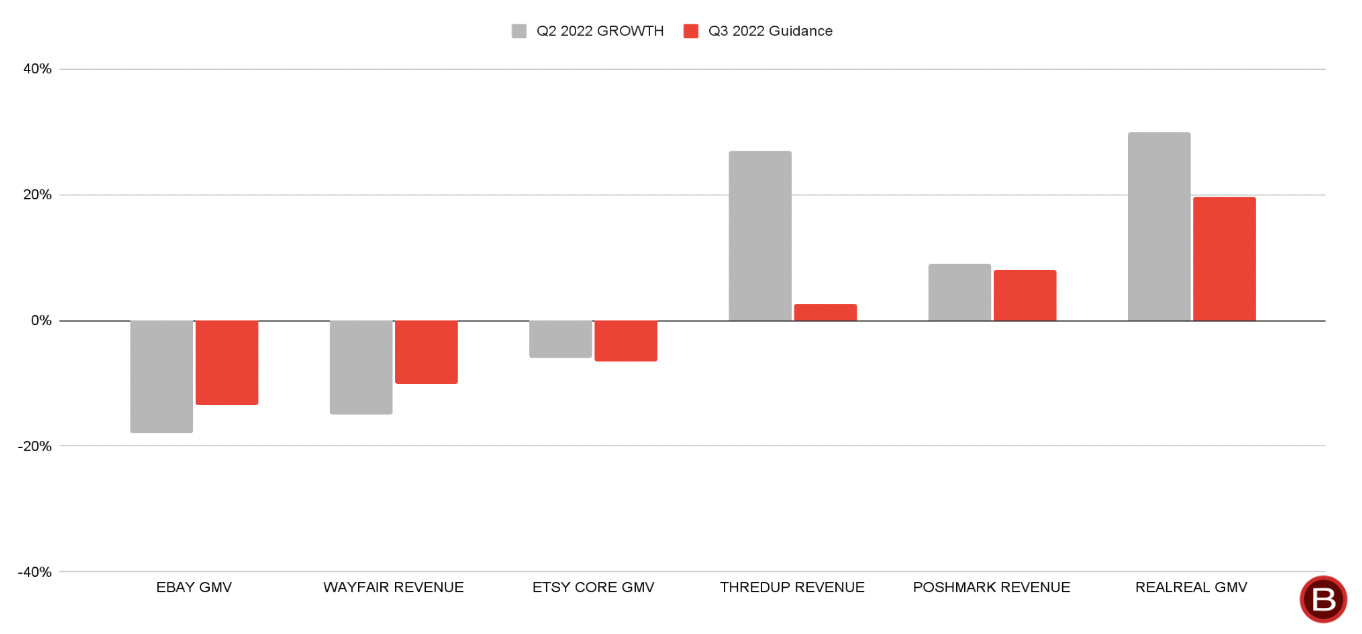

Industry growth reflects this challenging operating environment, which eBay’s CFO described as the most challenging in recent memory1. During the second quarter, e-commerce growth decelerated broadly. (In addition to the dynamics above, a strong US dollar pressured headline growth rates for US businesses with significant international exposure.) A number of companies – including eBay, Etsy, and Wayfair as well as Amazon’s first-party online sales2 – declined outright. Similar to the first quarter, marketplaces selling apparel like Poshmark, The RealReal, and ThredUp posted the best growth, while at-home categories like furniture struggled.

Like Tolstoy’s unhappy families, all e-commerce companies are unhappy in their own way. Etsy attributed 75% of its year-over-year GMV decline to higher consumer mobility and the remainder to deteriorating macro, inflation, and the war in Ukraine. GMV growth at The RealReal was restrained by product shortages, as higher-than-anticipated sales attrition negatively impacted supply acquisition, as well as changing product mix. Farfetch’s growth was depressed by Covid lockdowns in China, its second largest market, exiting Russia, historically its third largest market, and double-digit declines for marked-down items as part of a strategy to focus on full-price items (full-priced items double-digit growth rates).

Q3 2022 Outlook

Third quarter outlooks diverged. Some companies expect growth to improve, while others see further deterioration.

Guidance from eBay and Wayfair suggests year-over-year growth will improve sequentially, though both are still in the red3. Amazon continues to see strong demand and will benefit from moving Prime Day(s) into the third quarter4.

In contrast, Etsy, Poshmark, The RealReal, and ThredUp expect growth to deteriorate in the third quarter. For Etsy, visibility didn’t improve significantly during the second quarter. The company believes that it’s too soon to call if growth will bottom-out in the third quarter. Poshmark and ThredUp credited the macro environment and heightened uncertainty for weighing down their third quarter outlook, due in part to inflation pressuring discretionary spending. There’s likely conservatism embedded in this guidance. In August, ThredUp saw demand stabilize at lower-levels, while Poshmark called out a strong start to the month as people returned from vacation and kids went back to school. In contrast to macro concerns, The RealReal attributed its slowdown to supply issues and idiosyncratic factors like lower conversion and fewer items per order. It’s worth noting that The RealReal serves a more affluent customer base, which is more insulated from economic shocks.

Given shifting consumer behavior and a fluid economic environment, visibility remains low, making this a particularly difficult period to forecast. Etsy CEO Josh Silverman chooses his words carefully, so his comments during prepared remarks were telling5:

We have a lot of conviction that not only is e-commerce poised for meaningful growth over the medium-term but that each of the four Etsy marketplaces has a unique reason to succeed and scale, offering something truly important and different against a sea of sameness. That's why even through a challenging time, we've continued to invest in our people and our businesses, making bold moves that we very much believe will set us up for continued future growth.

The operative phrase is medium-term. While the near-term outlook is challenging, e-commerce executives remain upbeat about their medium- to long-term prospects. Hangovers don’t last forever. Many of the factors weighing on e-commerce growth are transitory, and secular growth should return following this period of indigestion. In the meantime, companies are retrenching by cutting costs, pulling back on hiring, reshuffling projects, and prioritizing profitability over growth.

Macro – The Usual Suspects

The macro factors influencing second quarter results were similar to the first quarter: higher consumer mobility (more time out-and-about, less time shopping online), persistent inflation, and the war in Ukraine dampening European demand. As noted above, two major trends were at play. First, consumers have more options of where to shop. Second, persistent inflation is squeezing household budgets. The net effect is that there’s pressure on online discretionary spend.

Consumer Behavior 1 – Divergence by Income Buckets

This pressure is most acute for budget shoppers in discretionary categories. A divergence in consumer behavior by income bracket was a theme across companies. While higher income shoppers remained resilient, less affluent shoppers pulled back. Lower income households spend a larger percent of their paychecks on necessities like gas, groceries, and housing, so they’re squeezed the most by inflation, which is running red hot. Discount and budget shoppers are one-third of ThredUp’s 1.7 million active buyers, and CEO James Reinhart went deep on this dynamic6:

The American consumer and particularly the budget consumer has pulled back on discretionary spending amidst today's economic climate. Inflation continues to squeeze the purchasing power of all but the wealthiest Americans. Recall that approximately 60% of our customer base has a household income below $100,000, and our customer data is telling us that this budget consumer is feeling particularly pinched…We're seeing a clear bifurcation of ThredUp customers with premium shoppers trading up and value shoppers trading down. Year-over-year, the average order value of the deep discount segment of our customers declined 7%, while our upscale shoppers average order value increased 15%...While we've only seen a slight dip in the number of upscale shoppers buying with us, we've seen a 23% decline across discount and budget shoppers in July compared to the same period in May.

Poshmark believes that consumers are looking for value and using resale to stretch their budget, which could explain some of the uptick ThredUp is seeing with higher income shoppers.

Wayfair saw a similar bifurcation, with interior designers and luxury buyers continuing to spend. Perigold, Wayfair’s high-end contemporary furniture line, grew 30% y/y (albeit off a small base), outperforming headline growth rates by 45 percentage points. Farfetch also saw high-end customers outperform. Here’s Farfetch Chief Customer Officer Stephanie Phair on consumer demand7:

Our private clients continue to perform the strongest of any cohort and are reflective of the resilience of the luxury consumer. During the quarter, we maintained over 90% retention of our private clients who delivered strong AOVs of circa $1,100. Also during the second quarter, we saw an increase in high-value transactions, with a focus on hard luxury investment pieces and the number of transactions exceeding $10,000, so an increase of 11% year-on-year.

Similarly, eBay’s focus categories – which include luxury shoes, luxury handbags, and luxury watches, as well as collectibles, trading cards, and auto parts – outperformed headline GMV growth by nine percentage points (though still declined year-over-year).

Consumer Behavior 2 – More Selective, More Promotional

Another recurring theme was that with more options for where to spend their money and less disposable income, consumers are becoming more deliberate and more value conscious. Here’s Wayfair CEO Niraj Shah on consumers seeking value8:

Regardless of geography, it is not surprising that our mass customers are being more deliberate about where their discretionary dollars are going as prices at the gas station and grocery store eat up a greater share of wallet. For the past few months, we have also seen many of those discretionary dollars flow away from goods to services, especially travel as the slow to start spring turned quickly into summer. Still the home remains an important pillar in our customers' lives, and they remain in market looking for great deals.

Another example of heightened deliberativeness comes from ThredUp, which saw an uptick in return rate as customers became more selective.

The environment is becoming more promotional, both online and offline. This is a stark contrast to 2020 and 2021, where log-jammed supply chains meant that inventories were lean and discounts were rare. Today, retailers like Macy’s, Nordstrom, Target, and Walmart are discounting to move excess inventory. This is reverberating online. Returning to Shah9:

It’s not that customers don’t have money. They need an excuse to spend. When they see value, they buy.

Normalization

The final broad theme was that product mix returned to pre-Covid levels. The days of gym shorts and sourdough starter kits are in the rearview mirror. Poshmark saw seasonality and product mix similar to 2019 levels, with shoppers focused on clothing for back-to-school and travel. Similarly, The RealReal’s product mix closely mirrored pre-Covid sales, with women’s apparel and shoes for work and travel doing well. Inventory levels too, are normalizing, with excesses in some areas. Lastly, Shopify said that e-commerce is trending back towards a more normalized growth curve. This reversion to the mean caught many online marketplaces off guard, as the heady growth rates of the pandemic dissipate.

How the industry is reacting to slower growth will be the focus of part two, which will be published after Labor Day.

If you’re finding this content valuable, consider sharing it with friends or coworkers. 🛍 🛍 🛍

For more like this once a week, consider subscribing. 🛍 🛍 🛍

More Good Reads and Listens

An E-commerce Recession, Below the Line’s Q1 2022 e-commerce recap: part one and part two.

eBay, Q2 2022 Earnings Call, August 3, 2022.

Amazon’s third-party e-commerce revenue likely grew, but the company doesn’t explicitly break this out. Third-party seller services revenue grew 9% y/y. This is driven by two factors: (1) higher volumes and (2) third-party sellers adopting more of Amazon’s services.

Like many companies, Wayfair stopped providing explicit quarterly guidance during Covid. Instead, it provides an update on quarter-to-day trends. Through early August, Wayfair’s revenue growth was (10%) y/y compared to (15%) y/y in Q2 2022.

Amazon only guides to total revenue, which includes AWS and Advertising.

Etsy, Q2 2022 Earnings Call, August 3, 2022.

ThredUp, Q2 2022 Earnings Call,August 15, 2022.

Farfetch, Q2 2022 Earnings Call, August 25, 2022.

Wayfair, Q2 2022 Earnings Call, August 4, 2022.

Wayfair, Q2 2022 Earnings Call, August 4, 2022.