Hi 👋 - Brands are intangible assets, but they can have tangible benefits. A look at how Peloton is leveraging its strong brand to lower customer acquisition costs with Corporate Wellness. Thanks for reading.

If you’re finding this newsletter valuable, consider sharing it with friends, coworkers, or Peloton members ❤️

New to Below the Line? Subscribe here👇

People love free stuff. In the summer of 2007, I interned on a Wall Street trading floor. Times were good. Housing prices and bonuses could only go up1. At lunchtime, I was struck seeing traders in Ferragamo ties jostling for free Chinese food. As a college student, there was a lot I’d do for a free meal: attend guest lectures, film screenings, club info sessions, you name it. It turns out a trading floor wasn’t that different, except for all the Gucci loafers.

On June 22nd, Peloton launched Corporate Wellness. The program’s economics should make the company as happy as an equity trader with a full plate of free lo mein.

More than Ellipticals

In December 2020, Peloton acquired commercial-fitness maker Precor for $420 million 2. The rationale was clear. At a time when Peloton’s Asian supply chain was logjamed, Precor provided US manufacturing capacity. Additionally, it had deep expertise in strength, a vertical Peloton was keen to enter. It also had a rolodex of relationships with colleges, corporate campuses, hotels, and multi-family residences.

Corporate Wellness enhances the deal's strategic rationale. Precor’s corporate contacts are an instant source of leads. It has the relationships while Peloton has the brand cache and a product employees and employers can get excited about.

Peloton is partnering with companies to offer free or subsidized access to Peloton Digital, which offers classes like yoga, strength, and meditation and doesn’t require hardware, and Connected Fitness Memberships, which requires a bike or treadmill. The press release also hints at discounts for Peloton hardware. Accenture Interactive, Samsung, SAP, Wayfair and a few others are piloting the program.

Jedi Mind Tricks

This is a smart move. People love free stuff, but they also like discounts. Employees enrolled in Corporate Wellness can sample Peloton’s classes for free or at a reduced cost3. Once Peloton signs up a new Corporate Wellness partner, it has a captive employee base to market to. What’s more, the partner helps defray the cost of Peloton’s products. In promoting its wellness program, the partner is also subsidizing Peloton, a Jedi mind trick enabled by its strong brand.

Corporate Wellness widens Peloton’s conversion funnel. Free or discounted access to Peloton Digital, normally $12.99 a month, incentivizes trial. The more people who try Peloton, the more upgrade opportunities there are.

Peloton Digital is as much a marketing channel as a business line. Peloton runs the business around breakeven, hoping to upgrade $12.99 a month Digital users to Connected Fitness members who pay $1,895 or more for a bike or treadmill plus $39 a month for an All Access membership.

Peloton seems increasingly confident about upgrading Digital users. In addition to Corporate Wellness, the company is partnering with Chase Sapphire to provide $120 in statement credits for Peloton memberships, defraying most of the $156 annual cost of a Digital subscription4. The strategy is to lure customers with discounts, then hook them, then upsell them. It’s working. On it March 2021 earnings call, Jill Woodworth, Peloton’s CFO said:

During the past year, we've dedicated more resources to building a powerful Digital to Connected Fitness upgrade path, and we are currently driving the highest monthly upgrade rates we have ever achieved. Trends suggest our new Digital cohorts will likely upgrade to Connected Fitness membership at a significantly higher rate than the 10% figure we've discussed in the past. As a testament to this progress, we're now seeing over 20% of our Digital subscribers ultimately upgrade to Connected Fitness, and that number continues to increase. As our Digital membership base grows, we expect our improving upgrade rates to become an increasingly large driver of our Connected Fitness sales.

Negative CAC

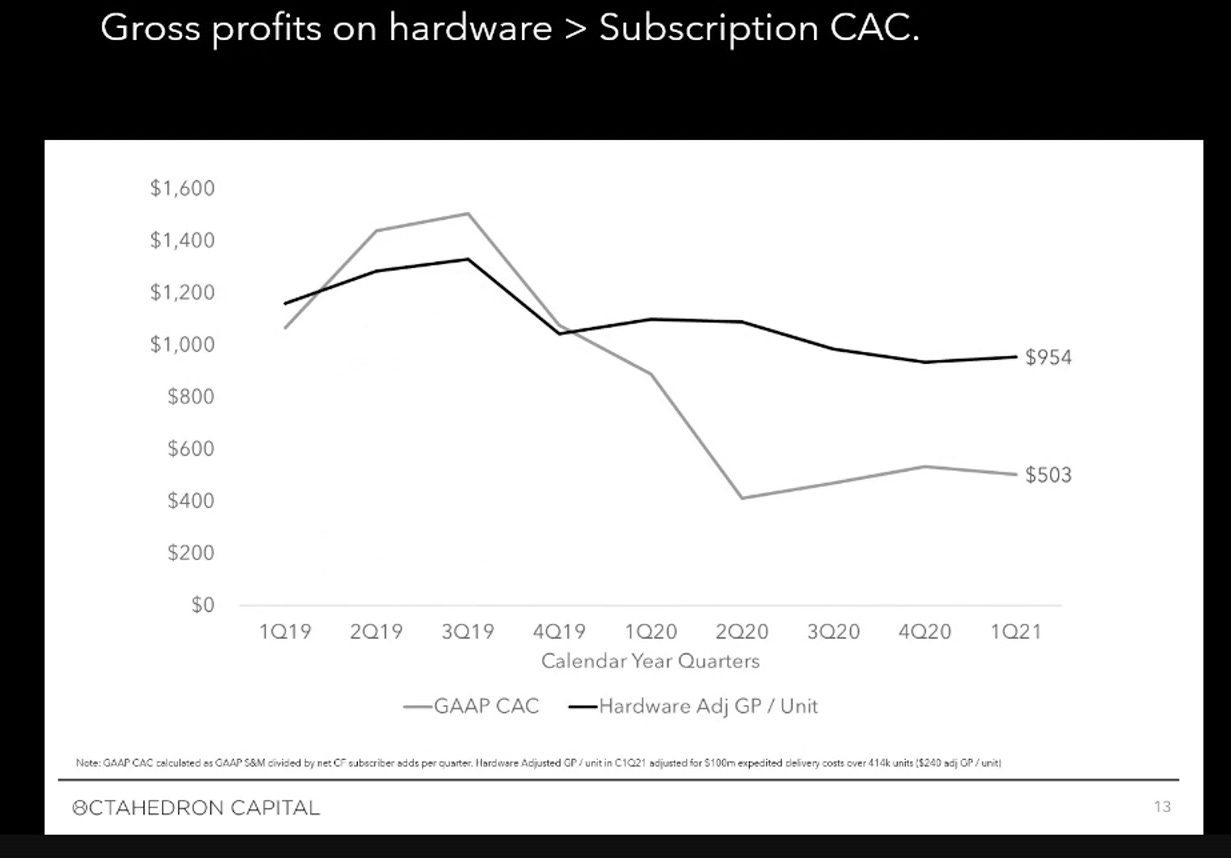

In his Peloton stock pitch at the Sohn 2021 Idea Contest, Ram Parameswaran5, founder of Octahedron Capital, argues that the company is building an internet-scale subscription business for free. Here’s his logic6:

Peloton’s hardware gross margins are over 40%. On a $1,895 bike, its gross profit is roughly $760.

It costs Peloton $500-$600 to acquire a customer. Therefore, Peloton has profitable unit economics on the hardware purchase ($760 gross profit less $500-600 CAC).

Here’s the kicker. Peloton’s hardware requires the $39 per month subscription, which generates contribution margins north of 65%.

In sum, Peloton is profitable on the hardware sale and then generates a residual stream of high-margin subscription revenue. Peloton’s monthly churn on these subscriptions is below 1%. At the end of every year, about 92% of subscribers are still paying. Not a bad business.

Revenue growth is the primary driver of corporate value, and customer lifetime value (LTV) is the primary driver of revenue growth. LTV is driven by acquisition cost (CAC), monetization, and retention. It’s the value of your current and future customers. With Corporate Wellness, partner businesses are helping lower Peloton’s CAC. The benefits teams at Samsung and Wayfair are helping Peloton acquire new customers, in essence subsidizing its marketing department7.

Peloton Corporate Wellness is a perfect example of how brand strength reduces CAC. Just like having a girlfriend makes you more attractive to other women or having a boatload of money makes banks want to lend you money, having a strong brand makes others want to work with you.

No Such Thing as a Free Lunch?

Business history is loaded with examples of initiatives that looked good on PowerPoint but never materialized. For Peloton, Fitbit is a reality check. During its IPO and short life as a public company, it talked about corporate wellness as a growth opportunity. Its marketing materials8 mirror Peloton’s talking points: improving employee health, improving employee engagement, insert buzzword here. Not much came of it. Furthermore, the business itself struggled as a stand-alone and ultimately needing to be put out of its misery by Google9. Peloton arguably has a better product, a stronger brand, and has built community and social features that Fitbit hasn’t, but Corporate Wellness isn’t guaranteed to succeed.

Corporate Wellness is a call option for Peloton. The initiative leverages its brand and Precor’s corporate relationships, and could potentially reach millions of employees at partner companies. SAP alone has over 100,000 employees. Only a subset of each partner's employees will participate in Corporate Wellness and only a subset of those will get hooked. The genus of the program is that Peloton’s partners are subsidizing its CAC. It’s a low cost gamble with high potential upside.

Like free food, arbitrage opportunities don’t last for long on a trading desk. Peloton’s Corporate Wellness arbitrage might have legs.

If you’re finding this newsletter valuable, consider sharing it with friends, coworkers, or Peloton members ❤️

New to Below the Line? Subscribe here👇

More Good Reads

Blind Squirrel’s overview of Peloton. It’s lengthy, but more comprehensive than most sell side initiations. Towards a Unified Theory of Peloton from Culture Study. Below the Line on Peloton and how the shift to digital changes the economics of fitness.

Disclosure: The author owns shares in Peloton.

This situation would reverse dramatically when I joined full time in the fall of 2008. Housing prices could indeed go down. Bonuses too. My first day of work, the House rejected the Troubled Asset Relief Plan, sending the Dow down 7%.

Peloton Investor Relations, Peloton Signs Agreement to Acquire Precor, December 21, 2020.

The economics of these arrangements aren’t public. Peloton is probably offering their Corporate Wellness partners some sort of bulk discount on Digital Fitness and Connected Fitness Memberships.

JP Morgan Chase, Let’s Go, Peloton and Chase Sapphire: Sapphire Teams Up with Peloton to Introduce New Cardmember Benefits, October 27, 2020.

Keep in mind that Ram is an outspoken Peloton bull and he’s talking his own book.

The program isn’t costless for Peloton. It will need to spend money to acquire Corporate Wellness partners.