Hi 👋 - The e-commerce industry is retrenching as e-commerce penetration reverts to pre-pandemic levels. During the second quarter, focus shifted from growth to survival. Today, a look at how e-commerce companies are responding to lower demand. (If you’re joining us for the first time this week, here’s part one of the series.) As always, thanks for reading.

If you’re finding this content valuable, consider sharing it with friends or coworkers.🛍 🛍 🛍

For more like this once a week, consider subscribing. 🛍 🛍 🛍

The Covid Pump Fake

It’s usually a safe bet that tomorrow will look a lot like today. But some days – December 7, 1941 or September 11, 2001 – look very different from the preceding one. As Nassim Nicholas Taleb writes, history advances more by jumps than straight lines. Extrapolation, by definition, misses turning points, which are inevitable with long time horizons (even if they’re impossible to forecast).

The Covid-19 pandemic jolted the e-commerce industry with two jumps. First, with stores closed and people stuck at home with sourdough starter kits, e-commerce penetration spiked in 2020 and 2021. Second, this trend reversed. Penetration is now reverting to its pre-pandemic trendline.

The chart below is the best way to understand the present moment for e-commerce. During the initial spike, firms reacted to surging demand by adding headcount, increasing marketing budgets, and ramping up investment. With demand waning, this is now unwinding.

Shopify CEO Tobi Lütke explained the dilemma facing operators well1:

When the Covid pandemic set in, almost all retail shifted online because of shelter-in-place orders. Demand for Shopify skyrocketed…Before the pandemic, e-commerce growth had been steady and predictable. Was this surge to be a temporary effect or a new normal? And so, given what we saw, we placed another bet: We bet that the channel mix - the share of dollars that travel through e-commerce rather than physical retail - would permanently leap ahead by 5 or even 10 years. We couldn’t know for sure at the time, but we knew that if there was a chance that this was true, we would have to expand the company to match. It’s now clear that bet didn’t pay off. What we see now is the mix reverting to roughly where pre-Covid data would have suggested it should be at this point. Still growing steadily, but it wasn’t a meaningful 5-year leap ahead…Ultimately, placing this bet was my call to make and I got this wrong. Now, we have to adjust. As a consequence, we have to say goodbye to some of you today and I’m deeply sorry for that.

Shopify, which conducted a 10% layoff in July, isn’t alone. Cost cutting took center stage during second quarter earnings.

Belt Tightening – Everything Everywhere All At Once

Faced with lackluster demand, companies are tightening their belts across the board.

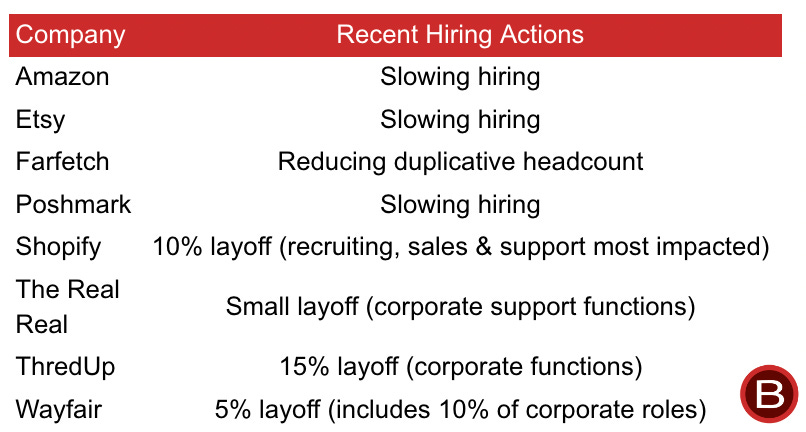

Amazon has been battling surging costs throughout 2022. During the first quarter, inflation (air and ocean shipping rates, fuel prices, wages), reduced productivity, and lower fixed cost leverage added an additional $6 billion of expenses relative to the prior year. In the second quarter, it cut this down to $4 billion as it curtailed hiring, adjusted staffing levels to improve efficiency, and slowed fulfillment network capacity expansion2. Amazon’s headcount declined by nearly 100,000 sequentially. A large part of this was likely driven by not backfilling attrition at distribution centers, which chew through workers like a hungry mosquito in a nudist camp, as opposed to outright layoffs.

Etsy significantly slowed hiring and cut performance marketing spending by roughly 20% year-on-year3. For online marketplaces, performance marketing is a large cost bucket and one that can be adjusted quickly and with less planning and less disruption than adjusting headcount levels.

Never waste a crisis. Farfetch is taking advantage of slower growth to redesign its organization, hoping to benefit from a streamlined business when demand rebounds. The company is reducing headcount by eliminating duplicative roles. It’s also looking for cost savings and shifting investments to projects with more immediate payback4.

Poshmark started rationalizing spending in the second quarter as it reevaluated its cost structure. The company is focused on identifying opportunities to deliver more with less and is working to reduce costs in the second half of 20225.

Like many other companies, Shopify believed that elevated Covid demand would be permanent. With e-commerce penetration reverting to pre-pandemic trends, the company is recalibrating spending. Shopify executed a 10% layoff in July. While the cuts spanned the entire organization, recruiting, sales, and support were disproportionately hit6. It also slowed hiring, reduced spending in non-core areas, and diverted sales and marketing investments to areas with shorter payback periods7. In a potentially related move, the company announced in early September the current CFO Amy Shapero, who has been at the financial helm since March 2018, was being replaced by Jeff Hoffmeister, a Morgan Stanley investment banker, following third quarter earnings.

The Real Real conducted a small layoff in corporate functions, slowed hiring for open support roles, and reduced discretionary spending during the second quarter. More cost cuts are planned for the third and fourth quarters, as the company focuses on achieving EBITDA breakeven and preserving capital8.

Everything is on the chopping block for ThredUp as it rigorously manages variable expenses and prioritizes cost efficiency across the business. ThredUp laid off 15% of corporate staff during the second quarter and is pulling back on construction of new distribution centers to reduce cash burn. In addition to lower headcount, it cut research and development and discretionary spending and closed a processing center9.

Expense reductions were the major focus of Wayfair’s earnings call. As part of a broad reprioritization across the company, Wayfair froze hiring in May, pulled back on planned investments like European expansion, and canned non-strategic projects10. (Why engage in non-strategic projects in the first place?) CFO Michael Fleisher said that every expense was being scrutinized under a microscope and that there are multiple work streams in process to cut expenses across the board. A few weeks after reporting earnings, Wayfair laid off 870 employees, 5% of total headcount. Comments from CEO Niraj Shah show that priorities are shifting from growth to efficiency, which was applicable across the industry11:

As the macro environment shifts, we know that our operating and financial plans need to evolve. Over the last few weeks, we articulated a clear set of goals to our entire organization, which include three key tenets: one, drive cost efficiency; two, deliver best-in-class execution by nailing the basics; and three, earn customer and supplier loyalty every day. Through this lens, we are making swift decisions, prioritizing clearly and looking to drive costs out of every pocket of the business. Some of this is already visible to you and more will become apparent as time goes on. This is an ongoing exercise and frankly, one that will serve us well in all sorts of environments as we evolve in the way we operate and grow Wayfair.

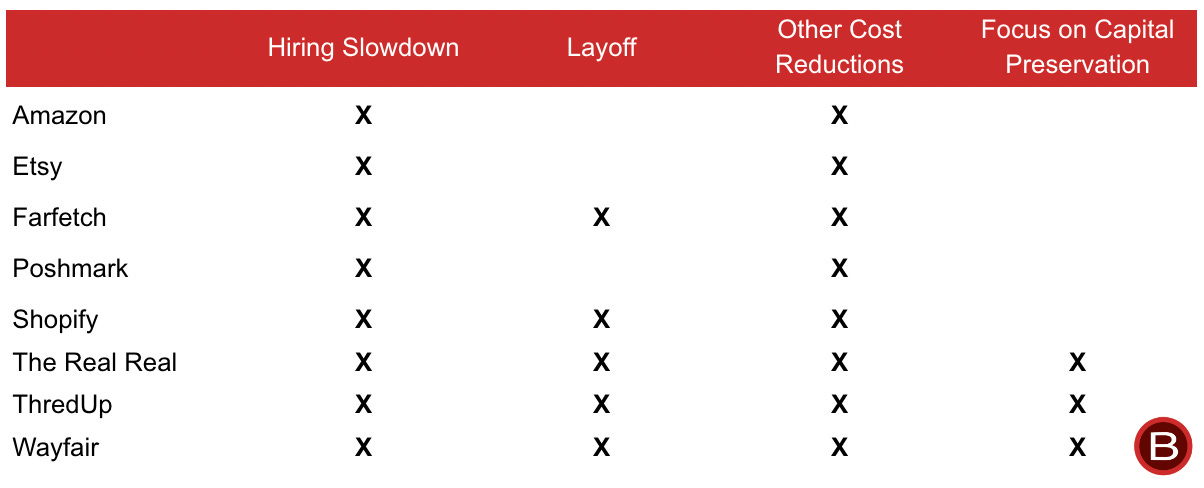

Hiring Trends – Freeze or Worse

With demand slowing, interest rates rising, and investors focused more on margins than growth, tech has entered the great hiring slowdown. E-commerce companies are the tip of the spear. Five of the eight companies tracked in this note conducted layoffs, while the others are slowing hiring and reducing the number of open roles. No wonder recruiting was one of the positions disproportionately impacted by recent layoffs at Shopify.

Capital Preservation – Looking For Breathing Space

Cash is like oxygen for a business. According to Warren Buffett12:

Cash is to a business as oxygen is to an individual: never thought about when it is present, the only thing in mind when it is absent.

E-commerce companies started thinking about cash a lot more during the second quarter. While cost cutting is industry-wide, some companies are in a worse position than others. Given current liquidity and cash burn profiles, The Real Real, ThredUp, and Wayfair are in the rockiest spot. All three are prioritizing capital preservation.

The reason is simple: at current burn rates, they’ve got between four and seven quarters of runway. That’ll make any CFO sweat. ThredUp ended the second quarter with $149 million in cash, down from $206 million at the end of 2021. That’s more than 25% of its cash pile vaporized in two quarters. This burn was split roughly 50/50 between losses from operations and capital expenditures for distribution center build outs. The Real Real’s coffers are also getting thin. The company ended the second quarter with $316 million in cash, down from $418 million at the end of 2021. While its revenue grew 30% year-on-year, unit economics are wobbly. Relative to ThredUp, The Real Real’s burn profile is more concerning, with $90 million of the $100 million coming from operations (the remainder is capex). Pausing construction is a lot easier than massively restructuring operations and resuscitating unit economics. Similarly, Wayfair ended the second quarter with $1.8 billion in cash, down from $2.4 billion at year end. The company is seeing significant year-on-year revenue declines as consumers pack airplanes and bars and aren’t spending on home.

The analysis above is admittedly both static and simplistic. All three companies are reducing expenses, which reduces cash burn. For example, ThredUp’s second quarter cost reductions are expected to save $30 million in the second half of the year13. Additionally, they could tap the capital markets for more cash. Earlier this week Wayfair announced it was issuing $600 million of convertible notes, maturing in September 202714. Some of the proceeds will be used to retire existing convertible bonds due in 2024 and 2025. By raising cash and extending maturities (albeit on dearer terms), Wayfair is giving itself more wiggle room to operate and more time for furniture demand to rebound.

Changing Priorities – Survive, Then Thrive

As the industry has gone from party to hangover, focus has shifted from growth to survival. (Tech investors' psychology has swung in this direction too.) Not surprisingly, this new positioning was strongest at ThredUp, The RealReal, and Wayfair.

ThredUp’s top priority is achieving EBITDA breakeven. Management laid out three operating principles, and two involve cost management: maintaining strong gross margins and rigorously managing variable expenses (the third was maintaining customer engagement). Similarly, The RealReal is prioritizing profitability over growth. This is impacting operations, with the company pulling back from owned-inventory (which chews up cash) and leaning more into consignment. Lastly, Wayfair’s number one operating tenant for an uncertain environment is driving cost efficiency. During the second quarter, the e-commerce industry’s focus shifted from growth to fighting to live another day.

If you’re finding this content valuable, consider sharing it with friends or coworkers.🛍 🛍 🛍

For more like this once a week, consider subscribing. 🛍 🛍 🛍

More Good Reads and Listens

Shopify CEO Tobi Lütke’s email to employees on the company’s 10% layoff in July. Luttig’s Learnings on mean reversion. Below the Line on Etsy’s pandemic success and how to survive a downturn.

Disclosure: The author owns shares in Shopify.

Shopify, Changes to Shopify’s team, July 26, 2022.

Amazon, Q2 2022 Earnings Call, July 28, 2022.

Etsy, Q2 2022 Earnings Call, August 3, 2022.

Farfetch, Q2 2022 Earnings Call, August 25, 2022.

Poshmark, Q2 2022 Earnings Call, August 11, 2022.

Shopify, Changes to Shopify’s team, July 26, 2022.

Shopify, Q2 2022 Earnings Call, July 27, 2022.

The Real Real, Q2 2022 Stockholder Letter, August 9, 2022.

ThredUp, Q2 2022 Earnings Call,August 15, 2022.

Wayfair, Q2 2022 Earnings Call, August 4, 2022.

Wayfair, Q2 2022 Earnings Call, August 4, 2022.

ThredUp, Q2 2022 Earnings Call,August 15, 2022.

Wayfair, Wayfair Inc. Announces Proposed Offering of $600 million Convertible Senior Notes, September 7, 2022.

Good gif this week. Writing's not so bad either.