Hi 👋 - E-commerce is hard. With the exception of Amazon, eBay, and Etsy, most public e-commerce companies aren’t yet profitable. Today, another look at fashion subscription service Rent the Runway. Despite high engagement, low dependence on paid marketing, and an affluent customer base, profitability remains far off. As always, thanks for reading.

👗 👗 👗 If you’re finding this content valuable, consider sharing it with friends or coworkers.

For more like this once a week, consider subscribing. 👗 👗 👗

No Time for Cartwheels

If you told an e-commerce executive that her business had high word-of-mouth traffic, minimal reliance on paid marketing, highly engaged users, and an affluent customer base, she’d do a cartwheel. Customer acquisition costs (CAC) kills many online and DTC businesses, and these attributes keep CAC manageable. That’s what makes Rent the Runway (RTR), a subscription service for designer fashion, a flummoxing business: 80% of its traffic is word-of-mouth, so dependence on paid marketing is low; the average subscriber visits the app three times per week, so engagement is high; over 80% of customers have a household income of at least $100,000. Yet the business burns cash like a cigarette dropped in a dry forest.

Restructuring

To reduce its cash burn, the company announced a restructuring on September 12th, in conjunction with second quarter earnings. The plan aims to reduce annual operating expenses by $25-$27 million, equivalent to 8% of total expenses in 20211. Layoffs account for the lionshare of the savings, about $20 million, as RTR will eliminate 24% of corporate positions. The remainder is reductions in tech and general and administrative (G&A) expenses, like consulting fees and third-party services2. Cuts were targeted towards back office functions and areas that won't impact the customer experience.

The restructuring owes more to RTR’s unwieldy expense base than a sudden drop in demand. Helped by easy comps, second quarter revenue grew a heady 64% year-over-year (though the number of active subscribers fell from 135,000 in the first quarter to 127,000 in the second, spooking investors). By cutting costs, management hopes to provide a margin of safety for tougher macro conditions and accelerate its financial objective of being self-funding and generating free cash flow.

Expensive Dry Cleaning

RTR has high fixed costs. Another justification for restructuring is slimming its fixed cost base, which is capable of supporting a significantly larger subscriber count3. These fixed costs are predominantly G&A – a hodgepodge including functions like customer service, finance, and HR, as well as rent (both for offices and warehouses) – and tech – mostly software development and engineering headcount. Long-term, RTR expects tech and G&A to be less than 30% of revenue4, compared to 51% in 2021 and 61% in H1 2022. Before the restructuring, the company targeted achieving this level at $600 million in annual revenue5, a bit more than twice its 2022 expected revenue.

RTR also has high variable costs. Here’s CFO Scarlett O'Sullivan on the company’s Q1 2022 earnings call6:

We are laser-focused on staying on our path to profitability even with a recessionary environment. And then more practically speaking, the way that we would get there is really to remind you a bit about the kind of the structure of the business and the business model that we have. A significant portion of our operating costs are largely variable, and they represent approximately 60% of our cash operating costs, which means that they either will vary with demand automatically or we have high flexibility and discretion to adjust as we did throughout Covid. So these would be things like our fulfillment expenses, our customer service costs, credit card fees, revenue share payments that are performance-based and marketing.

Two of its largest expenses are rental product depreciation and revenue share (say that three times fast) and fulfillment.

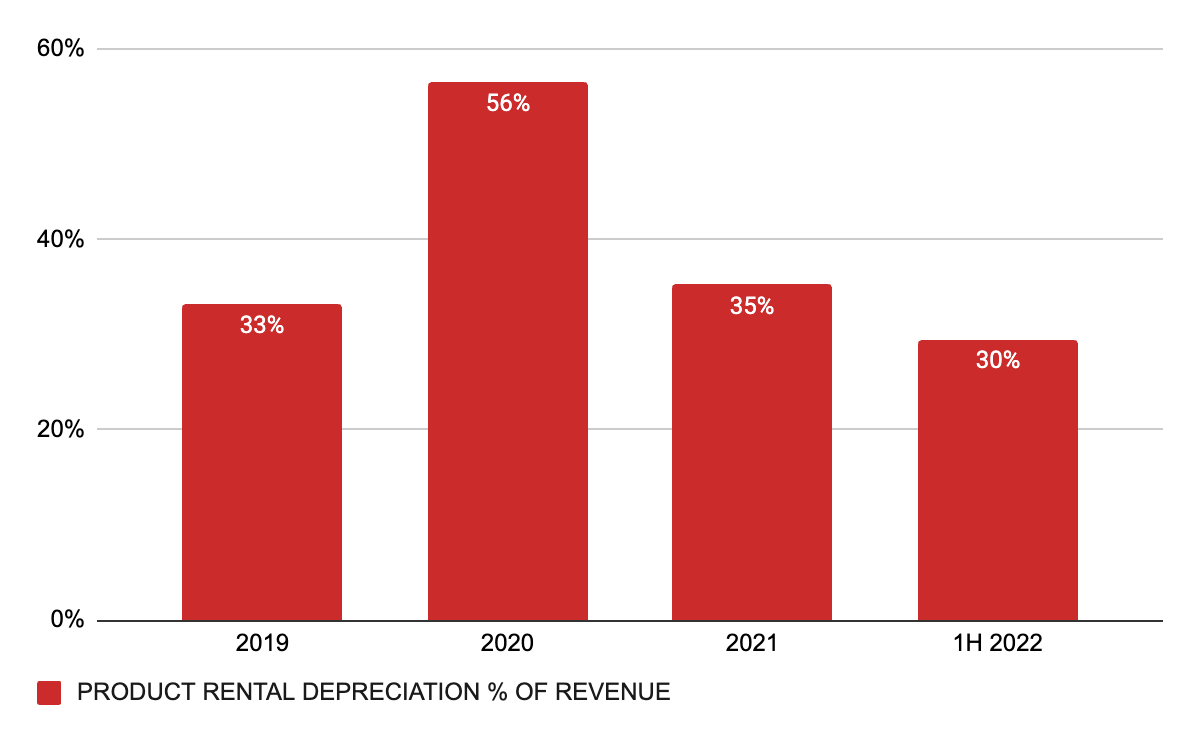

Conceptually, RTR’s business model is simple: buy clothes, then rent them out. It’s like Blockbuster Video, but more online and for cocktail dresses and designer gowns. Operationally, it’s difficult. Its largest investment is buying clothes to rent out. In 2022, RTR plans to spend $60 million – about 20% of revenue – acquiring new garments, what it calls rental product capex (this isn’t the kind of capex that your grandma would recognize). Rental product depreciation and revenue share accounts for how the economic value of garments decrease over time due to wear and tear, mustard stains, and changing styles7 (here’s a look at that metric and RTR’s creative non-GAAP accounting). Not surprisingly, it’s RTR’s largest expense. Excluding 2020, which is distorted by Covid, this has been running around 30% of revenue. Of this, the revenue share accounts for 10-12% of revenue, and the remainder is depreciation8.

RTR procures garments three ways:

Wholesale: Buying directly from brands, typically at a discount to wholesale price (due to volume). About 45% of garments were acquired this way in 2021.

Share by RTR: Pay-for-performance model. RTR acquires items directly from brands on consignment and pays out a revenue share each time an item is rented. Brands also pay a logistics expense for each rental. In 2021, this accounted for one-third of product acquisition.

Exclusive Designs: RTR collaborates with brands to produce exclusive garments, levering RTR data. This method is 50% cheaper than wholesale and accounted for one-third of product acquisition.

There are cash flow and profitability trade-offs embedded in each option. Wholesale requires a large upfront cash outlay, but the cost is fixed and known upfront. Share by RTR and Exclusive Designs require less upfront cash, but are variable expenses (though negotiated caps provide a ceiling with some brands).

RTR’s business is levered to social events like weddings, galas, and date nights and to a lesser extent, office attire. During the pandemic, demand dried up as people stayed at home in their sweatpants. To survive, the company raised expensive debt, furloughed or laid off half the company, and renegotiated terms with designers to move away from wholesale acquisition towards consignment and revenue share. Wholesale went from 74% of acquisition in 2019 to 55% in 2021 and RTR hopes to boost this to 66% within a few years. These procurement changes reduced the upfront cost of units from $111 to $95, or 14%, between 2019 and 20219.

While RTR is making progress managing these charges, they’ll remain a meaningful expense. Depreciation reflects a true economic cost, even if it’s non-cash. Stop buying new clothes and the business would eventually stagnate then rot.

Fulfillment is RTR’s second largest expense. This line item covers everything required to receive, process, and deliver orders including shipping costs and personal costs for processing, cleaning, and repairing orders, as well as packing materials and cleaning supplies. (Fun fact: the company runs America's largest dry cleaner.) Returns make RTR’s logistics more complicated as garments need to be shipped twice, cleaned, and when red wine is spilled or someone is overzealous with nail polish, restored. About half of rentals come back with blotches, smears, stains, or smudges that require hands-on remediation10. Operationally, getting a package back is more difficult than shipping one out. E-commerce returns are an industry headache11:

Each step of the process is costly. Retailers have to pay for goods to be picked up or posted. Processing returns is labor-intensive, explains Zac Rogers who worked as a returns manager at Amazon and is now at Colorado State University. The outbound system is highly automated and streamlined; a return must be opened and someone has to decide what to do with it. “A worker in an Amazon warehouse can pick 30 items in a minute, but a return can take ten minutes to process,” says Mr Rogers.

Since handling returns is a normal part of RTR’s business, its operations are designed to accommodate them. The company leverages technology like RFID tags to automate formerly manual processes, helping to bring down non-transportation fulfillment cost per item. (Before introducing RFID, returning an item involved 10-15 manual barcode scans). Still, the nature of returns means that RTR’s fulfillment costs will be structurally higher than peers who only need to worry about outbound shipping. In 2021, fulfillment costs were a hair over 30% of revenue. They’ve increased so far in 2022 due to shipping inflation. Over the next few years, the company is targeting fulfillment expenses at 30% of revenue12. There’s definitely some room to improve productivity, but until robots get good at drycleaning and delivery, this will remain another significant expense.

The Spotify Problem

You don’t need to be a partner at Ernst & Young to see that high fixed costs and high variable costs are a troublesome combination. RTR has a Spotify problem. The knock on Spotify’s music streaming business is that it’s structurally low margin. Variable costs are extremely high. For every dollar of revenue, Spotify pays out over sixty cents in royalties and other fees to the labels. What’s more, this is a marginal expense that scales linearly with revenue. A big difference with Spotify is that RTR has a fragmented supplier base, yet the variable expense dynamic is similar – by its own admission, RTR pays out about sixty cents for every dollar it generates. When you account for tech, G&A, and marketing, it’s hard to see the current business model ever generating respectable margins or cash flow.

To compensate for music streaming’s low profitability, Spotify embarked on a multi-year, multi-hundred million dollar podcast strategy to capture more attention and improve its margins (unlike music streaming, podcast costs are largely fixed). RTR’s management team did a good job getting the business off life support post-Covid. While I don’t wear many frocks, there’s a clear value proposition: renting makes a lot more sense than buying something you’re only going to wear once or twice. Additionally, the business has winning e-commerce attributes: lots of organic traffic, high engagement, and an affluent customer base. Now RTR needs to find its podcast equivalent. September’s restructuring may be the first of many.

👗 👗 👗 If you’re finding this content valuable, consider sharing it with friends or coworkers.

For more like this once a week, consider subscribing. 👗 👗 👗

More Good Reads and Listens

Fast Company on the challenges of stain removal at RTR. The Economist on the hassle of e-commerce returns. Below the Line on RTR’s sloppy financials.

Rent the Runway operates on a fiscal year beginning February 1st and ending January 31st. Fiscal years are stupid and confusing. For brevity, I’ll refer to them as years, and omit the fiscal part.

Rent The Runway, Q2 2022 Earnings Call, September 12, 2022.

Rent The Runway, Q4 2021 Earnings Call, April 13, 2022.

Rent The Runway, Q4 2021 Earnings Call, April 13, 2022.

Rent The Runway, Q4 2021 Earnings Call, April 13, 2022.

Rent The Runway, Q1 2022 Earnings Call, June 9, 2022.

A garment's lifetime is dedicated by the number of items it's worn and cleaned, not fashion trends. Here’s RTR CEO Jennifer Hyman on the company’s Q1 2022 call:

We have 12 years of data that show that, number one, things actually don't go out of style after a season, that we can monetize inventory for many years and that what the customer cares about is she cares about wearing something that is new to her every single time she comes to Rent the Runway. Often, our customers don't know and they don't care whether something is right off the runway or it's from previous seasons as long as they've never worn it before. So that's why we've invested so much in personalization because we constantly want to show our customers a fresh assortment of new items that are new to her.

Rent The Runway, Q4 2021 Earnings Call, April 13, 2022.

Rent The Runway, Q4 2021 Earnings Call, April 13, 2022.

Fast Company, Inside Rent The Runway’s Secret Dry-Cleaning Empire, October 28, 2014.

The Economist, A tidal wave of returns hits the e-commerce industry, August 25, 2022.

Rent The Runway, Q1 2022 Earnings Call, June 9, 2022.