Hi 👋 - This week The New York Times teased a new product: New York Times Audio. A look at the company’s audio strategy. Thanks for reading.

If you’re finding this content valuable, consider sharing it with friends or coworkers. ❤️

For more like this once a week, consider subscribing. ❤️

Nothing But Net

Michael Barbaro is the Michael Jordan of podcasting1. Since launching in February 2017, The Daily has been one of the most successful podcasts in the world. In 2020, it got 1.25 billion downloads, 4.8 million per episode.

Audio is an investment priority and growth opportunity for The Times. Today, an expanding roster of podcasts supplements The Daily. The Times continues attracting world-class audio talent, most recently signing Lulu Garcia-Navarro, who spent 16 years at NPR hosting Weekend Edition Sunday. Garcia-Navarro will host a yet to be named podcast2. Lastly, audio is the centerpiece of The Times’ recent M&A. The company acquired Audm, an app providing professionally narrated long-form journalism in March 2020. In July 2020, it acquired Serial, the studio behind the eponymous hit podcast, and inked a partnership with This American Life.

The contours of a broader audio strategy became visible this week when the company teased the beta of New York Times Audio, an app for audio journalism and storytelling:

We’re building something to help you understand the world, just by listening. With New York Times Audio, you’ll find context and clarity on current events, perspectives that will challenge your own and stories that will entertain and illuminate. And it’ll all be curated by our editors.

By bundling its audio assets, New York Times Audio should help retain existing subscribers, acquire new ones, and grow revenue, while advancing the company’s strategic priority of scaling digital subscriptions.

Giving A Damn About Audm

The New York Times acquired Audm as a lab to experiment with different audio formats3. Audm uses professional voice actors to narrate long-form journalism from publications like The Atlantic, The New Yorker, and Vanity Fair. The experiment is paying off. The app is currently ranked ninth in the Magazines & Newspapers category of the iOS app store, ahead of National Geographic (#11), USA Today (#12), and The New Yorker (#15).

The Times has been mum on Audm’s performance, but Noa (short for News Over Audio), a competing app, trumpets a 78% completion rate for audio articles and being a source of new subscribers for publications like Harvard Business Review4. Similarly, audio boosts retention for The Economist5:

“We are a premium-priced publication and people feel guilty if they don’t read many stories,” says Economist deputy editor Tom Standage, who oversees audio strategy. “Our evidence suggests that the audio edition is a very effective retention tool; once you come to rely on it, you won’t unsubscribe.”

Audio widens the Times’ acquisition funnel. The Daily is already a launchpad for other podcasts and leveraged to cross-pollinate New York Times content. Most episodes include an ad for a Times product or a call to action to subscribe. The show also attracts a different demographic, helping The Times reach new audiences. Daily listeners skew younger and more female6. The vast majority are under 40, which can’t be said of print subscribers. They show up four or five times a week and spend 20 to 30 minutes a day with The Daily. The Times wants to scale daily habitual use7; an audio app could build on The Daily’s progress.

The Times’ approach to newsletters hints at where audio could be headed. Every week, 15 million people read a Times newsletter. Eighty-five percent of these readers aren’t subscribers, but newsletters provide an onramp. Once the company has a reader’s email address, it can nudge them to download the app and engage with other products. Consuming a breadth of content is a leading indicator for paying and staying8. Like newsletters, audio is an onramp. As the company looks to scale digital subscriptions, audio offers the trifecta of engagement, retention, and acquisition.

Lastly, audio leverages fixed cost newsroom investments, like maintaining a bureau in Kabul, Afghanistan. This improves margins. With limited incremental expense, audio package existing reporting for new audiences and new distribution channels. For example, The Daily often features reporters talking about a story they published earlier that week. The audio production is an incremental expense, but most of the cost is in the upfront reporting. Additionally, audio prolongs content’s shelf life. In music streaming, sixty-five to seventy-five percent of streams come from back catalogs9. This is likely much lower for podcasts, but higher compared to the digital homepage that changes multiple times per day.

Changing Diapers

The Times is also tapping into shifting consumer behavior and IT hardware trends. The form factor change from print newspapers to digital creates new avenues for consumption. It’s easier to listen to something than to read it. For example, a commute from Fort Greene, Brooklyn to Bryant Park, Manhattan takes 34 minutes, split fifty-fifty between walking and riding the Q train. With a physical newspaper, reading time is capped at 17 minutes (unless you walk and read a newspaper, which is not advisable in New York City, or anywhere). With audio, you can listen for the whole 34 minutes (or 68 minutes of content on 2x speed).

Audio adds convenience. The ubiquity of AirPods means there are more opportunities to consume media and listen to reporting on the go. You can’t read a newspaper while washing the dishes, taking out the trash, walking the dog, or changing a diaper, but you can listen to a podcast.

Similarly, an increasing number of Americans listen to podcasts. Forty-one percent listened to one in June 2021, compared to thirty-seven percent in 2020 and thirty-two percent in 2019. This figure has been steadily growing since 2013, one of the reasons why in addition to The New York Times, tech platforms like Apple, Facebook, and Spotify are investing in audio. Embracing audio expands The New York Times’ market and meets subscribers - and potential subscribers - where they are.

Not Failing

New York Times Audio is in beta. Some beta products never see the light of day and launching a product doesn’t guarantee success. However, the Times has a track record of successfully launching and commercializing new products and has a strong podcasting business.

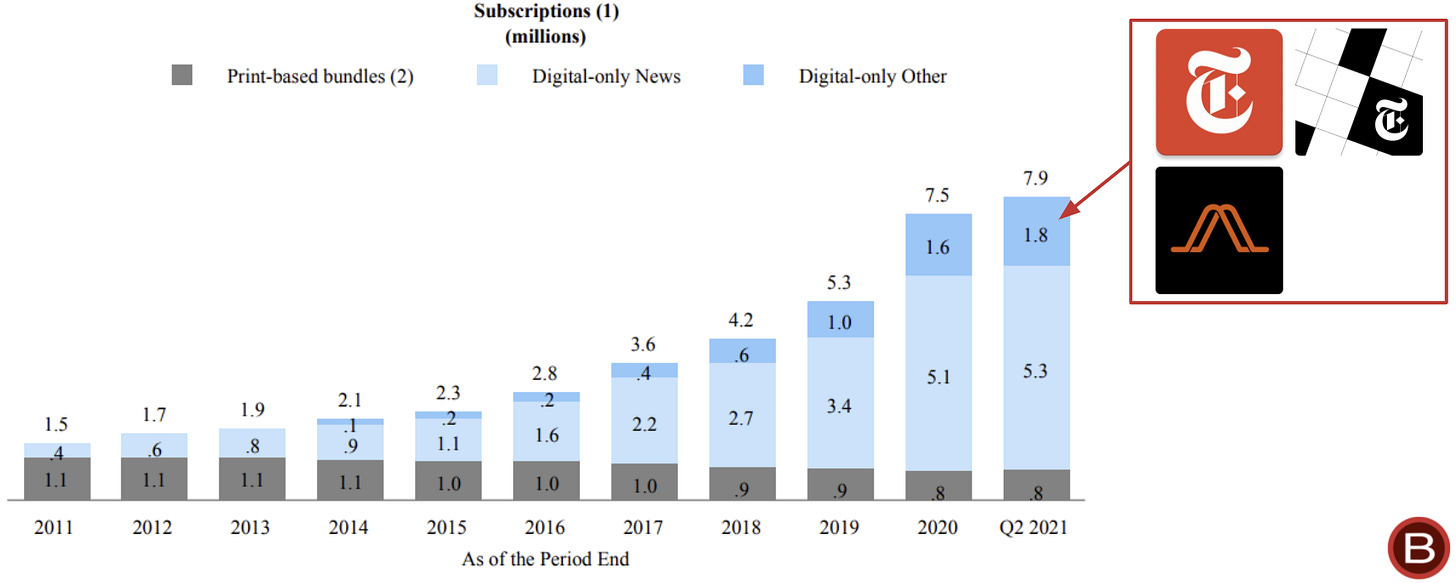

In August 2021, the Times crossed eight million paid subscriptions. Of these, 1.8 million, over twenty percent, were outside of news. Cooking and Games both have nearly one million subscribers. While journalism is the core, increasingly The New York Times’ business model resembles a digital subscription service like Netflix or Spotify more than a traditional newspaper.

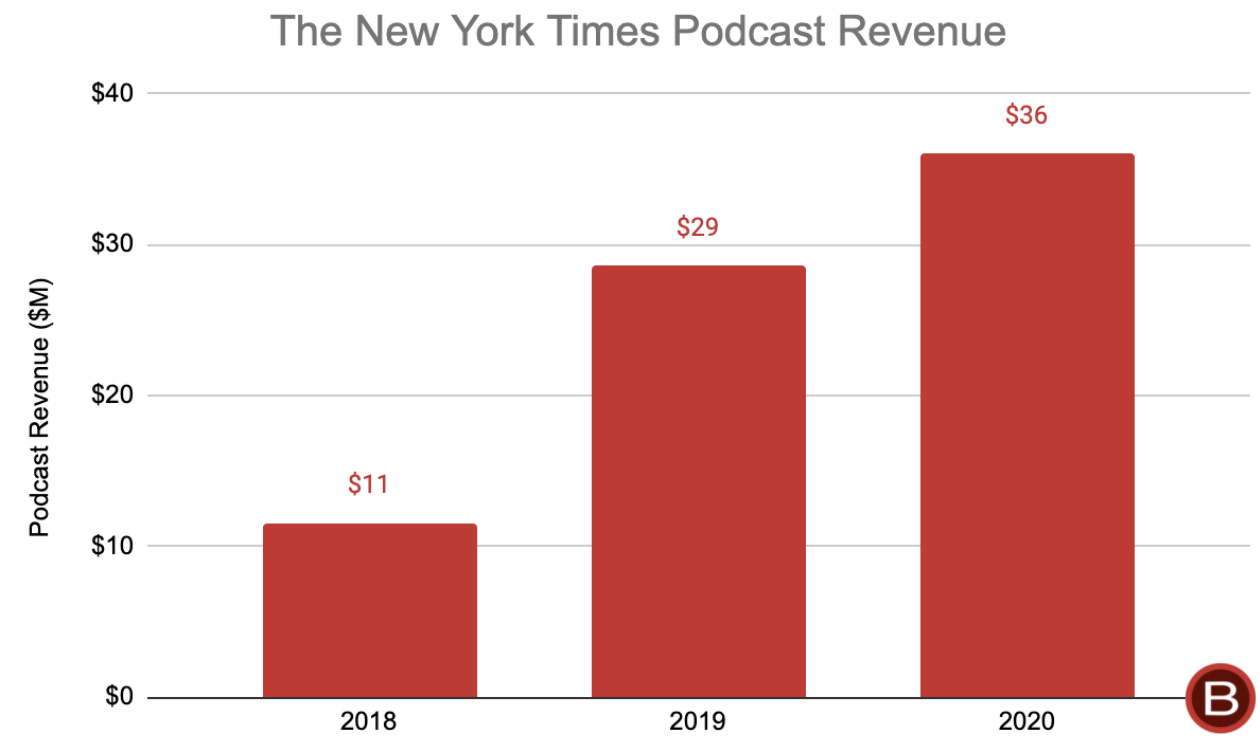

Further, The Times is already successful in audio. The Daily has propelled podcast ad revenue from $11 million in 2018 to $36 million in 2020. It should hit another record in 2021 due to continued growth of The Daily, an expanding audio portfolio including The Ezra Klein Show (launched January 2021) and The Argument with Jane Coaston (launched February 2021), a full year contribution from Serial Productions (acquired in June 2020) and Sway with Kara Swisher (launched September 2020), rights to sell advertising for This American Life, and the continuing development of the podcast ad market. I wouldn’t be surprised to see podcast advertising revenue north of $50 million in 2023.

While audio data is released sporadically, disclosures to date have been encouraging10. In 2020, podcasts made up sixteen percent of total digital advertising revenue. Audio users grew 30% year-on-year in Q1 2021. Additionally, the company credited an expanded audio portfolio for helping digital ads grow 79% year-over-year in Q2 2021.

New York Times Audio has multiple paths to success: acquiring new readers, retaining and engaging existing subscribers, driving brand affinity, exposing new audiences to Times’ content, and creating new revenue streams (either ads or subscription). The podcast dream team keeps getting stronger.

If you’re finding this content valuable, consider sharing it with friends or coworkers. ❤️

For more like this once a week, consider subscribing. ❤️

More Good Reads

Nieman on audio articles and audience loyalty. Mine Safety Disclosures’ brilliant analysis of the Times. NYT CEO Meredith Levien's interview with Recode’s Peter Kafka. Below the Line on The New York Times’ audio opportunity.

Disclosure: The author is an investor in The New York Times.

Joe Rogan is more of a Kyrie Irving.

Axios, Exclusive: NYT hires Lulu Garcia-Navarro as Opinion podcast host, September 30, 2021.

Recode Media with Peter Kafka, New York Times CEO Meredith Levien on the future of news, and her newspaper, February 11, 2021.

Nieman, Audio Articles are Helping News Outlets Gain Loyal Audiences, February 24, 2020.

Nieman, Audio Articles are Helping News Outlets Gain Loyal Audiences, February 24, 2020.

The New York Times, Presentation at the 29th Annual Goldman Sachs Communacopia Conference, September 15, 2020

The New York Times, Q2 2021 The New York Times Company Earnings Conference Call, August 4, 2021.

The New York Times, Q2 2021 The New York Times Company Earnings Conference Call, August 4, 2021.

Water & Music, Just how difficult is it to make a sustainable living from streaming?, September 27, 2021.

Take this with a grain of salt as companies tend not to voluntarily disclose information that makes them look bad.