Hi 👋 - Klarna is one of Europe’s most valuable start-ups. To justify its $46 billion valuation, the company is going to need to move beyond offering buy now, pay later services. A look at Klarna’s app and its shopping strategy. Thanks for reading.

If you find this content valuable, consider sharing it with friends or coworkers. ❤️

Buy now, pay later, but subscribe today. 🤑

If Sebastian Siemiatkowski made the boat, Klarna wouldn’t exist. Siemiatkowski, Klarna’s co-founder and CEO, was backpacking around the world without taking any airplanes. Missing a cargo ship in Australia delayed his schedule so that instead of enrolling in a masters program in Sweden, he spent a year working for an accounts receivable agency. While there, Siemiatkowski realized there were better payment options than credit cards.

Siemiatkowski is no longer reliant on cargo ships for transportation. Today he can fly private. In June 2021, Klarna raised $639 million at a valuation of $46 billion in a round led by SoftBank’s Vision Fund 2, making it one of the most valuable private companies in Europe. The company provides buy now, pay later (BNPL) services for merchants, but its ambitions extend far beyond installments. For Klarna to justify its valuation, it will need to diversify its business. It can’t miss any more boats.

Pay in 4

Younger consumers are shy to adopt credit cards and eager to shop online, creating an opening for BNPL providers like Klarna. Pay in 4 is Klarna’s BNPL product and consumer onramp. It’s layaway for Millennials1. Pay in 4 splits a purchase into four equal payments with the first due at checkout and the remaining three collected every other week. The full purchase price is spread over six weeks, with no fees or interest if payments are made on time2.

Unlike credit cards, most of Klarna’s revenue comes from retailers, not consumers. Its pitch to merchants is simple: it helps them sell more. BNBL boosts conversion rates, average order values (AOV), and customer acquisition. According to Klarna, merchants who adopt Pay in 4 see AOV increase by 20-80% and average conversion increases of 20%3. Affirm, a competitor, claims to boost AOV by 85%4. That’s catnip for retailers.

But Klarna’s no charity. The company charges merchants a 2-8% fee on each transaction. This is higher than traditional payment processors of roughly 3%. The tradeoff for retailers is absorbing heftier fees for a boost to AOV and conversion.

Klarna’s pitch to shoppers is equally simple: it helps them buy more. It provides an alternative to credit cards, allowing shoppers to expand their purchasing power and buy something they may be unable to afford to purchase outright. The other option is saving up to buy something, which is simply un-American. It also offers transparency and simplicity.

BNPL offerings resonate with younger consumers, particularly the Gen Z, who eschew credit cards. With the wind at its back, Klarna’s growth has been impressive. In 2020, gross merchandise volume (GMV) was $53 billion, growing 46% year-over-year, accelerating from 32% in 2019. Klarna currently processes over two million transactions per day, up from one million per day in 20195. The company works with over 250,000 retailers across twenty markets including Etsy, Lululemon, Nike, and Sephora. Pay in 4 is also accepted at over 60,000 brick-and-mortar locations in the United States.

Given the commoditized nature of installment payments, distribution is the locus of competition and acquiring merchants is competitive. To woo merchants, BNPL providers offer marketing support and engineering resources to help with the integration. Klarna competes with Affirm, Afterpay (which is being acquired by Square), and Sezzle. Apple and others are rumored to be eyeing the BNPL market as well.

Installments, the Gateway Drug

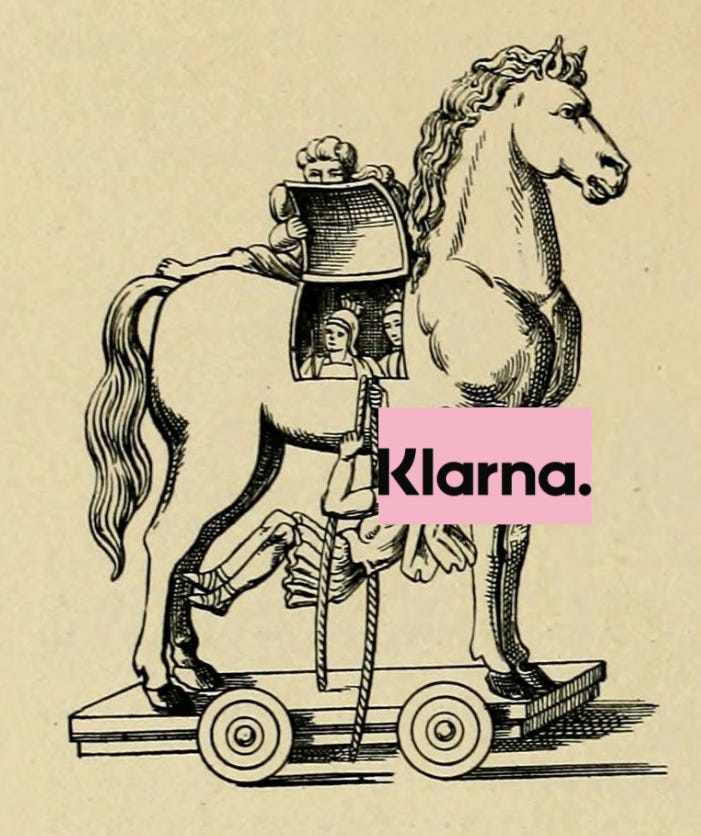

Once a merchant integrates Pay in 4, Klarna begins acquiring users (shoppers) from them. Customers typically discover Klarna while checking out. This is how the Trojan Horse gets into the city:

The $46 billion question is what Klarna does with these shoppers after they’re acquired. Spend time in the app and it quickly becomes clear that Klarna’s ambitions lie beyond BNPL. Little space is devoted to payments. Instead, most real estate is devoted to shopping and ads:

Installments are the sweetener that get shoppers into the app. Having customers visit an app three times over six weeks is a beachhead for habit formation. Once inside, Klarna lays the honey on thick. For example, it prompts users to create wish lists, sign up for price drop notifications, and track packages. There’s also Vibe, its loyalty program which offers rewards for purchasing through Klarna. Lastly, shopping and BNPL are embedded into the app. These features are geared to increasing visit frequency and engagement.

Klarna’s goal - and challenge - is using payments to get customers hooked on shopping. Success here grows GMV and opens up ancillary revenue streams like advertising, in addition to personal finance products like savings accounts. Come for the installments, stay for the ads.

Klarna’s Ambition: Own The Demand

In online businesses, value accrues to whoever owns the demand. Google wants shopping sessions to start on search. Amazon wants customers to begin every product search on Amazon. Lululemon wants shoppers to come directly to their store or website. The alternative is paying a tax to Google or Facebook. Or Klarna.

Klarna is trying to build a retail tollbooth. It hopes that Pay in 4 customers start their next purchase on Klarna. That’s why so much of the app is devoted to shopping. As Florent Crivello, a product manager at Uber bluntly puts it in a blogpost:

If somebody successfully inserts themselves between you and your customer, they can exercise tremendous control over you, including taking a big chunk of your profits or outright killing you.

Doing the former increases Klarna’s take rate. If it can become a jumping-off point for commerce, it can take a cut of a bigger slice of economic activity. It’s a big if.

If You Build It, Will They Come?

Klarna is gaining traction. In August 2021, the company announced that it had 20 million customers in the US, up from 10 million in June 2020. About one million new US customers have joined monthly since October 2020. Additionally, Klarna’s app has four million monthly active users in the US and gets 30,000 to 50,000 app downloads per day6. Globally, Klarna has 90 million customers, with particular strength in Germany.

Success looks like more customers shopping directly on Klarna. Changing consumer behavior is hard, but there are hints of progress. Earlier this year, David Sykes, who runs Klarna’s US business, noted that customers are going directly to the app to shop, though he didn’t quantify how many (probably off of a low base). Additionally, Sykes mentioned that after Google and Facebook, Klarna is the third largest customer acquisition channel for its merchant7. Similarly, competitor Affirm said that roughly one-third of its transactions begin on Affirm, rather than a retailer’s website8. This is a powerful position for Klarna, and an uncomfortable one for merchants. Following Crivello’s logic, inserting itself between a retailer and their customer enables Klarna to extract more value.

One way to do this is ads, which are prominently featured in Klarna’s app. Building an online advertising business requires traffic and relevancy, which breaks down into advertiser density and targeting ability. Klarna’s traffic is growing, but is sub-scale relative to pure-play online advertisers. The relevancy picture is brighter since Klarna has SKU level data on every transaction9. While a credit card company knows that you spent $68 at Lululemon, Klarna knows that you spent $68 on a black Fundamental T-shirt, size large. Amassing granular data aids discovery, promotion, and targeting. In terms of advertiser density, Klarna’s 250,000 merchants offers a good starting point. Ads provide a high margin revenue stream to supplement Klarna’s core payments business.

The Trojans were surprised by what was inside the wooden horse the Greeks left outside the gates of Troy. If Klarna successfully executes on its strategy, its retail partners may be in for a similar surprise.

If you find this content valuable, consider sharing it with friends or coworkers. ❤️

Buy now, pay later, but subscribe today. 🤑

More Good Reads

Mario Gabriele’s deep dive on Affirm’s S1 is a good introduction to the BNPL space. KindredCast's interview with Sebastian Siemiatkowski offers a good overview of Klarna’s business. Siemiatkowski sees retail banking as an industry focused more on rent seeking than providing a good customer experience. JP Morgan CEO Jamie Dimon sees fintechs as benefitting from regulatory arbitrage. Below the Line on Dimon’s 2020 annual letter and competition between banks and fintechs.

H/T to Mario Gabriele and the S1 Club for this phrasing.

For late payments, Klarna charges a fee of up to $7, capped at 25% of order value.

Klarna, Klarna celebrates 20 million US customers, August 23, 2021

The Wall Street Journal, Amazon Is Doing It. So Is Walmart. Why Retail Loves ‘Buy Now, Pay Later.’, September 16, 2021.

KindredCast, Earn Every Transaction with Klarna CEO Sebastian Siemiatkowski, April 30, 2021.

Klarna, Klarna celebrates 20 million US customers, August 23, 2021

Tearsheet Podcast, Behind Klarna's massive growth in the US with David Syke, February 3, 2021.

Bloomberg, Affirm to Debut Crypto, Debit Products in Push Toward Super App, September, 28, 2021.

KindredCast, Earn Every Transaction with Klarna CEO Sebastian Siemiatkowski, April 30, 2021.