#79 - Horizontal Advantages

The Battle Between Brands and Online Marketplaces

Hi 👋 - This week’s post digs into customer acquisition and marketplace liquidity by trying to book a hotel room through Booking.com and Marriott. The search starts in Manhattan and somehow ends up in Secaucus, New Jersey. Thanks for reading.

❤️ Many new readers discover this newsletter when a friend or colleague shares it with them. If you enjoy Below the Line, please consider sharing:

New to Below the Line? Subscribe! It’s free and it might even make you smarter 🧠

Economies of Scale

Booking.com is the largest aggregator of accommodations in the world. At the end of 2020, it offered reservations for nearly 2.4 million properties. This included over 430,000 hotels and 1.9 million vacation rentals, apartments, and alternative accommodations1. In contrast, Marriott ended 2020 with roughly 5,600 hotels and 943,000 rooms2. For every room that Marriott has, Booking has two-and-a-half properties. Advantage, Booking.com.

Booking’s global, diverse supply enables it to serve multiple travel needs. Whether you’re looking for a hotel in Tokyo, a vacation rental in Lake Como, or a chalet in Chamonix, it has the supply. In contrast, hotel chains only offer hotels and even large brands like Marriott have a fraction of the properties of Booking.com.

Booking has a wider geographic footprint and more supply density in each geography. It’s more liquid. Consequently, its potential purchase frequency and cross-sell - key drivers of customer lifetime value - are high. This gives it a boost in acquiring customers using performance marketing on platforms like Google and Facebook. If you’re looking to stay somewhere, anywhere really, Booking has more options than Marriott or any other hotel brand. This means it can profitably bid on more travel keywords and more geographies. It can also pay more to acquire a user and still be profitable3. That’s why in 2019 the company spent nearly $5 billion on marketing. In 2020, it spent a puny $2.2 billion on marketing as Covid-19 depressed travel demand.

Taste Test: Booking vs. Marriott

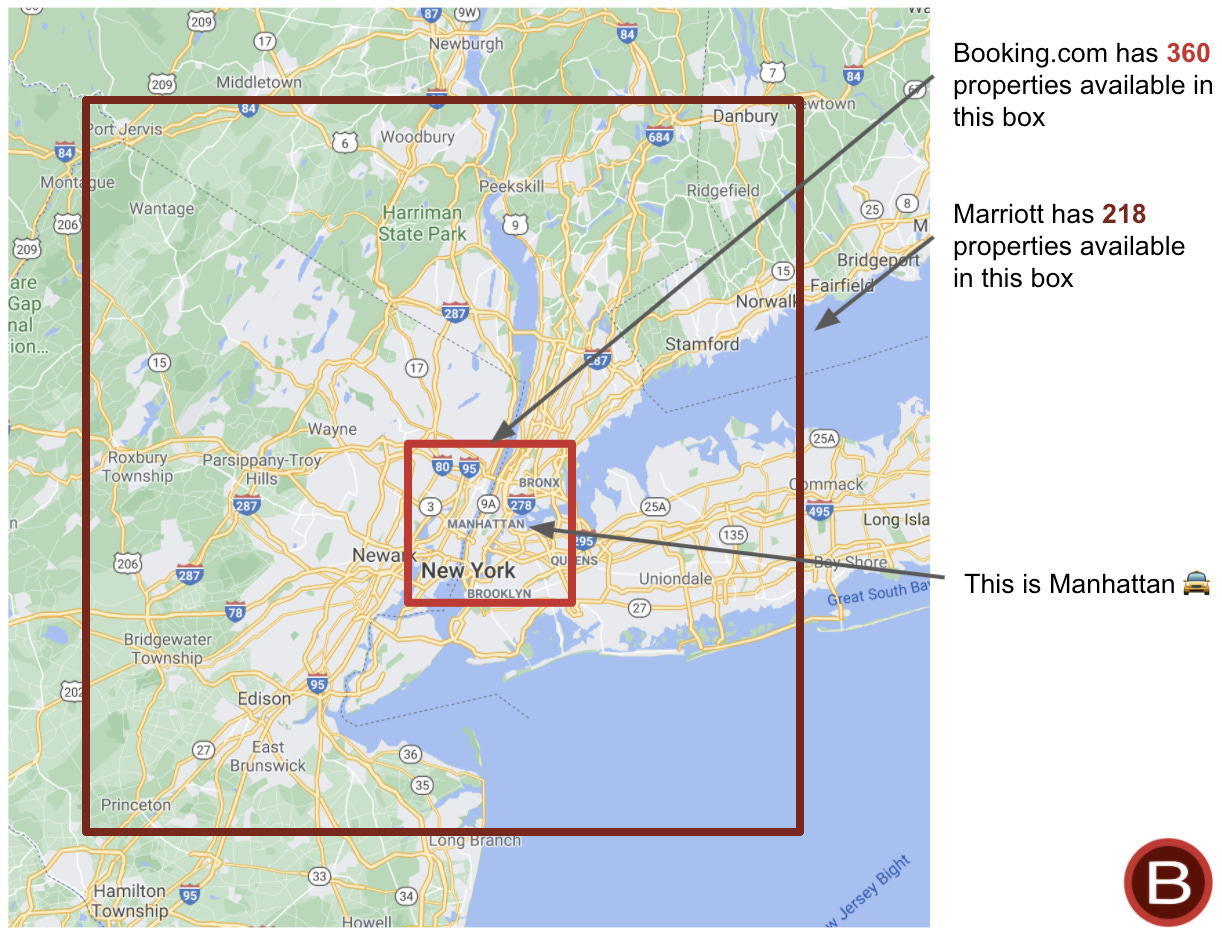

Search Booking and a hotel brand for the same location and dates, and Booking’s advantage is clear. For example, it has reservations available at 360 properties in and around Manhattan this Labor Day:

Booking’s properties are in Manhattan, or adjacent neighborhoods in Brooklyn, Queens, and New Jersey:

The same search on Marriott yields 218 properties. Less than Booking, but still ample:

Dig deeper, and the 218 starts looking disingenuous. Things get shaky on page two of Marriott’s search results (listings 41-80), which includes the Courtyard Secaucus Meadowlands and the Residence Inn Secaucus Meadowlands. Nothing against Secaucus, but it’s not Manhattan. For comparison, on Booking the forty-first result is the Courtyard New York Midtown East and the eightieth is the Fairfield Inn & Suites by Marriott Times Square. Both are very much in Manhattan and very ironically Marriott properties.

By the fourth search results page on Marriott, the wheels fall off: Residence Inn New Rochelle, Courtyard West Orange, and Fairfield Inn & Suites New York Staten Island. These hotels are 20 miles away from Manhattan geographically, but thousands of miles away in spirit.

The difference between Booking and Marriott illustrates the importance of marketplace liquidity. The more supply, the higher the chances of fulfilling demand. Building supply is a hellish task, but once a marketplace hits scale, it’s a tremendous asset for customer acquisition. In contrast, searching for a hotel in Manhattan and getting served results from Staten Island is no way grow a business. Liquidity matters.

While Booking is used above, the principle holds for scaled online marketplaces generally: Etsy, DoorDash, and Uber will outperform local makers, restaurants, and taxis on customer acquisition, reach, and variety.

Going Direct

Though disadvantaged in customer acquisition, hotels aren’t helpless. A big focus of hotel chains is getting guests to book directly, thus avoiding commissions to Booking or Expedia. There are a number of tactics to accomplish this. Saving the rooms next to the elevator or ice machine for guests that booked with OTAs is a stick. Reserving the best rooms and upgrades for loyal guests is a carrot. Perks like free wifi, complimentary breakfast, and spa credits are tools. Loyalty programs like Hilton Honors and Marriott Bonvoy are another strategy to engender allegiance. Branded credit cards with juicy rewards and loyalty programs are forms of lock-in aimed at increasing switching costs4. Of course, the best way to win a repeat customer is offering warm hospitality and exceptional service. Booking has an advantage in online acquisition, but hotels control a guest’s experience on premises.

Change Is The Only Constant

While scaled, horizontal marketplaces like Booking are amazing business models, they aren’t unassailable. No business is. You don’t need to rewind the tape too far to a time when eBay was the dominant online marketplace. Fast forward, and Amazon defenestrates eBay. Eventually, another business will usurp Amazon.

Nothing is inevitable in business or investing, a point reinforced by Warren Buffett in Berkshire Hathaway’s 2021 annual meeting. In 1989, thirteen of the top twenty largest companies in the world were Japanese:

Nippon Steal, Sumitomo Bank, and Tokyo Electric Power occupied the territory now held by Amazon, Apple, and Google. Buoyed by a booming economy and strong Yen, Japanese companies spent the late 1980s acquiring trophy assets in the US including Rockefeller Center, Columbia Pictures, and Pebble Beach Golf Links. Columbia Pictures is still owned by Sony, but the other two properties changed hands amid unsustainable debt loads. None of the world’s top twenty companies from 1989 are in the top twenty today. Despite its impressive reach and business model, there’s no guarantee that Booking will dominate online travel in a decade or two. The only constant in business is flux.

❤️ Many new readers discover this newsletter when a friend or colleague shares it with them. If you enjoy Below the Line, please consider sharing:

New to Below the Line? Subscribe! It’s free and it might even make you smarter 🧠

More Good Reads

This article was inspired by a podcast breaking down Wix’s business model featuring software seed investor and friend of the show Dave Ambrose. If you’re interested in software start-ups, the knowledge economy, or venture investing, David is a great follow on Twitter. Below the Line on marketplace liquidity. While acquisition marketing is a common growth tactic for scaled online marketplaces, few marketplace start-ups use it to jumpstart supply or demand. Growth tactics necessarily vary based on state of maturity and availability of resources.

Disclosure: The author owns shares in Apple, Berkshire Hathaway, and Facebook.

Booking.com is the world's leading brand for booking online accommodation reservations, based on room nights booked, with operations worldwide and headquarters in the Netherlands. At December 31, 2020, Booking.com offered accommodation reservation services for approximately 2,373,000 properties in over 220 countries and territories and in over 40 languages, consisting of approximately 434,000 hotels, motels and resorts and approximately 1,939,000 homes, apartments and other unique places to stay.

Per Marriott’s Q4 2020 earning release.

Business Breakdowns, Dave Ambrose - Wix: The Internet Storefront, May 26, 2021. This comment from Dave Ambrose inspired this note:

One of the benefits that Priceline can do because it aggregates all of this supply is that they can actually spend money on Facebook marketing, Instagram marketing, Google Ad Words, and target all of the keywords for the supply that they're encompassing whereas Marriott can only bid on the terms that are Marriott. ' So what that means in this case of Priceline, and if you think about this in the concept of Wix and in the context of Wix is Priceline is far more effective. It's spending money to acquire customers because it's truly horizontal and it aggregates all of this disparate supply. And by doing that, they're actually far more profitable and can spend far more money than all of the companies that they're aggregating to reach a faster scale.

Michael Mauboussin, Morgan Stanley Investment Management, The Economics of Customer Businesses: Calculating Customer-Based Corporate Valuation, May 19, 2021.