Hi 👋 - Third quarter earnings show that big tech is subject to the law of gravity, just like everyone else. While headcount and operating expenses are growing briskly at companies like Alphabet and Meta, revenue growth is slowing. Today, diminishing returns and big tech. As always, thanks for reading.

📱If you’re finding this content valuable, consider sharing it with friends or coworkers.

📱 For more like this once a week, consider subscribing.

The Dismal Science

Last year, Alphabet’s revenue was about the same size as Portugal’s GDP. Today, its market cap is as big as the Netherland’s economy. Similarly, Meta’s 2021 revenue was the equivalent of Puerto Rico’s GDP. Its market cap recently fell by the GDP of Switzerland1. Given their scale, macroeconomics is a helpful lens for analyzing big tech companies.

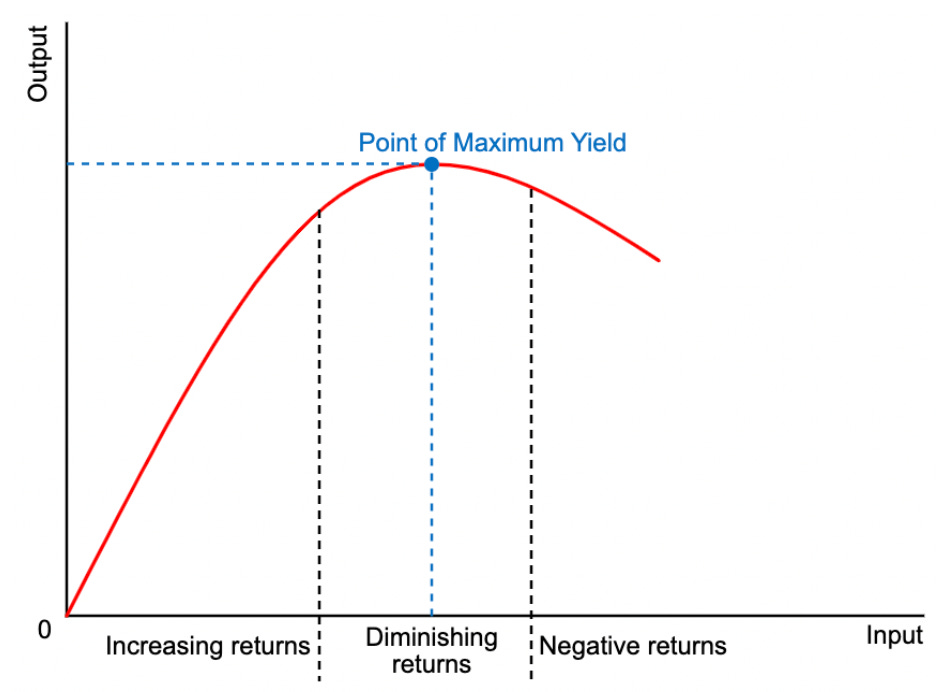

Three variables drive economic growth: the accumulation of capital stock (capex), labor (number of workers and total hours worked), and technological advancement. Long-term growth is governed by technological progress, because capital and labor are subject to diminishing marginal returns2. This economic concept states that after a certain point, adding an extra unit of input – hiring another worker for example – will result in smaller increases in output. Less oomph. Graphically, diminishing returns is what’s happening to the right of the point of maximum yield:

If you give a dying plant some water, it will perk up a bit. Give it some more, and it blooms. Give it too much, and it rots. There’s an optimal amount of water for the plant to flourish. The same is true for a business. At a given time, there’s an optimal headcount level. Add employees beyond that point and productivity suffers.

The Law of Gravity

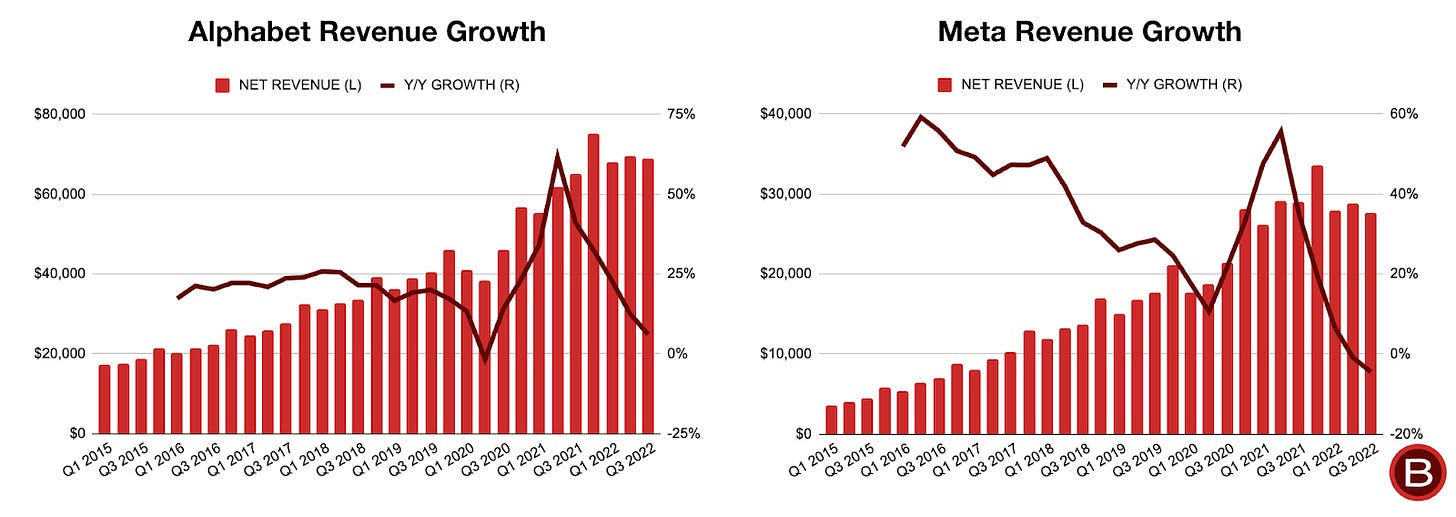

After years of indefatigable growth, third quarter earnings revealed that big tech is subject to the law of gravity. Alphabet, Amazon, Meta, and Microsoft all reported disappointing results. Alphabet’s revenue increased 6% from the prior year, similar to its growth rate in 2009 during the Global Financial Crisis. Though paltry by recent standards, Alphabet looked like Usain Bolt compared to Meta, where revenue fell 4% year-over-year. While both companies faced tough comps and conversion headwinds from a strengthening US dollar, the trend is clearly downward.

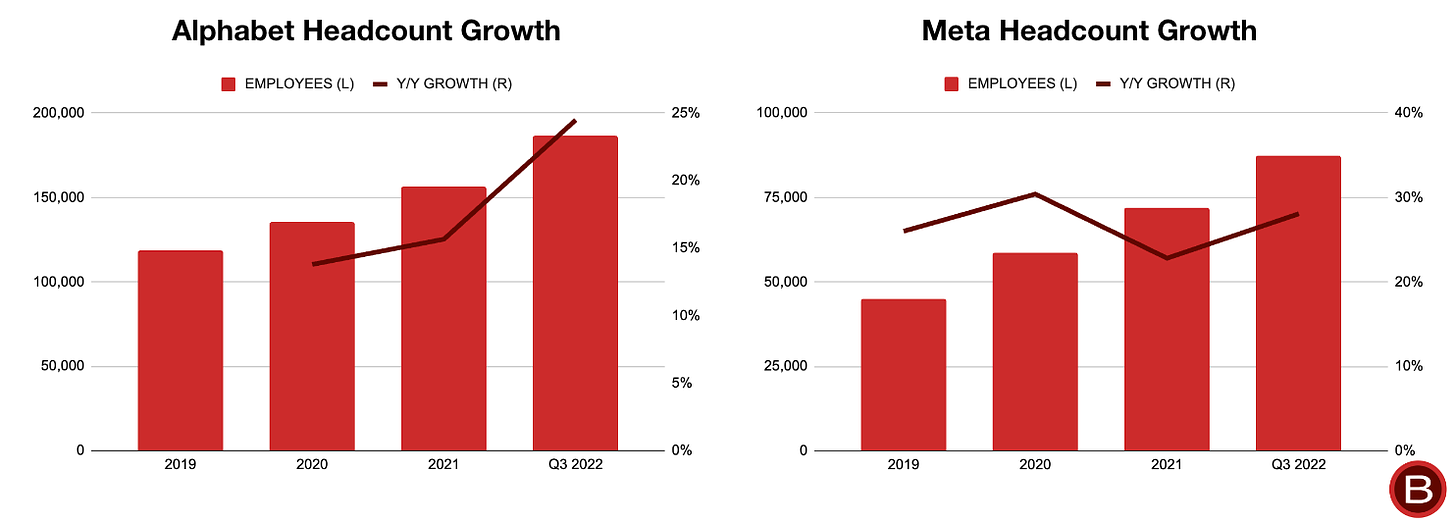

Despite slowing growth, expenses continued defying gravity. Meta closed the quarter with over 87 thousand employees, up 28% versus a year ago. Alphabet had nearly 187 thousand, up 24% year-over-year. It’s estimated that Russia invaded Ukraine with around 200,000 troops in February. Google has enough headcount to fight a ground war in Europe.

This hasn’t gone unnoticed by analysts and investors. Here’s Morgan Stanley internet analyst Brian Nowak on Alphabet's earnings call3:

Sundar, just to go back to the comment about earlier in the quarter becoming 20% more efficient. I thought tonight your comment – investing responsibly over the long term, about being responsive to the environment is helpful. But if I look at, sort of the Excel sheet, I think you have added about 51,000 new people to the company since the start of last year. Can you give us some examples of internal KPIs or quantifiable analysis you're running just to ensure you're generating ROI for investors from all your hiring as you sort of run through these analyses?

That’s about as saucy as a bulge bracket analyst gets with a mega-cap CEO. It’s the earnings call equivalent of the “what would you say you here?” scene in Office Space.

For listeners looking for KPIs or quantifiable analysis, CEO Sundar Pichai’s response was disappointing4:

Brian, look, I think we gave some – we've been clear that we are going to moderate our pace of hiring – going into Q4 as well as 2023. I think we are seeing a lot of opportunities across a whole set of areas. And every time – talent is the most precious resource, so we are constantly working to make sure everyone we have brought in is working on the most important things as a company, and particularly so. And that's a lot of what sharpening our focus has been about. We are reviewing projects at all scales pretty granularly to make sure we have the right plans there, and based on that, the right resourcing and making course corrections. And this will be an ongoing thing.

Ceteris Paribus

Alphabet and Meta are aggressively adding headcount (or as an economist would say, factors of production) while growth is slowing. Increasing inputs. Decreasing outputs. Seems like diminishing returns.

A key assumption underpinning diminishing returns is ceteris paribus, which is a fancy way of saying all else equal. This condition exists only in textbooks. In reality, persistent inflation, tightening monetary policy, the war in Ukraine, post-Covid behavioral shifts, sagging consumer confidence, and a laundry list of other factors make 2022 an economically discombobulating year. Although Google and Facebook still dominate digital advertising, Apple’s App Tracking Transparency (ATT) and TikTok make their positions more tenuous. All else isn’t equal.

The case for diminishing returns is clearest at Meta, where the core advertising business declined two consecutive quarters. The company is waging war on two fronts with TikTok on one side and Apple on the other. TikTok is luring both highly coveted Gen Z and Millennial users and advertisers. Apple’s privacy-enhancing ATT policy makes retargeting less efficient, costing Meta $10 billion in missed revenue in 2022.

While questions around the core business mount, what’s next isn’t evident. Usage and time spent with Reels, Meta’s short-form video feature and response to TikTok, is growing5. However, it doesn't monetize as well as other ad formats. (Meta hopes to get Reels to monetization parity over time; it did so with Stories previously.) In addition to hiring aggressively, Meta is spending tens of billions of dollars annually to rebuild its ad targeting technology and content recommendation capabilities, as well as generously funding metaverse and VR projects. These investments have yet to demonstrate returns. It’s not clear that all those extra heads are paying off.

Alphabet’s position is less precarious. Google Search is a dominant franchise, growing like the Energizer Bunny and throwing off plenty of cash. But similar to Meta, what’s next isn’t clear. In contrast to Search, YouTube is temporarily stuck in reverse, with revenue falling 2% in the third quarter. Google Cloud Platform, while growing nearly 40% year-over-year, remains a distant third behind AWS and Azure. Lastly, Other Bets – which includes drone delivery, self-driving taxis, and life sciences – is an expensive science project.

Twitter’s Natural Experiment

In light of slowing growth and slumping share prices, both companies have committed to pulling back on hiring in 2023. If Alphabet and Meta are easing off the gas, Twitter is slamming the brakes with a steamroller driven by a sledgehammer. The company, now Elon Musk’s plaything, is firing half its staff, around 3,700 employees. This creates a natural experiment with Alphabet and Meta.

Economists love natural experiments more than they love using obscure Latin phrases like ceteris paribus. In a natural experiment, there’s a naturally occurring reason randomly assorting subjects into a treatment group and a control group. Peppered moths and the Industrial Revolution is a classic example. During the nineteenth century, air pollution from factories caused an increase in the frequency of dark Peppered moths. During the twentieth century, this trend reversed as air quality improved6. Another example is studying how changes to one state’s minimum wage laws impacted labor markets in bordering states, like Pennsylvania and New Jersey.

Musk operates from first principles. One of these might be the Pareto principle, or 80/20 rule, stating that for many outcomes, 20% of the causes drive 80% of consequences. This pops up all over biology, social sciences, and technology, from music streams, to citations of research papers, to the distribution of wealth. For a business, the interpretation is that a small number of managers and employees generate a disproportionate amount of the value. On the chart above, Musk’s shock therapy approach to people management could be seen as shifting from the zone of negative or diminishing returns back towards the point of maximal yield7. This might resuscitate the company, or Twitter might become Musk’s Waterloo.

Back to Reality

An alternative explanation to diminishing returns is that the hordes hired by Alphabet and Meta are working on projects that take time to pay off. In ten years, we may all be living in the metaverse with Mark Zuckerberg as our overlord. Regardless of what eventually materializes from projects like the metaverse or Alphabet’s other bets, slowing growth, limited visibility, and a changing interest rate regime are forcing big tech to recalibrate. Whether gradually or suddenly, efficiency is back in vogue.

📱If you’re finding this content valuable, consider sharing it with friends or coworkers.

📱 For more like this once a week, consider subscribing.

More Good Reads and Listens

Stratechery on why it's too soon to write Meta’s obituary. Platformer on the chaos at Twitter.

Stripe CEO Patrick Collison’s memo to the company detailing its recent 14% layoff. This is an example of how the tech operating environment has changed post-Covid and how companies need to react to this new reality. Collison deserves respect for taking responsibility for the situation, in stark contrast to the process at Twitter. Below the Line on TikTok, Meta, and algorithmic content distribution.

Disclosure: The author owns shares in Alphabet and Apple.

Wikipedia contributors, "List of countries by GDP (nominal)," Wikipedia, The Free Encyclopedia, https://en.wikipedia.org/w/index.php?title=List_of_countries_by_GDP_(nominal)&oldid=1119415698 (accessed November 6, 2022).

The Federal Reserve of St. Louis, What Drives Long-Run Economic Growth?, June 1, 2021.

Alphabet, Alphabet Q3 2022 Earnings Call, October 25, 2022.

Alphabet, Alphabet Q3 2022 Earnings Call, October 25, 2022.

Stratechery, Meta Myths, October 31, 2022.

Wikipedia contributors, "Natural experiment," Wikipedia, The Free Encyclopedia, https://en.wikipedia.org/w/index.php?title=Natural_experiment&oldid=1080139254 (accessed November 3, 2022).

This isn’t an endorsement of Musk’s tactics. Layoffs suck. They’re devastating and upending. This one seems unnecessarily chaotic and devoid of empathy. There’s no good way to do a layoff. But this is a particularly bad – and potentially illegal – approach.