#77 - Raking It In

Take Rates: How Marketplaces Make Money

Hi 👋 - Marketplace month continues. Companies like Booking.com and Etsy earn a fee for connecting buyers and sellers. This post looks at take rates, pricing strategy, and the tools marketplaces use to increase them. This is Below the Line’s second deep dive of 20211. Like the format? Think it’s boring? Let me know by responding to this email. As always, thanks for reading.

If you’re finding this content valuable, consider sharing this newsletter with friends. ❤️

If you’re new to Below the Line, you can subscribe below.

Take Rates 101

Gross merchandise volume (GMV) is the lifeblood of a marketplace. It measures transaction value and is a key metric for operators and investors. For example, Airbnb’s GMV is the number of nights booked times the average price per night. To grow GMV, Airbnb needs some combination of higher volumes (nights booked) and higher prices (average daily rate).

Marketplaces aggregate supply and demand and sell transactions. For their matchmaking services, they take a cut of every transaction. This is known as a take rate (or commission, or vig, or rake). Take rates range from 10% to 30%2. They’re influenced by factors like buyer and seller concentration, exclusive supply, and the availability of alternatives. For example, there are a handful of major airlines in the US. This gives them leverage against OTAs like Booking.com, Kayak, and Expedia, resulting in low take rates for air travel (about 2-3%). In contrast, hotel supply is fragmented, so hotel take rates are higher than flights (about 10-20%). Similarly, chains like Hilton and Marriott have more sway, and are able to negotiate better rates versus independent and boutique hotels, so they get a lower take.

Etsy and the Anatomy of a Take Rate

GMV multiplied by the take rate equals revenue. This is the pot of cash that a marketplace has to hire engineers, acquire customers, conduct customer service, and earn a profit. Here’s Etsy’s GMV, revenue, and take rate progression from 2017 through 2020, for example:

Take rates can have multiple components. All marketplaces have different structures, but Etsy’s composition is fairly representative:

Transaction Fees: 5% of order value, including shipping and gift wrapping. Etsy increases its take rate by offering other seller services.

Listing Fee: $0.20 per listing for being stocked on Etsy’s store shelves. This fee needs to be paid to restock an item after it sells or after it expires (listings last four months).

Payment Processing Fees: A fee charged on each transaction for sellers enrolled in Etsy Payments, which enables seamless transactions across payment methods and geographies. The fee varies by country. In the US, it’s 3% plus $0.253. Most of this offsets credit card fees, though Etsy also makes a margin.

Shipping Labels: Etsy purchases shipping in bulk form carriers like FedEx, Royal Mail, and USPS. Because it buys in bulk, it gets a discount rate. It then sells shipping labels to individual sellers. Sellers get a better deal than they would on their own and Etsy takes a cut for its troubles.

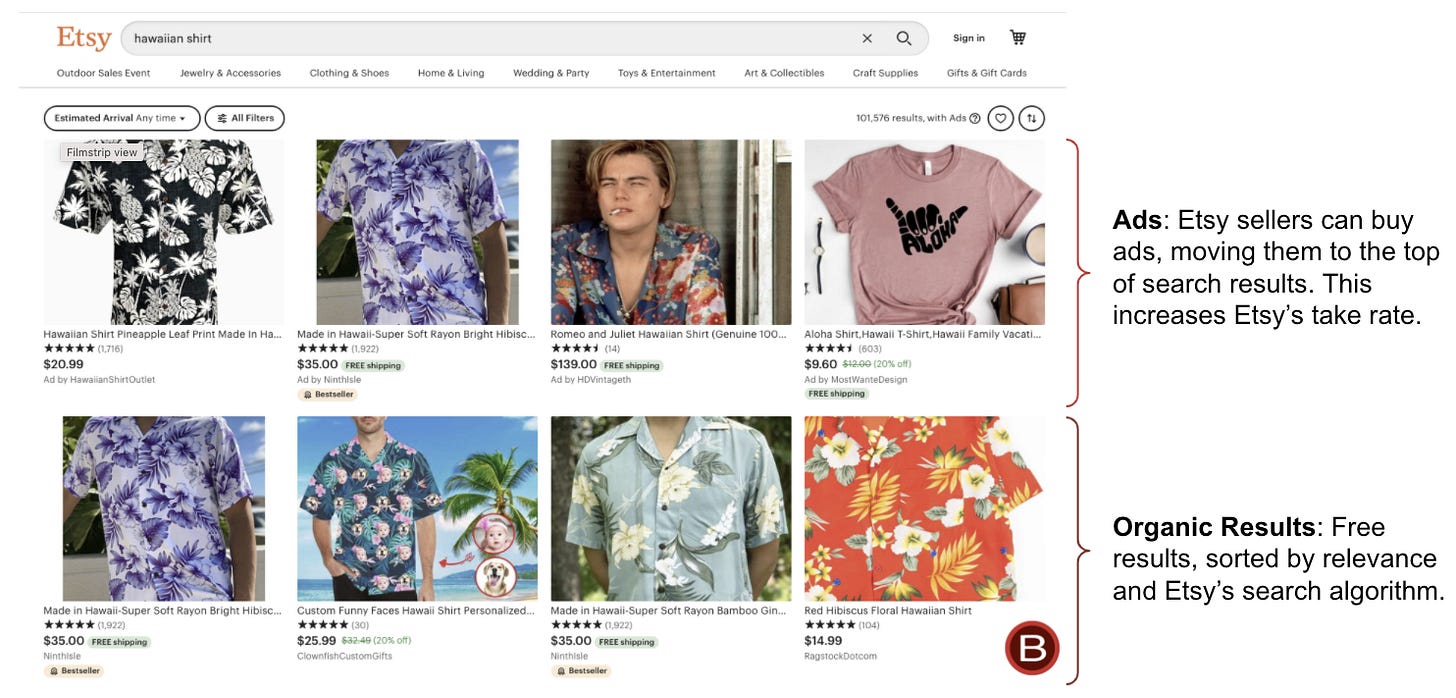

Ads: Sellers can buy onsite ads to improve their listing’s prominence in search results. Etsy also charges sellers a fee when they make a sale through offsite ads on sites like Google or Facebook.

Etsy segments revenue into two buckets: Marketplace and Services. Marketplace encompasses transaction fees, listing fees, payments, and offsite ads. Services includes shipping and onsite ads. In July 2018, Etsy increased the transaction fee from 3.5% to 5%4. Additionally, it recently started charging sellers fees for sales made through offsite ads. These policy changes are what’s driving Marketplace take rates higher. Services take rates are driven by higher seller adoption of ads and shipping.

Marketplace Pricing Strategy

Take rates and revenue have a direct positive relationship. A $100 order generates $1 of revenue at a 1% take rate and $10 of revenue at a 10% take rate. For a given level of GMV, a higher take rate means more revenue. There’s a powerful temptation to raise take rates. But the highest take rate isn’t necessarily the best, particularly for a young marketplace.

Marketplaces sell transitions. Anything that increases the friction needs to be analyzed skeptically. Higher take rates increase friction, give suppliers a reason to look for alternatives, and opens you up to competition from below. That’s what Jeff Bezos meant when he said: your margin is my opportunity. High volume at a modest take rate is the ideal. Bill Gurley, a venture capitalists at Benchmark, notes5:

If your objective is to build a winner-take-all marketplace over a very long term, you want to build a platform that has the least amount of friction (both product and pricing). High rakes are a form of friction precisely because your rake becomes part of the landed price for the consumer…In order for your platform to be the “definitive” place to transact, you want industry leading pricing.

Take Rate Levers

Take rates are dynamic and companies have many tools to adjust them. A common strategy is to set a minimum take rate, and then provide sellers tools that increase visibility for a higher rake. Want more traffic? Pay more. Merchants voluntarily bid up their commission rate for better placement in search. Over time, competition between merchants puts upward pressure on take rates.

Booking.com has been savvy in using take rate to scale its business. The company gained prominence by offering hotels lower commissions versus competitors. After establishing itself as the leader in online travel, it launched tools that let hotels improve their search ranking.

The best place to hide a dead body is on the second page of search results. Top search results get a disproportionate share of views, so better search results lead to more business. Suppliers are willing to pay for better placement (Google’s search business model in a nutshell). Booking.com uses search rankings as a tool to increase commissions, a common tech tactic:

Booking.com’s search ranking algorithm is an ever changing mix of relevance, guest preference (is there a pool and free wifi?), availability, reviews (the higher, the better), property performance (a low cancellation rate is a plus), and commission rate. The company offers hotels two tools to enhance their search ranking:

Preferred Partner Program: A program for top performing properties. Preferred hotels get 65% more page views and 35% more bookings. They pay 18% commissions versus an average of 15%. This program is not strictly pay-for-play. To be eligible, hotels must meet criteria like booking performance (do people want to stay there?), reviews (do guests like it?), and competitive pricing. Membership is reviewed once a quarter to make sure that criteria are being met.

Visibility Boost: Hotels can opt to pay a higher commission rate to fill rooms on select dates. The higher the commission, the better the search visibility. This can be used during times of low demand or high cancellations.

While Booking’s search ranking algorithm is confidential, a high conversion rate (how many travelers who look at a property end up booking) is an important signal6. Commission is one of many criteria used to determine search ranking. It’s probably more of a tiebreaker than a primary driver. Booking.com wants you to have a good experience and use the platform again, which is why elements like guest reviews are incorporated. For Booking.com and other marketplaces, the goal of is to maximize transactions, not take rates.

If you’re finding this content valuable, consider sharing this newsletter with friends. ❤️

If you’re new to Below the Line, you can subscribe below.

More Good Reads

Bill Gurley on take rates and marketplace pricing strategy. Tanay Jaipuria on the variables that influence take rates. Below the Line on marketplace liquidity and Hipcamp’s exclusive supply.

The first was this three part series on Nick Sleep and Nomad Investment Partnership: Nomad’s Investment Process & Philosophy Part 1, Nomad’s Investment Process & Philosophy Part 2, and Nomad’s investments.

Tanay Jaipuria (Tanay’s Newsletter), Marketplace take rates factors, January 18, 2021

Etsy, What are Payment Processing Fees for Etsy Payments?, accessed May 22, 2021.

Etsy Community Forum, Etsy is increasing the seller transaction fee from 3.5% to 5%, June 14, 2018.

Bill Gurley (Above the Crowd), A Rake Too Far: Optimal Platform Pricing Strategy, April 18, 2013.

Booking.com Partner Hub, All you need to know about ranking, search results, and visibility, accessed May 22, 2021.