Hi 👋 - There’s an arms race on for creators. Today, a look at Facebook’s creator strategy and the rise of TikTok. For readers in the US, happy Labor Day. As always, thanks for reading.

For more like this once a week, consider subscribing👇

👉 If you enjoyed reading this post, please share it with friends!

TikTokers at the Gates

Mark Zuckerberg is an empire builder. Facebook gobbles up online advertising dollars like Joey Chestnut eats hotdogs. Every month, nearly 2.9 billion people use one of its apps. In some parts of the world, Facebook is synonymous with the internet. Yet despite a net worth in the billions and impressive hydrofoil surfing and boar hunting skills, I get the impression that Zuckerberg doesn't sleep very well.

There are a few reasons to be anxious. First, Facebook doesn’t own a mobile operating system, so it’s at the mercy of Apple and Google. That’s why 20% of Facebook’s engineers are working on virtual reality1. Having a passenger seat to Android and iOS in mobile, the company wants to be in the driver's seat for the next evolution of the internet. Similarly, competitors occasionally threaten its hegemony. Regulators too.

The latest competitor, and possibly the fiercest, is TikTok. Launched in 2016, TikTok has been downloaded over three billion times. Four other apps have hit this milestone: Facebook, Instagram, Messenger, and WhatsApp; all are Facebook properties. In the first half of 2021, TikTok was the most downloaded app globally2. What’s more, TikTok drives popular culture. In 2014, Facebook shaped culture with the Ice Bucket Challenge. While Instagram still influences the design of coffee shops, TikTok has arguably become a larger cultural force, particularly in music.

Facebook’s business model is based on growing users and time spent. Alternatives that capture attention pose a strategic threat. Metcalfe's Law is virtuous on the way up, but painful on the way down. No wonder Zuckerberg isn’t sleeping well.

Facebook’s competitive response to TikTok has been swift. In 2021, it announced four strategic pillars: creators, commerce, building the next computing platform (AR/VR), and the metaverse. The creator pillar is aimed squarely at TikTok. It’s no coincidence that Facebook's creator strategy and initiatives like Reels, Instagram’s short-form video product and answer to (copy of?) TikTok, and paid online events, coincide with TikTok’s rise.

Facebook didn’t mention “creator” once during its first quarter of 2020 earnings call. By the second quarter of 2021, it appeared 35 times. Here’s one example, from Zuckerberg3:

Now we want our platforms to be the best place for millions of creators to earn a living. And if we can do this, then our services will also have the best content across many different types of media, from text and photos to audio, gaming and video.

Facebook’s Creator Strategy

Facebook’s creator strategy has three legs:

Creator Tools: Building tools for audio, video, and writing to make it easy to publish content across Facebook properties.

Discovery & Distribution: Helping creators to get discovered and engage with their audience.

Monetization: Enable creators to make money on Facebook.

Helping creators earn a living is good PR. It’s also good business. More and better content attracts new users and improves retention. This rings the cash register. Creator content opens up new ad surfaces and more ad inventory. Additionally, it creates ancillary revenue streams, like subscriptions, in-app payments, and ticketed events.

Facebook’s creator tool objective is making it effortless to publish newsletters, podcasts, and videos or to host a live event. To this end, it’s investing in audio, video, writing tools:

Audio: In June 2021, Facebook launched Live Audio Rooms, its answer to (copy of?) Clubhouse. It has also teased a feature called Soundbites, which algorithmically serves short audio clips, like an audio-only version of TikTok. Lastly, like every other tech platform, it has embraced podcasts. It’s allowing select creators to stream their podcasts on Facebook and integrate podcasts into their pages. Additionally, an integration with Spotify lets users play music and podcasts from Spotify on Facebook.

Video: Instagram launched Reels, a short-from video feature in August 2020. Like TikTok, Reels lets users record, edit, and share videos as well as incorporate licensed music. Initially capped at 15 seconds, Reels can now be a minute long (TikTok is currently capped at three minutes; expect Reels to follow). Additionally, Instagram is showing users more videos from accounts they don’t follow, just like TikTok. Algorithmic discovery is an avenue for creators to reach new audiences, and a path for Facebook to spread engaging (and monetizable) content. In addition to Reels, Facebook is building more tools for live video, including live shopping.

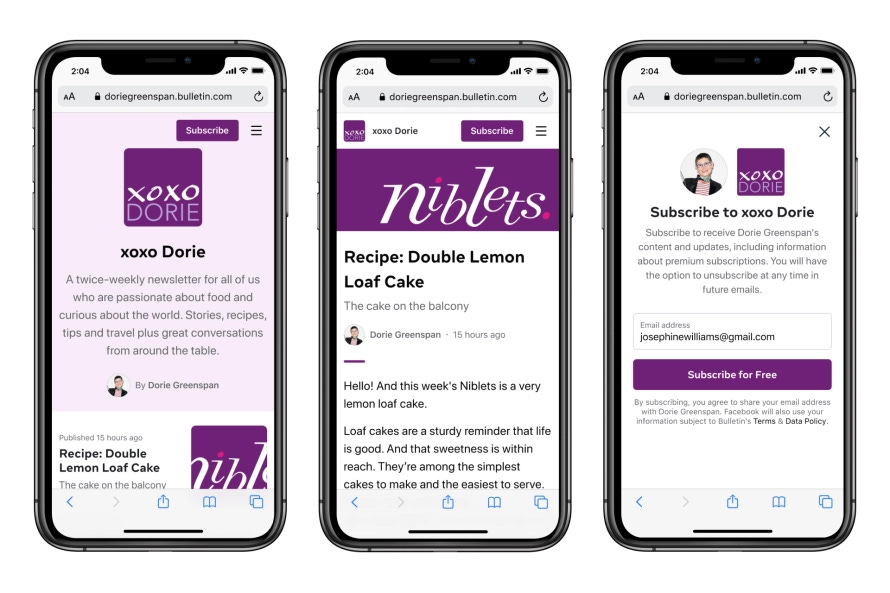

Writing: In June 2020, Facebook launched Bulletin, a subscription newsletter product and Substack competitor. Like Substack, Bulletin writers get a custom standalone website and newsletters can be free or paid. In addition to email distribution, Bulletin content is shared throughout Facebook. This is an advantage over Substack or Revue, which rely heavily on Twitter for discovery. Bulletin also includes the ability to host podcasts. Facebook seeded the platform by paying high profile writers like Erin Andrews and Malcolm Gladwell to participate (Substack has a similar program, Substack Pro). Currently in beta, Bulletin isn’t accepting new writers yet.

Of the three mediums, video is the priority:

We're very focused on making it easy for anyone to create video and then for those videos to be viewed across all of our different services, starting with Facebook and Instagram first4.

Video is where TikTok is gaining on Facebook and it’s also where user engagement is. In the second quarter of 2021, video accounted for half of all time spent on Facebook.

Show Me The Money, Part 1: Creators

Facebook was slow to embrace creators. Zuckerberg acknowledges that creators have many options and are likely to use multiple platforms. His goal is for Facebook to be the best place for creators to make money, thus attracting the best content.

Content is key. It’s the honeypot for users and attention that make Facebook’s flywheel spin. Already world-class in digital advertising, Facebook is building out creator monetization tools, including:

Branded Content: Facebook’s Brands Collabs Manager helps creators and influencers get discovered by brands for paid promotions. The program is selective and requires an application to join.

Fan Subscriptions: Launched in the US and UK in 2018, Facebook has slowly rolled out subscriptions to more geographies and use cases. Fans pay a fixed monthly fee between $0.99 and $99 for access to benefits like exclusive content. The product is currently invite only. Facebook will take a revenue share starting in 2023.

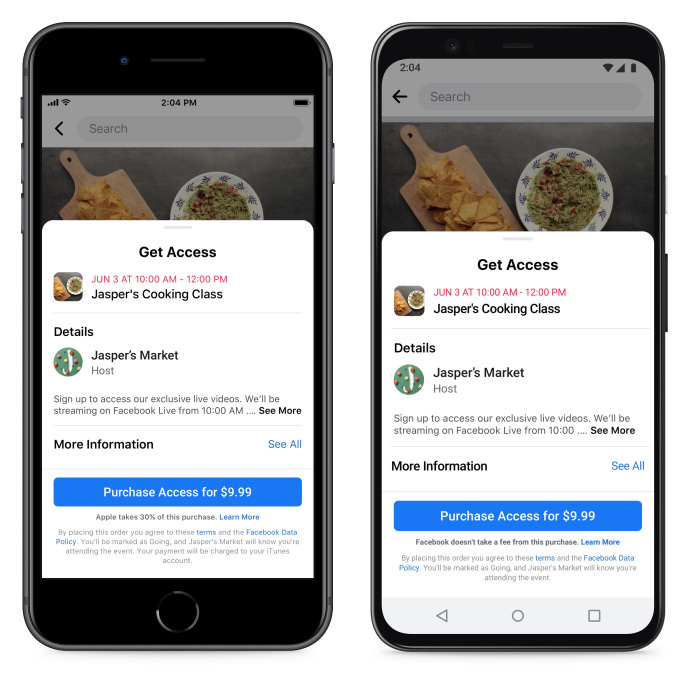

Paid Online Events: Ticketed live online events hosted by creators and businesses. For example, cooking classes, comedy shows, or a yoga class. This product started gaining traction during Covid-19 lockdowns. Creators set the ticket price and will eventually pay a 30% commission to Facebook. This also creates a new ad format for Facebook: event ads.

Source: Facebook via TechCrunch.

Stars: Digital tipping. Stars brings in-app purchases, a common monetization tactic in digital gaming (think: Candy Crush) to Facebook. Users purchase Stars in packs from $2 to $100 (Facebook takes a cut) and can send them to creators during live streams. Creators get paid a penny per Star. In 2020, gaming streamers earned $50 million from Stars. In 2021, Facebook extended Stars to video and Live Audio Rooms and is starting to roll out Star related benefits. For example, listeners who send Stars in Live Audio Rooms are bumped to the front row.

Video Ads: Facebook’s operating playbook is: launch a new product, grow engagement, launch ads, then increase ad load. Rinse, repeat. With video accounting for half of time spent, Facebook is adding new video ad formats like mid-roll ads. Previously, mid-roll ads were only allowed in videos three minutes or longer, but Facebook reduced the cap to one minute. With Reels engagement growing, Instagram launched Reels ads. It also launched live shopping, a format popular in China, on Facebook and Instagram and is testing sticker ads in Stories. For example, if someone posts a video from Central Park, a sticker could advertise a nearby business5. Eligibility differs by product, but in general creators must hit minimum thresholds, like having 600,000 minutes of video viewed over the past sixty days with a revenue share between Facebook and creators.

Show Me The Money, Part 2: Facebook

While Facebook’s creator strategy is defensive, a nice side effect is that it creates new revenue streams: in-app purchases, subscriptions, and ticketed events. It also generates revenue from Facebook’s users directly. Presently, the bulk of Facebook’s revenue comes from advertisers. Additionally, some creators may become advertisers, for example, promoting their events. As Zuckerberg noted during Facebook’s first quarter 2021 earnings call6:

But if we become the best place for creators to make a living, then I think that's going to mean that there's better content across the services and better opportunities for community building and engaging people, and that's what we care about. But of course, if there's more engagement and if creators are finding that there are good opportunities to monetize, then they'll engage more with our business products, too, and there will be some opportunity there.

Facebook is keeping most creator tools free through 2023, so this ancillary revenue stream will take years to develop. To succeed, Facebook’s creator strategy doesn’t need to generate meaningful revenue, it just needs to keep users engaged with the platform. It doesn’t need to win, it just needs not to lose.

Facebook lagged Snapchat, TikTok, Twitch, and YouTube in embracing creators. However, its user base (2.9 billion and climbing) and discovery tools are enough to make any creator salivate. Launching Stories on Facebook and Instagram shows that it can successfully adopt features from other platforms. With digital ads, the company has already built a world-class monetization engine. Facebook has the resources to invest and can be patient around the timing of payoffs. Success is never guaranteed, but these factors should help Zuckerberg sleep a little better at night.

For more like this once a week, consider subscribing👇

👉 If you enjoyed reading this post, please share it with friends!

More Good Reads

Eugene Wei on TikTok. The New Yorker on Mark Zuckerberg. Below the Line on Clubhouse and increasing speed to copy in consumer social.

Disclosure: The author owns shares in Facebook.

The Verge, Almost a fifth of Facebook employees are now working on VR and AR: report, March 12, 2021.

SensorTower, TikTok Becomes the First Non-Facebook Mobile App to Reach 3 Billion Downloads Globally, July 14, 2021.

Facebook, Second Quarter 2021 Results Conference Call, July 28, 2021.

Facebook, Second Quarter 2021 Results Conference Call, July 28, 2021

The Verge, Facebook is testing a way for creators to make money through Stories: sticker ads, March 11, 2021.

Facebook, First Quarter 2021 Results Conference Call, April 28, 2021.