#155 - Bringing The Receipts

Berkshire Hathaway’s 2022 Annual Letter

Hi 👋 - Berkshire Hathaway published its annual letter yesterday. In other words, Christmas in February. Over the decades, mitigating downside and patience are two factors that have driven Berkshire’s performance. Both featured prominently in its 2022 shareholder letter. Let’s dig in.

🥤If you’re finding this content valuable, consider sharing it with friends or coworkers.

🥤For more like this once a week, consider subscribing. ❤️

Earning the Benefit of the Doubt

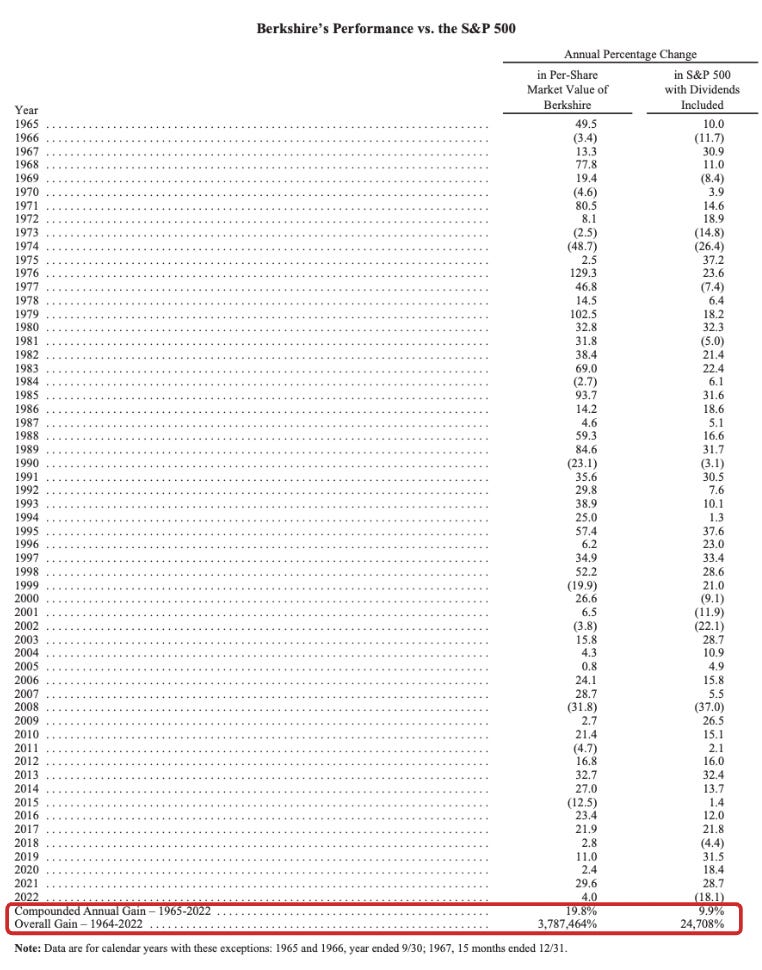

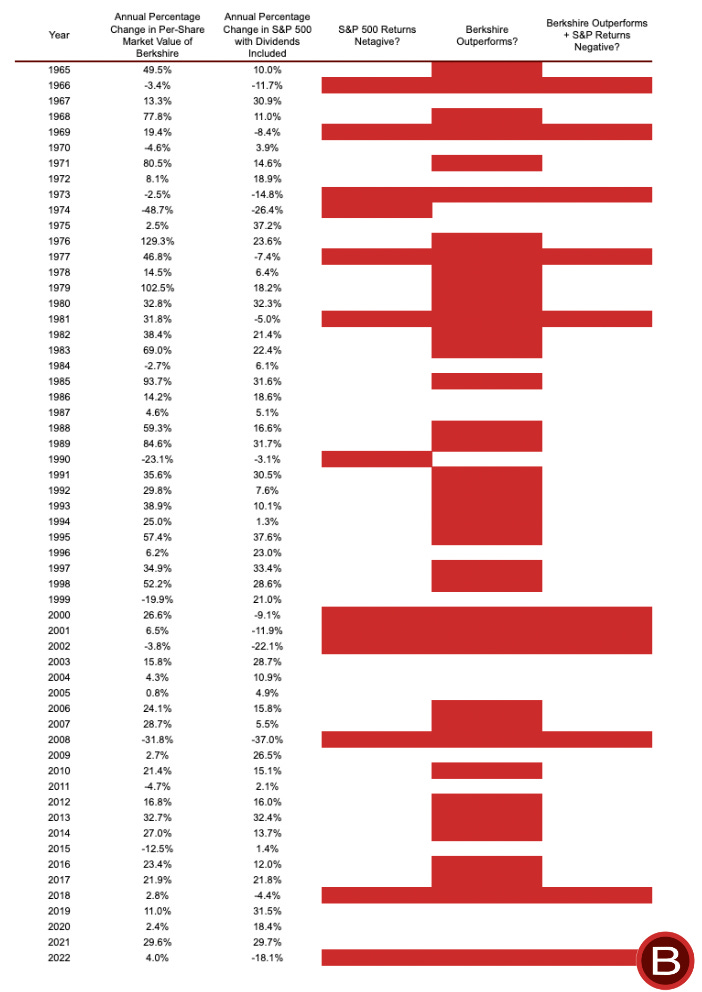

Capital allocation is hard. Good capital allocation is harder. Doing it well for decades is nearly impossible. Yet Buffett brings the receipts. He begins each annual letter by comparing the performance of Berkshire Hathaway to the S&P 500. In 2022, Berkshire gained 4% while the S&P 500 slid 18%. That’s not an anomaly.

A property of compounding is that over long intervals, minute differences in growth rates lead to drastic differences in outcomes. Since 1965, the performance differential between Berkshire and the S&P 500 isn’t particularly tight; Berkshire’s CAGR is nearly 10 percentage points higher. A dollar invested in the S&P 500 in 1965 would be about $250 today. That same dollar invested in Berkshire would be worth over $37,000, more than two orders of magnitude higher.

Like ‘strategy,’ ‘long-term’ has become hackneyed in business speak. However, as its 58-year track record attests, Berkshire is one of the few companies that can credibly talk about the long-term. It’s earned the benefit of the doubt.

Avoid Multiplying by Zero

Limiting downside has been an important component of Berkshire’s success. Because multiplying by zero ends any winning streak, avoiding costly mistakes is as important as picking winners. If you’re lucky enough to have a compounding machine, the last thing you want to do is interrupt it. The goal of the game is to keep playing1:

At Berkshire, there are no finish lines.

As such, the company looks to avoid situations that could create a cash crunch at inconvenient times, like recessions or banking panics. Berkshire is built to preserve staying power and the ability not just to withstand downturns, but to opportunistically benefit from them. (Buffett gladly took out his checkbook during the Great Financial Crisis and cherishes the opportunity to play lender of last resort.)

The magic of compounding relies on two variables: the rate of return and duration. As Buffett understands, the only surefire way to get rich is to do it slowly, enlisting time as an ally. This makes Berkshire – which regularly holds over $100 billion of cash on its balance sheet2 and eschews leverage – a conservative institution. Sleeping soundly at night easily trumps a few extra basis points. Buffett credits the firm's success to3:

The combination of continuous savings by our owners (this is, by their retaining earnings), the power of compounding, our avoidance of major mistakes and — most importantly of all — The American Tailwind.

Another way that Berkshire mitigates risk is by only partnering with trustworthy people. Famously, Buffett likes handshake deals, which require trusted counter-parties. Character and company culture don’t fit neatly into a spreadsheet, but play an important role in business outcomes. In addition to long-lasting favorable economic characteristics, trustworthy management is a key requirement on Berkshire’s investing checklist. The same is true for the managers of its wholly-owned subsidiaries like BNSF, Geico, and See’s Candies4:

When large enterprises are being managed, both trust and rules are essential. Berkshire emphasizes the former to an unusual – some would say extreme – degree. Disappointments are inevitable. We are understanding about business mistakes; our tolerance for personal misconduct is zero.

This conservatism manifests in Berkshire’s returns. One of its unique characteristics is that it typically outperforms the S&P on down years. Since 1965, the S&P 500 has had thirteen years with negative returns, and Berkshire outperformed in eleven of them.

Patience & Power Laws

Power laws are usually associated with venture capital portfolios, social media, or streaming, but they’ve been another part of Berkshire’s success. A few shrewd investments, held for decades, have driven the company’s $300 billion public equity portfolio5:

Our satisfactory results have been the product of about a dozen truly good decisions – that would be about one every five years – and a sometimes-forgotten advantage that favors long-term investors such as Berkshire.

For example, in 1994 Berkshire invested $1.3 billion into Coca-Cola, which earned $75 million in dividends that year. Fast forward to 2022, and Berkshire’s stake in Coca-Cola generated $704 million in dividends, over half of the initial investment. What’s more, the shares appreciated from $1.3 billion to $25 billion. It only takes a handful winners to produce solid results6:

The lesson for investors: The weeds wither away in significance as the flowers bloom. Over time, it takes just a few winners to work wonders. And, yes, it helps to start early and live into your 90s as well.

A few good ideas go a long way. The key is being prepared and able to act with conviction when opportunity knocks. Sometimes less is more.

🥤If you’re finding this content valuable, consider sharing it with friends or coworkers.

🥤For more like this once a week, consider subscribing. ❤️

More Good Reads and Listens

Berkshire Hathaway's 2022 annual letter (here’s the archive since 1977). Founders on All I Want To Know Is Where I'm Going To Die So I'll Never Go There. Below the Line on Berkshire Hathaway’s 2019, 2020, and 2021 annual letters.

Disclosure: The author owns shares in Apple and Berkshire Hathaway. He also has an intellectual crush on Warren Buffett.

Berkshire Hathaway, 2022 Shareholder Letter, February 25, 2023.

Berkshire Hathaway, 2022 Shareholder Letter, February 25, 2023.

Berkshire Hathaway, 2022 Shareholder Letter, February 25, 2023.

Berkshire Hathaway, 2022 Shareholder Letter, February 25, 2023.

Berkshire Hathaway, 2022 Shareholder Letter, February 25, 2023.

I always love learning more about BRK, thanks for this. Curious what you think will happen to the company when its leadership is forced to retire (dies)?