Hi 👋- Capital allocation drives business performance and shareholder returns. Businesses have four options: reinvest, return capital to shareholders through dividends or repurchases, M&A, or build the balance sheet. Historically, tech companies favored reinvesting: hiring more engineers, entering new markets, and building new products. As tech profits and cash flow has grown, M&A and capital returns have increased. Today, a look at Etsy’s M&A strategy. Thanks for reading.

If you’re finding this content valuable, please share it with friends or coworkers. ❤️

For more like this once a week, consider subscribing. ❤️

Building a House of Brands

When Josh Silverman and Rachel Glaser joined Etsy as CEO and CFO in the second quarter of 2017, they inherited a business with slowing GMV growth and ballooning expenses1. After a year of reducing costs, rejiggering priorities, and jumpstarting growth, Etsy was on solid enough footing to look for external opportunities. In June 2018, it acquired DaWanda2, a German marketplace for gifts and homemade goods. Its corporate development team has been busy ever since.

The internet is a massive market and niche marketplaces can generate hundreds of millions or billions of GMV annually. Etsy’s M&A strategy is to build a House of Brands by acquiring a portfolio of unique marketplaces. Acquired companies operate independently as standalone businesses3, but share best practices and resources. When the recent Depop acquisition closes, Etsy will own four differentiated brands:

Etsy: A global marketplace for vintage and handmade goods;

Depop: Secondhand fashion with a strong Gen Z customer base;

Reverb: A marketplace for new, used, and vintage musical instruments; and

Elo7: Brazil’s leading online market for unique and made-to-order goods

Etsy’s acquisition sizes have grown in tandem with its GMV and balance sheet. DaWanda, Silverman’s first deal in 2018 was $35 million, Reverb, acquired in 2019 was $275 million, and Depop, announced in July 2021, was $1.625 billion. Etsy’s House of Brands will continue growing.

Marketplace M&A

Online marketplaces have three options for M&A:

Consolidation: Increasing market share in existing verticals or geographies.

Expansion: Entering new verticals or geographies.

Technological: Adding tech capabilities or acqui-hiring engineers.

Under Silverman and Glaser, vertical and geographic expansion have been the focus. Depop is a vertical (and demographic) expansion into Gen Z secondhand fashion. Elo7, a marketplace for unique, handmade items, established a footprint in Brazil, where Etsy didn’t have a presence. Reverb provided a leading position in the market for musical instruments. It’s easy to roll your eyes at the vintage musical instrument market, but online niches can be big businesses. DaWanda was a twofer. It consolidated Etsy’s market share in Germany and improved its marketplace liquidity, while also expanding its footprint into Austria, Poland, and Switzerland. Blackbird Technologies, which leverages machine learning to improve search relevance, is Etsy’s lone technical acquisition. This deal was completed in 2016 under Chad Dickerson, Silverman’s predecessor.

Picky & Patient: Etsy’s M&A Playbook

Silverman, who knows how to spin up a good phrase, refers to Etsy’s M&A strategy as being patient and picky:

In my experience, companies can be in a mode where they kind of feel like they need to go and buy something and I'll buy whatever I can in the next three to four months to fill some kind of need, in my experience, that usually doesn't end well. A better place to be is to have a clear set of criteria for what you're looking for and be patient and picky and then opportunistic. When the right deal comes around, you buy it. If it's at the right price, if you've got the bandwidth to do it and if it's a great fit. 4

Etsy patiently waits for deals that meets its M&A criteria. These include: strong and authentic brands, vertical or geographic leadership, expanding Etsy’s TAM, asset-light marketplace business models, unique supply, similar growth drivers5, and aligned missions. A long runway for growth and the ability to improve operational and financial performance by implementing customer service, payments, product, and marketing learnings from Etsy are two additional defining characteristics.

Underpinning its M&A strategy is the belief that Etsy knows how to efficiently scale online marketplaces. This has been proven over the past few years under the tutelage of Sliverman and Glaser. For example, between 2017 and 2020, Etsy’s GMV grew from $3.3 billion to $10.3 billion and its take rate increased from 13.5% to 17.3%. While Covid turbocharged 2020 results, operating a business is about playing the hand you're dealt.

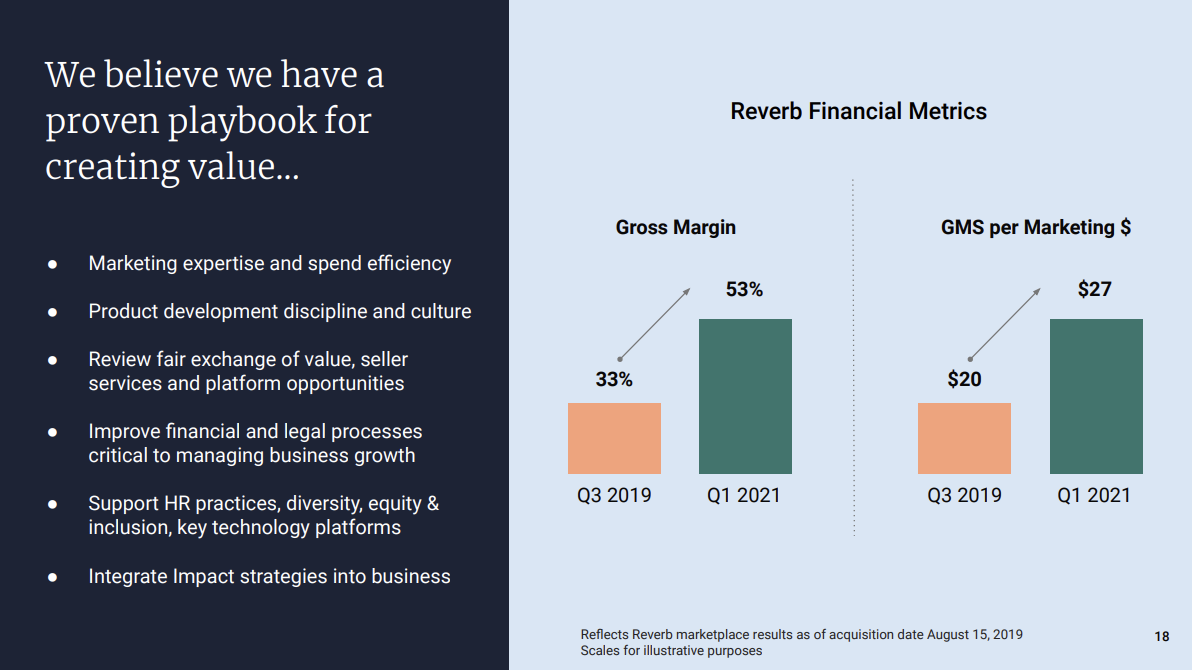

Post-acquisition, Reverb’s gross margins have expanded and its marketing efficiency has improved post-acquisition. Etsy believes that improvements like this are repeatable. Between take rate and conversion improvements, there are multiple ways to win with marketplace M&A.

A High Class Problem

Two-sided marketplaces get better as they get bigger. More sellers attract more buyers and more buyers attract more sellers. While Depop puts a dent in Etsy’s balance sheet, the company will throw off more free cash flow (FCF) as it grows. In 2019, it generated $190M in FCF and in 2020, when Covid pushed shopping online, FCF was $670M. In a few years, FCF will likely exceed $1 billion annually, providing plenty of M&A firepower. Here are a few targets that could fit with Etsy’s M&A strategy:

StockX: With a strong brand serving the sneakerhead community, StockX would give Etsy a leading position in sneakers and streetwear (Depop is also strong in streetwear). StockX meets many of Etsy’s M&A criteria, but one potential hiccup is capital intensity. Etsy’s targets capital light marketplaces. While it doesn’t own inventory, StockX has a large authentication function, adding a layer of costs and complexity. Another issue is size. In 2020, StockX had over $1.8 billion in GMV and its latest valuation was $3.8 billion6. A deal could have a price tag of $5 billion or more7.

Geographic Expansion into India and Mexico: Etsy has teased international M&A in every annual report since 2015 and has been investing in India since 2018. India is a rich source of supply with a burgeoning e-commerce market. In 2019, Etsy added India to its core markets, alongside the United States, United Kingdom, Germany, Canada, France, and Australia. I’d be shocked if someone on Etsy’s corporate development team hasn’t spent time evaluating Indian companies. Craftvilla, a marketplace for handmade fashion, jewelry, and home decor could be a target8. While not a priority market, Mexico has a heritage of craftsmanship, making it a source of unique supply sitting next door to Etsy’s biggest market. A DaWanda-like deal could make sense here. Etsy is currently hiring a dozen product and engineering roles in Mexico City and is looking to open a physical office there (Etsy had an office in Berlin prior to DaWanda).

Kidizen: A peer-to-peer marketplace for children’s clothing, focused on helping mothers become entrepreneurs. Like Depop, but for moms. Kidizen’s mission strongly aligns with Etsy’s. Additionally, Etsy’s buyer base skews female, so there would be good cross-sell potential.

Faire: Etsy Wholesale 2.0. Faire is an online wholesale marketplace connecting independent makers with boutiques, shops, and other small businesses. Adding the ability for Etsy sellers to cross-list on Faire could give them physical distribution. One hesitation here is that Etsy tried and failed to get into wholesale in 2017 and 2018. Another is the price tag: Faire’s last valuation was $7 billion.

M&A is dangerous because it’s easy to do, but hard to do well9. For every company that creates value with M&A, at least ten others destroy value with M&A. Corporate development is a discipline that takes time to hone and a process that requires discipline to execute. While it’s too early to issue a verdict on the success of Etsy’s M&A strategy, early results are encouraging.

If you’re finding this content valuable, please share it with friends or coworkers. ❤️

For more like this once a week, consider subscribing. ❤️

More Good Reads

The a16z Marketplace 100 provides a solid overview of top private online marketplaces. MBI’s Etsy deep dive. Below the Line on marketplace liquidity and tactics to scale online marketplaces.

As a member of Etsy’s Strategic Finance team, I had a front row seat.

DaWanda was technically a referral agreement and intangible asset acquisition. Etsy acquired its buyer and seller relationships, but not its assets, liabilities, or employees. More here (source):

In the coming months, the Etsy and DaWanda teams will work to ensure a seamless transition for both buyers and sellers. Beginning the week of July 2, DaWanda sellers will be able to easily import their shops and listings to Etsy free of charge. Etsy will invest in other key areas to support a successful migration, including increased marketing in the region, additional German and Polish customer support, full translation of its website to Polish, and expanded payment options in Germany through a new partnership with Klarna. Etsy will not acquire any of DaWanda's assets, liabilities, or employees as part of this agreement.

Silverman on tech platform integrations:

We do not plan to migrate Depop onto an Etsy platform. In my experience, you slow down a lot and you lose a lot of flexibility in doing that.

Per Etsy’s conference call discussing the Depop acquisition on June 2, 2021.

Growth drivers include: product enhancements to improve conversion rates, fine turning search, discovery, and personalization, scaling performance marketing, reducing buyer and seller friction, improving monetization by implementing seller services, and potentially raising take rates.

The Wall Street Journal, StockX Valued at $3.8 Billion and Lets Employees Sell Shares, April 7, 2021.

My sneakerhead friends say this wouldn’t be great for StockX’s brand. Thanks BC, ET, and JT, er, JC.

Thanks for the suggestion RK!

M&A is a competency. Serial acquirers like Amphenol, Constellation Software, and HEICO have turned M&A into a valuable, repeatable process. But most companies aren’t Constellation Software. With the exception of IAC, Barry Diller’s online empire, there aren’t many consumer internet companies with long, successful M&A track records.