Hi 👋 - This week kicks off a sporadic series looking at how legacy businesses are leveraging technology and adopting to a digital world. Today, a look at Nike’s DTC strategy. Thanks for reading.

If you’re finding this content valuable, consider sharing it with friends or coworkers.❤️

For more like this once a week, consider subscribing. 🙏

Skate To Where The Puck Is Going

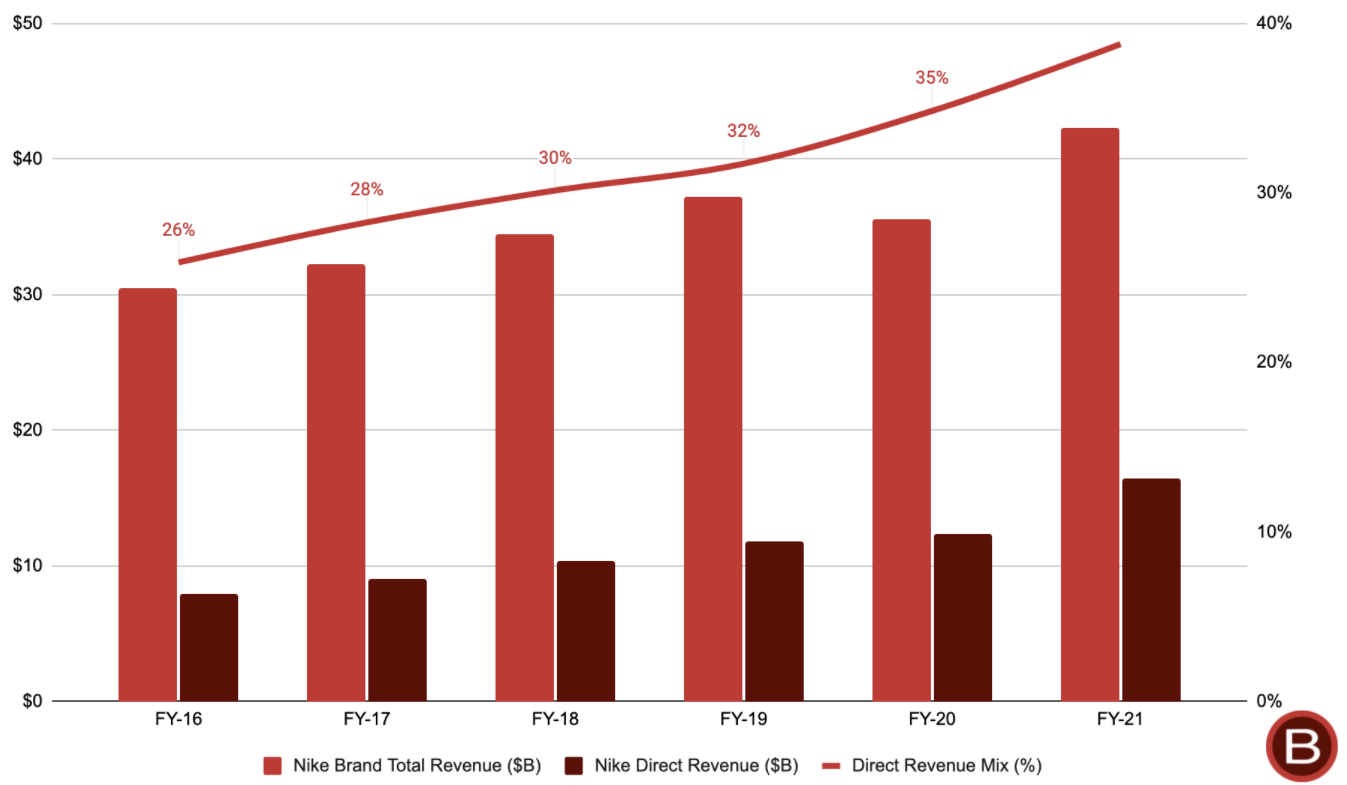

The day you stop changing is the day you die. Nike built its business off a strong wholesale distribution network. In 2016, this channel accounted for 74% of its sales. In 2017, Nike’s distribution network was over 30,000 strong, ranging from independent shoe stores and skate shops to scale players like Amazon and Foot Locker. But the world doesn’t stand still. Winning means skating to where the puck is going, not where it is. The secular shift to e-commerce meant consumer behavior was changing, so Nike changed too.

In 2017, the company replaced its wholesale distribution playbook with Consumer Direct Offense. The new strategy targeted increasing direct sales through Nike’s 7,000 plus stores and digital channels like the SNKRS app, where it drops exclusive merchandise. The five-year plan called for pruning its distribution network, growing direct-to-consumer (DTC) channels, investing in digital capabilities, and doubling down on 40 strategic partners like Dick’s Sporting Goods, Foot Locker, and Nordstrom. By 2025, Nike’s goal is for 60% of revenue to be DTC and 50% to be digital1.

The Internet Playbook: Megas & Minnows

Online business is bifurcated. At one extreme, network effects drive a winner-takes-most dynamic, resulting in behemoths like Amazon and Google. By removing the constraints of geography and collapsing distribution costs, the internet enables a proliferation of niches to flourish at the other end2. There’s never been a better time to be an AMSR or unboxing enthusiast. While the tails prosper, the middle gets squeezed. Mediocrity doesn’t sell online.

Digital business requires a new playbook. By deepening its connection with customers and controlling its distribution, Nike’s DTC strategy acknowledges this. While controlling supply dictates success offline, controlling user relationships drives success online3. Prioritizing direct relationships and loyalty aligns Nike’s strategic pivot with internet assumptions. As Nike’s CEO John Donahoe sees it4:

It’s the deeply connected authentic brands with scale that will win.

Undifferentiated Retailers

Nike spent decades building a storied brand and delivering quality products. However, its network of third-party retailers didn’t provide a consistent brand experience. Investing in e-commerce capabilities enabled Nike to reach customers directly, diminishing the importance of offline distribution.

As part of its DTC strategy, Nike is pruning its network of 30,000 retailers and wholesalers. The company believes that undifferentiated, mediocre retailers will struggle to survive5, an example of the middle being squeezed. In November 2019, Nike stopped selling on Amazon. It takes a strong brand - and a strong constitution - to pull out of Amazon, given the firehose of spending that it funnels. In the spring of 2021, Nike severed ties with DSW, Olympia Sports, and Urban Outfitters. Since launching its DTC strategy, Nike has slashed its North American retail base over 30%6.

One motivation for culling is brand protection. For premium products, brand adjacency matters. Nike doesn’t want its shoes showing up on the bargain rack next to a pair of pink camouflage Crocs because that dilutes its brands. Tighter control of distribution helps avoid stores reliant on heavy discounting.

By emphasizing its own retail locations and a handpicked group of forty strategic partners, Nike is able to control its brand experience. Strategic partners like Dick’s Sporting Goods, Foot Locker, and Finish Line are investing to deliver Nike’s desired customer experience. For example, having trained salespeople dedicated to selling Nike and sharing data with the company. In return, Nike provides them with exclusive product offerings and in-store events.

The Benefits of Loyalty

In addition to reflecting changing consumer behavior, Nike’s DTC strategy makes economic sense. Removing the middleman improves margins. When Nike sells to a retailer, it gets a wholesale price. When it sells to a consumer, it gets a higher retail price. Mix shift from wholesale to DTC improves margins7. Nike’s DTC channel can be twice as profitable as selling through wholesale8.

Customer acquisition cost (CAC) is where most DTC models fall apart. Thanks to services like AWS, Shopify, Stripe, and Wix, starting an online business has never been easier. But nature doesn’t like a free lunch. The flip-side of low barriers to entry is that acquiring customers and scaling an online business is more competitive. A differentiating factor is the ability to generate organic traffic. Nike has spent decades building a powerful brand and designing quality products which drives traffic. Its DTC strategy leverages brand strength to reduce CAC, similar to Peloton’s corporate wellness strategy.

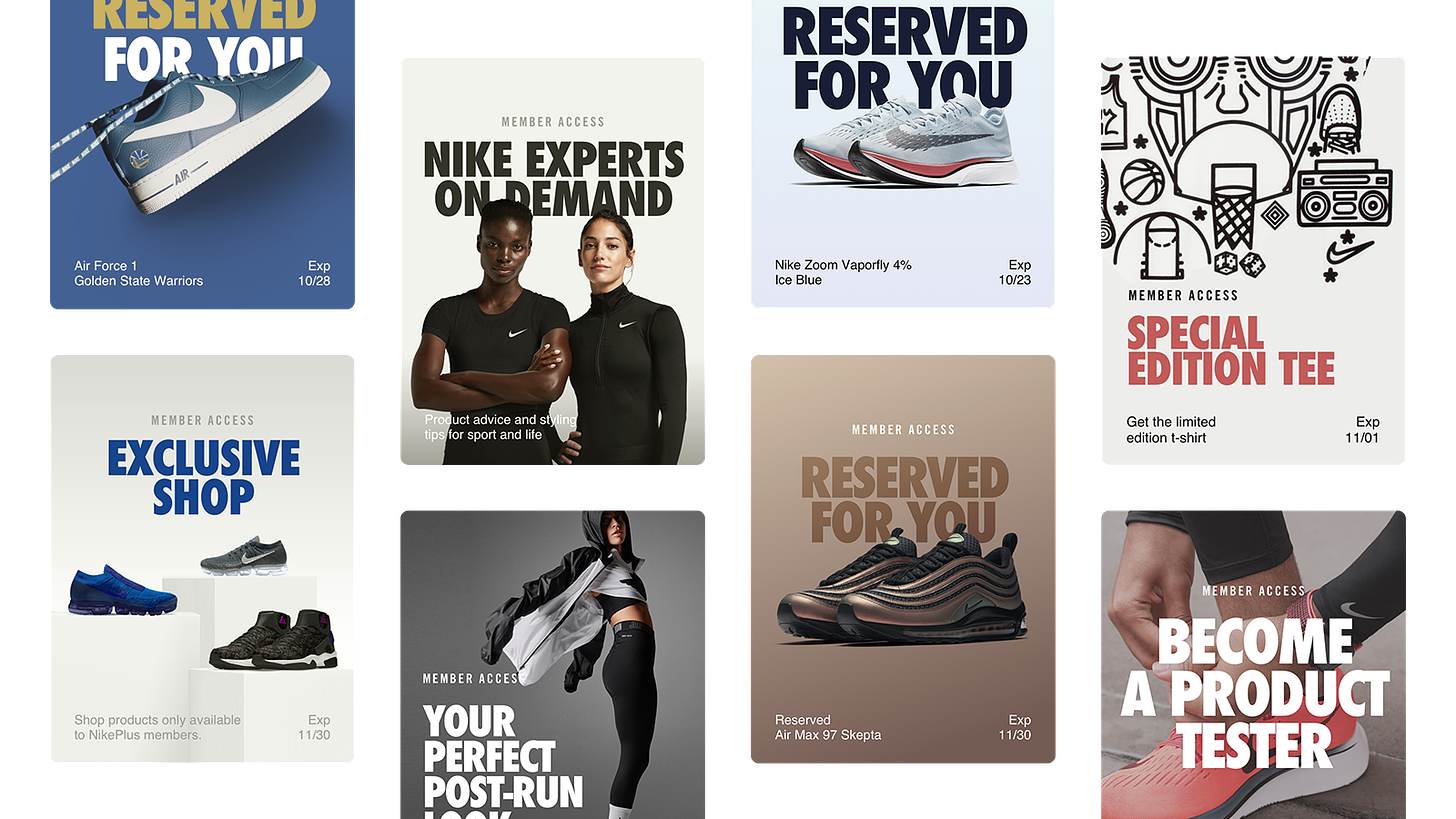

Loyalty increases lifetime value and is another critical factor for DTC success. Acquiring new customers can cost five times as much as retaining an existing customer9. Additionally, returning customers often have higher conversion rates and higher average order values. Nike uses its rewards program to engender customer loyalty. One carrot for members is free shipping. Another is access to exclusive supply. About one-third of Nike’s products are only available to rewards members and available through direct channels10. Rewards members shopping on the Nike app have order values three times higher versus non-rewards members shopping on Nike.com11. Since 2017, enrollment has grown from 100 million to over 300 million. That’s an internet scale business.

Additionally, the DTC shift also provides Nike with more data, which is used to improve personalization and customer experience. Offline, customer data is leveraged for product creation, inventory optimization, and increasing speed to market. Each rewards member has a unique profile spanning Nike’s online and physical retail, so online data also enhances the retail experience. Lastly, with ad-targeting using third-party data becoming more difficult following the roll-out of iOS 14, first-party data and direct relationships are becoming more important for effective digital marketing.

By embracing change, Nike has increased the odds of having a long and prosperous life.

If you’re finding this content valuable, consider sharing it with friends or coworkers.❤️

For more like this once a week, consider subscribing. 🙏

More Good Reads

Packy McCormick on the difficulties of scaling DTC brands. Sweetgreen’s CEO John Neuman lists Starbucks and Nike as aspirational for their ability to forge direct connections with users. Below the Line on how Sweetgreen leverages tech to foster direct relationships and avoid aggregators like DoorDash and Uber Eats.

Disclosure: The author owns shares in Peloton and Shopify.

This goal includes digital sales through Nike’s apps and Nike.com, as well as digital sales at its distribution partners like Dick’s Sporting Goods and Foot Locker.

Stratechery, Never-Ending Niches, Tuesday, June 9, 2020.

Stratechery, Aggregation Theory, July 21, 2015.

Fortune, How Nike hit its e-commerce goal 3 years early, September 23, 2020.

RetailWire, Nike turns its back on ‘undifferentiated, mediocre’ retailers, October 26, 2017.

CNN Business, Nikes are getting harder to find at stores. Here's why, March 22, 2021.

In order to do this, Nike had to invest in digital capabilities and revamp its supply chain to go from delivering shipping containers full of shoes to retailers to individual shoe boxes directly to consumers. This took time, money, and management fortitude and was enabled by Nike’s strong brand. The bet is that as DTC volume ramps, the per unit costs of these investments will fall, improving profitability.

CNN Business, Nikes are getting harder to find at stores. Here's why, March 22, 2021.

McKinsey & Company, DTC e-commerce: How consumer brands can get it right, November 30, 2020.

Nike Analyst Day 2017, Heidi O’Neill, President, NIKE Direct & Adam Sussman, Chief Digital Officer, October 25, 2017

What's wrong with pink camo crocs?