Hi 👋 - Spotify is a fascinating company. Despite being a fraction of their size, it regularly competes with and wins against giants like Apple and Amazon. To unshackle its financial model from record labels, it has boldly moved into podcasts. It’s also attempting to define a category (audio). This week and next, an update on Spotify’s podcast strategy. Thanks for reading.

🎵 If you’re finding this content valuable, consider sharing it with friends or coworkers. 🎵

🎵 For more like this once a week, consider subscribing. 🎵

Gross Gross Margins

Spotify is at the mercy of record labels. Sony BMG, Universal Music Group, and Warner Music Group control about 70% of music licenses and they know it. For every dollar of music streaming revenue that Spotify earns, it pays out about sixty cents in royalties. This is a variable expense, growing in parallel with revenue. This constrains Spotify’s profitability - for every extra dollar of music streaming revenue from here to infinity, it needs to pay out those royalties - and is the cornerstone of the bear thesis on the company. This manifests as low gross margins.

Spotify’s move into podcasts, and audio more broadly, is an attempt to kick off these shackles. Unlike the variable expense structure of music streaming, podcasts are largely fixed costs, providing a path to higher gross margins and profitability.

Content Is King

For Spotify’s podcast strategy to succeed, it needs compelling content. It deserves high marks here. The number of podcasts on Spotify grew from 500 thousand in 3Q 2019 to over 3.6 million in Q4 2021. In 2021, it added over one million podcast titles.

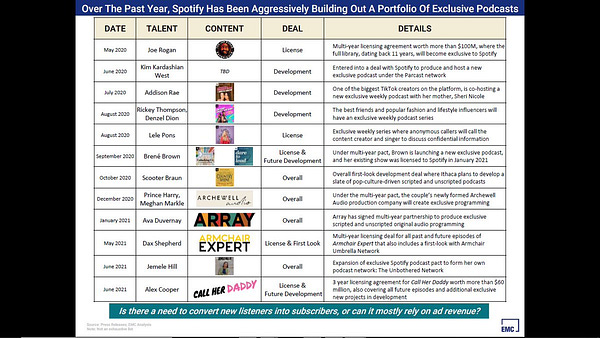

Spotify’s content acquisition strategy has two tenets. First, paying up for exclusive deals with marquee names like Alex Cooper (Call Her Daddy), Dax Shepard (Armchair Expert), and Joe Rogan (the eponymous Joe Rogan Experience). Second, making it easier for everyone else to publish and distribute their podcasts (the Anchor acquisition was key here).

Pursuing this strategy isn’t free. Spotify shelled out over $100 million on just Joe Rogan. Since 2020, it's spent hundreds of millions acquiring Original & Exclusive podcasts (O&E) globally. Things aren’t slowing down. The company plans to continue spending on podcast content in 20221. O&E podcasts drives user acquisition and encourages existing users to listen to podcasts2. It also increases engagement and retention. Lastly, it helps justify the price increases that Spotify instituted in over 40 markets in 2021.

Spotify’s corporate development team has also been busy acquiring podcast advertising and distribution technologies, like Anchor, which lets individuals create and publish podcasts, and Megaphone, a podcast hosting company. The team didn’t get a break over the holidays, acquiring Whooshkaa, a technology that lets radio broadcasters turn their existing audio into podcasts, in Q4 2021. These acquisitions all increase the number of podcasts on the platform. Spotify aims to grow its advertising business and more podcast content unlocks more ad inventory.

Another component of Spotify’s strategy is to increase the number of creators on the site to 50 million (across audio, music, and podcasts) and help them monetize their work. Success here has been less clear. Unlike content acquisition, this isn’t a problem that you can just throw money at. Part of the issue is structural. The popularity of online content follows a power law distribution, meaning that economics spoils disproportionately accrue to a handful of people like Joe Rogan or Taylor Swift. For example, in the UK the top 1% of streamed tracks accounted for over 75% of total streams between October 2014 and October 20203.

Attempting to overcome this, Spotify is throwing a lot of spaghetti against the wall. It deserves an A for effort. In April 2021, it launched paid subscription on Anchor, allowing podcasters to paywall their content and charge a monthly subscription for access. It also added Anchor inventory to Spotify Audience Network, its podcast advertising network, opening up advertising to smaller shows (though most probably make $0.67 a month; see: power laws). Small podcasters now have the option of subscriptions or ads. Additionally, in October 2021 it partnered with Shopify, letting artists and creators sell merch on their Spotify profile pages.

Building tools and services for creators is a priority for CEO Daniel Ek, who wants to move beyond one-size-fits all monetization models and make it easy for superfans to slap leather4. This isn’t a selfless undertaking. Helping creators monetize endears them to the platform, ensuring a steady stream of content. It also creates new revenue streams (albeit small ones) unencumbered by record labels contracts or licensing fees.

One place where Spotify could do more is helping podcasters grow their audience. While there’s been a Cambrian explosion of podcasts on Spotify (3.6 million episodes and growing), discovery tools haven’t kept pace. Admittedly, this is a hard problem to solve. The June 2021 acquisition of Podz, a podcast discovery platform, acknowledges that there’s work to be done. Spotify has an incentive to improve. Better discovery, combined with dynamic ad insertion (Casper ads from 2017 don’t age well), would improve the value of back catalogs. A great sign would be if the next Serial launched on Anchor. So far, this hasn’t happened.

Calling Sherlock Holmes

While Spotify’s podcast library remains on an upward trajectory, podcast listener growth is slowing. After impressive early gains, podcast penetration seems to be plateauing. Seems to be, because the company has made it difficult to know what exactly is going on.

Through Q4 2020, it disclosed podcast penetration in plain English. For example, noting in Q4 2020 that5:

25% of our Total MAUs [monthly active users] engaged with podcast content in Q4 (up from 22% of MAUs in Q3 2020).

It’s since gotten cute. Too cute. Recent disclosure has been as clear as mud. Here’s what the company said about podcast user growth throughout 2021:

Q1 2021: “The percentage of MAUs that engaged with podcast content on our platform was consistent with Q4 levels.”6 For context, Spotify made clear that MAU penetration was 25% in Q4 2020.

Q2 2021: “The percentage of MAUs that engaged with podcast content on our platform improved modestly relative to Q1.”7 It’s unclear what modest means. In prior quarters Spotify explicitly quantified sequential gains of two to three percentage points. This leads me to believe that modest means less than two percentage points. Whether it’s one percentage point or twenty basis points is unclear. My best guess is somewhere between 25% and 26%.

Q3 2021: “The percentage of MAUs that engaged with podcast content continued to increase throughout the quarter, marking an acceleration relative to Q2 trends.”8 Because Spotify didn’t quantify Q2 2021 penetration, it’s impossible to size what acceleration means. It could mean a move from 26% to 26.3% or from 26% to 30%. Given that Spotify called out full percentage point jumps in the past, my suspicion is that it's closer to the former, but it’s impossible to tell.

Q4 2021: “At the end of Q4, we had 3.6 million podcasts on the platform (up from 3.2 million at the end of Q3) and were pleased to see a double digit increase in the number of MAUs that engaged with podcast content relative to Q3.”9 For context, Spotify’s user base grew 7% q/q in Q4 2021, so 7% q/q growth in podcast users would mean penetration is treading water. Mathematically, podcast penetration increased in Q4 2021, but the magnitude is obfuscated.

To summarize, at the end of 2021 there were modest improvements, sequential acceleration, and double digit growth, all off an unspecified base. Even Sherlock Holmes would struggle to make sense of this. Gun to the head, I’d say podcast penetration 27% plus or minus 1%, but that’s just a guess.

Unless they’re monopolies (Spotify isn’t, check the income statement), public companies typically don’t hide good news. Tactically, highlighting a growing podcast audience attracts marketer attention, supporting the ads business. This leads me to conclude that podcast penetration is losing steam. However, there are alternative explanations. For example, perhaps Spotify is shielding it for competitive reasons.

Semantics aside, Spotify’s user base was 406 million strong in Q4 2021, so whether podcast penetration is 25.4% or 26.2% or 27.3% or 31.6% there’s an audience of over 100 million monthly podcast listeners. Big businesses have been built with less. Additionally, Spotify is the top podcast platform in over 60 countries and in 2021 dethroned Apple Podcasts as the top podcast player in the US10. It also has secular trends at its back. Podcasts, audio books, and other forms of spoken word audio are growing in popularity in the US, according to analysis from NPR and Edison Research.

Getting Engaged

While listener growth is slowing, podcast listener engagement is improving. Throughout 2021, podcast consumption hours grew, revenue mix shifted towards podcasts, and per user listening increased. Here’s what Spotify said about podcast listener engagement in 2021:

Q1 2021: “From a consumption standpoint, we saw a strong increase in Q1 podcast consumption hours vs. Q4, with March activity driving an all-time high in terms of podcast share of overall platform consumption hours.”11

Q2 2021: “Among MAUs that engaged with podcasts in Q2, consumption trends were strong (up 95% Y/Y in aggregate and more than 30% Y/Y on a per user basis) while week-over-week and month-over-month retention rates reached all-time highs.”12

Q3 2021: “Among MAUs that engaged with podcasts in Q3, consumption trends remained strong (up 20% Y/Y on a per user basis) while month-over-month retention rates continued to trend positively.”13

Q4 2021: “Among MAUs that engaged with podcasts in Q4, consumption trends remained strong (up 20% Y/Y on a per user basis).”14

These need to be taken with the context of a small base, but it’s still an encouraging picture. Spotify monetizes podcasts with ads, and ad impressions are the product of the number of podcast listeners (MAU penetration rate) and how engaged each user is (hours listened per user). The company’s advertising business had a strong 2021, the topic of next week’s post.

🎵 If you’re finding this content valuable, consider sharing it with friends or coworkers. 🎵

🎵 For more like this once a week, consider subscribing. 🎵

More Good Reads

Stratechery on Spotify’s podcast aggregation play. Sleepwell Capital on Spotify’s live audio opportunity. Below the Line on the economics behind Spotify’s podcast push, the history of Spotify's podcast strategy, and the battle for your ears.

Disclosure: The author owns shares of Apple and Shopify.

Spotify, Q4 2021 Earnings Call, February 2, 2022.

Spotify, Q2 2021 Earnings Call, July 28, 2021.

UK Intellectual Property Office, Music Creators’ Earnings in the Digital Era, September 2021.

Spotify, Q4 2021 Earnings Call, February 2, 2022.

Spotify, Q4 2020 Shareholder Letter, February 3, 2021.

Spotify, Q1 2021 Shareholder Letter, April 28, 2021.

Spotify, Q2 2021 Shareholder Letter, July 28, 2021.

Spotify, Q3 2021 Shareholder Letter, October 27, 2021.

Spotify, Q4 2021 Shareholder Letter, February 2, 2022.

Spotify, Q3 2021 Earnings Call, October 27, 2021.

Spotify, Q1 2021 Shareholder Letter, April 28, 2021.

Spotify, Q2 2021 Shareholder Letter, July 28, 2021.

Spotify, Q3 2021 Shareholder Letter, October 27, 2021.

Spotify, Q4 2021 Shareholder Letter, February 2, 2022.