#167 – Turn Every Page

A Few Lessons from Berkshire Hathaway's Annual Meeting

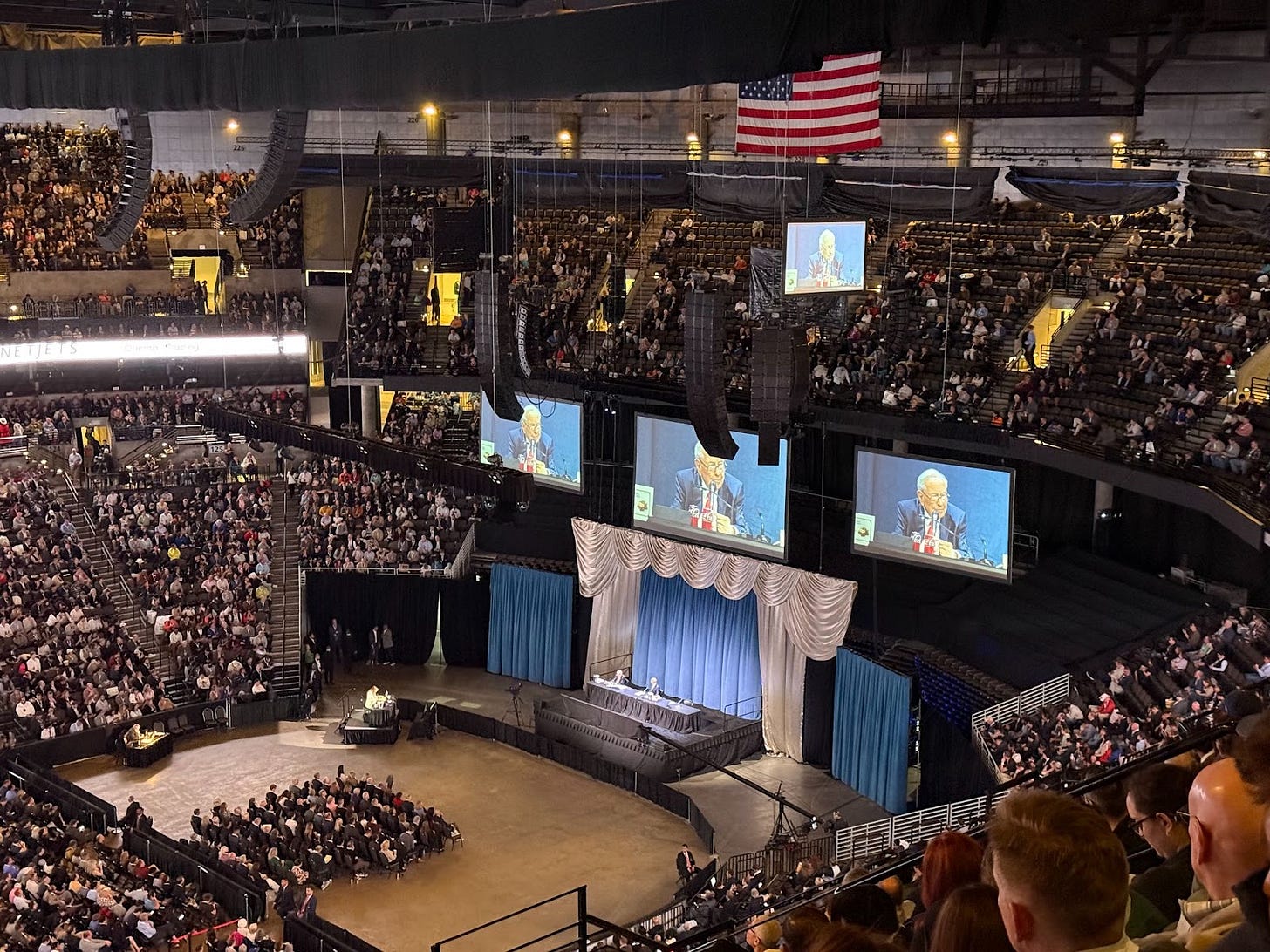

Hi 👋 - Attending the Berkshire Hathaway annual meeting is part financial conference, part secular pilgrimage, and part Midwest Costco run. I’ve been meaning to go for years, but it never felt urgent. That changed with Charlie Munger’s death in 2023. Today, a few thoughts from Berkshire Hathaway's annual meeting how to live well, invest wisely, and maybe even go out with a standing ovation.

Turn Every Page

In 1951, a young Warren Buffett hopped on a train from New York to Washington to visit GEICO, an insurer. It was a Saturday, so the office closed. Undeterred, Buffett knocked. And knocked. And knocked. Eventually, a janitor let him in. Fortuitously, the only other person inside was Lorimer Davidson, GEICO’s CEO1. Their chat would shape Berkshire’s future.

Buffett’s conversation with Davidson set off a chain reaction culminating in the acquisition of GEICO. If Buffett spent his Saturday at the movies, Berkshire’s history would have taken a different route.

A few weekends ago, I attended Berkshire Hathaway's annual shareholder meeting in Omaha. As a first-time attendee, I was surprised by the diversity of the audience. Sure there were some Midtown uniforms, but there were also retirees from Montana, students from Seoul, and at least one guy in cowboy boots explaining discounted cash flow with a Texas twang. Value investors come in many forms – some even wear Crocs.

During the question and answer session, several teenagers had the opportunity to ask Buffett advice on careers and life. One point that he repeated several times was, “turn every page.” In other words: show up; do the work; be thorough; knock, even when the door says “closed.” As Buffett put it:

If you get to talk to a Lorimer Davidson on a Saturday afternoon you just listen. This is part of turn every page.

Later on, Buffett mentioned that he reviews the financial statements of 50-60 of Berkshire’s portfolio companies monthly. He’s a billionaire and in his nineties, and yet still he’s turning every page, just like he did on a Saturday morning in 1951.

Time and Patience (and a Fortress Balance Sheet)

Berkshire is sitting on a pile of over $300 billion in cash, roughly equivalent to the GDP of Portugal or Chile. When you’re sitting on an economy-sized cash balance, investors naturally ask: what are you going to do with it?

The answer: nothing until the right opportunity comes along. Berkshire wants to put its cash to work through acquisitions or equity investments, but it’s in no rush2. In describing his capital allocation philosophy, Buffet stressed the need for patience. Investing is an opportunistic activity. Great deals don’t arrive on a schedule, and having cash doesn’t conjure them into existence3:

If you told me I had to invest $50 billion a year that would be idiotic. The long-term trend is up but no one knows what the market will do tomorrow, next week, or next month. Very occasionally we will be bombarded with offers we are glad we have the cash for.

The best deals come when people are the most pessimistic. To an investor with courage, cash, and equanimity, The Great Depression was the opportunity of a lifetime.

Opportunities in markets don’t arrive on a schedule. Mr. Market, ever the manic-depressive, swings from euphoria to despair with little warning. While we know with certainty that these opportunities will occur, it’s impossible to know when they will occur. You can’t predict, but you can prepare. The key is to have your homework done and your affairs in order so that you can act when the time is right.

Berkshire’s investment process is characterized by extreme inactivity, punctuated by occasional feeding frenzies, like during the Financial Crisis. Like a cobra basking in the shade, Buffett wastes no energy on passing distractions – but when the right prey wanders close, the strike is sudden, precise, and final:

We’ve made a great deal of money by acting fast. You want to be patient when you’re waiting for opportunities but quick to act on them when they occasionally arrive.

According to French polymath Blaise Pascal:

All of humanity's problems stem from man's inability to sit quietly in a room alone.

For Berkshire, patience isn’t a problem, it’s a principle. Over his career, patience and discipline have been defining characteristics of Buffett’s investment approach. While most investors think in quarters, Berkshire thinks in decades. You get the impression that Buffett is very comfortable sitting alone – presumably with a few Cherry Cokes, a box of See’s chocolates, and a stack of 10ks – waiting patiently for the opportunity to act.

Avoiding Stupidity

I spent eight years on Wall Street covering tech stocks, and the past decade in various finance roles for consumer internet companies. No matter the seat, the focus was almost always on the income statement. Where do eyeballs even go on a balance sheet?4

In contrast, Buffett spends more time analyzing balance sheets than income statements. There’s a compelling logic to this. At Berkshire, permanent loss of capital is anathema. Given the company’s valuation discipline, focus on business quality, and long investment horizon, the balance sheet reveals fragility. It’s where potential landmines hide: leverage, covenants, derivatives, and other potential tripwires.

Analyzing balance sheets is a means of understanding risk. While many investors are focused on potential upside, downside protection is paramount to Berkshire. (Invert, always invert.)

Study Berkshire long enough and a few themes recur: stay within your circle of competence; prioritize avoiding mistakes over being clever; quickly toss hard-to-understand businesses in the “too hard” pile. These tools are all aimed at reducing the probability of making a mistake and the risk of permanent loss of capital.

When asked for his philosophy on capital allocation, Buffett’s successor, Greg Abel listed six shared values including maintaining Berkshire’s reputation, understanding and managing risks, the ability to thoroughly understand what a businesses economics prospects look like ten or twenty years into the future, and understanding the underlying risks of the business.

Time does the heavy lifting in compounding. Hence, Charlie Munger’s first rule of compounding: never interrupt it unnecessarily. Or, as Buffett mentioned at the annual meeting:

Be sure you can play the next day. You only need to get rich once.

Keep Good Company

Berkshire’s focus on good people is as strong as its focus on good companies. When buying a company, Buffett doesn’t care where (or if) its managers went to college. Instead, he’s focused on if they are trustworthy and of high integrity.

At several points throughout the day, Buffett stressed the importance of who you associate with. For example:

Be very careful who you work for, because you will take on the habits of the people you work with.

Or:

Bad behavior is contagious in a company, especially if it comes from the top.

Life bends in the direction of the people you spend time with. His advice was simple and straightforward: spend time with people who are better than you; associate with people you can learn a lot from; and stay away from people who ask you to do things that you shouldn’t do.

On Predicting the Future

No commentary here, just a good reminder:

The future will be different than you think.

Omaha, Finally. Omaha, Thankfully

I’ve studied Warren Buffett for years and bought my first B share in March 2015. Attending the annual meeting was always on my list, but never at the top. That changed after Charlie Munger passed in 2023. Buffett may be beating the odds, but actuarial tables remain undefeated. How many more meetings would there be left?

Around 1pm, as the Q&A wrapped up, Buffett leaned into the mic and said that he had an announcement. Then came the bombshell: he would retire at year’s end, handing the reins to Greg Abel. A brief silence gave way to a thundering standing ovation. It felt like watching Michael Jordan hit his last shot as a Bull or Babe Ruth hitting his 659th and final home run in pinstripes. A legend, signing off on his own terms.

Talking about speculative frenzies, Buffett warned that investors are like Cinderella, dancing in a room where the clocks have no hands and hoping to leave just before the clock strikes midnight and everything turns to pumpkins. As Buffett said, the future will be different than you think. You never know when the music will stop. Deferred gratification is wise, especially in investing. But life is more than a number in a spreadsheet. So let discipline and deferred gratification guide your investment decisions, but if something truly matters, don’t let it sit in your someday pile.

🥤🥤🥤 If you’re finding this content valuable, consider sharing it with friends or coworkers. 🥤🥤🥤

More Good Reads and Listens

Buffett’s 1998 lecture at the University of Florida School of Business. Alex Morris on lessons from Berkshire's annual meetings over the years. Below the Line on Berkshire’s annual shareholders letters: 2019, 2020, 2021, 2022.

Disclosure: The author owns shares of Berkshire Hathaway.

GEICO, GEICO's Story From the Beginning, accessed May 31, 2025.

Buffett likes to sleep well at night and Berkshire prides itself on having ample liquidity. The business is run so as to never be reliant on the kindness of strangers for funding. Certainly, Buffett hopes to put a big slug of the cash on his balance sheet to work, but it will always maintain a robust balance sheet.

All Buffett quotes come from my notes of the meeting. They’re more paraphrased than verbatim.

That’s an internet equity research dad joke for you. As my wife tells me constantly, if you need to explain a joke, it’s not funny. Sorry.

Great summarization!

“Turn every page” was my favorite theme of this year’s meeting as well. It also happens to the title of a documentary about Robert Caro, which is a great watch!

Thanks for writing this one. I also had a chance to attend for the same reason you laid out: wanting to avoid regret after Charlie’s passing. You captured the energy and lessons from this year really well.