#5 - Grubhub & The Limitations of TAM

Flip through any start-up’s pitch deck and you’re likely to find a few references to a large market size, often denoted as total addressable market, or TAM. Large, growing markets are catnip to businesses and investors. But a point not often highlighted in pitch decks is that large markets attract lots of competitors. In the absence of a strong moat, a large market only provides limited protection against competition.

This week food ordering and delivery company Grubhub provided a good case study about the limitations of TAM, the importance of moats, and the need to constantly sense check assumptions. The excerpts below come from the company’s 3Q 2019 letter to shareholders.

Grubhub operates a large market:

It is widely believed that the total market for takeout in the United States, including pickup and delivery, is greater than $200 billion annually.

And large markets attract lots of competition. Grubhub’s competitors include Doordash, Postmates, and Uber Eats. Uber alone is sitting on over $11B of cash on its balance sheet. And competition has consequences:

In August, overall DAG [daily orders] growth began trending noticeably lower than our expectations. As we dug into the data, we saw that our newer diners, particularly those in our newer markets, were not driving as many orders as we expected at that point in their lifecycle. While retention of these newer diners was good, their ordering frequency wasn’t “maturing” at the same level as earlier cohorts.

Grubhub’s newest diners were also less loyal:

We believe online diners are becoming more promiscuous. For years, we saw in our data that a Grubhub diner was extremely loyal to our platform. However, our newer diners are increasingly coming to us already having ordered on a competing online platform, and our existing diners are increasingly ordering from multiple platforms.

Reduced purchase frequency and lower customer loyalty suggest a declining LTV. In other words, Grubhub’s newest cohorts are less valuable than its older cohorts.

While it’s easy in a spreadsheet to forecast drivers moving up and to the right, it’s much harder to realize this IRL, particularly in a competitive market. Indeed, what Grubhub found was that things were getting harder over time:

With billions being poured into awareness campaigns, diner incentives, driver incentives and restaurant incentives, it makes sense that easy-to-access “analog” diners would quickly become aware of the substantial benefits of online ordering. And, as a result, the easy wins in the market are disappearing a little more quickly than we thought.

The company determined that at the margin, they were in a food fight with competitors over the same customers:

What we concluded is that the supply innovations in online takeout have been played out and annual growth is slowing and returning to a more normal longer-term state which we believe will settle in the low double digits, except that there are multiple players all competing for the same new diners and order growth.

In response to slowing growth and competitive pressure, Grubhub decided it needed to step up its investments around restaurant supply and customer loyalty:

While our competitors continue to spend aggressively, swallowing steep losses in the process, we need to give new diners more reasons to try Grubhub, stop our existing diners from looking elsewhere and continue growing our diner base…What this means is that we will be moving quickly, spending more and trying many different strategies over the next 12–18 months to increase restaurant supply aggressively while making our diner experience more sticky — effectively taking action to remove any reason for diners to look anywhere else.

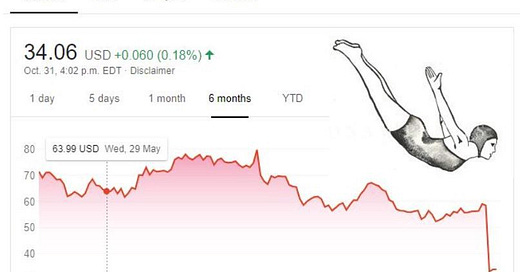

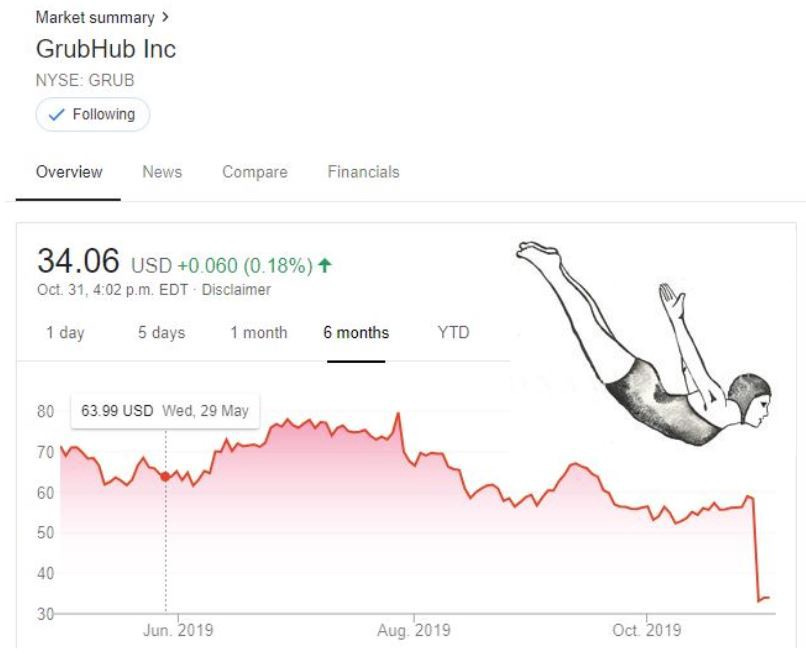

While it will take years to assess the efficacy of Grubhub’s strategy pivot, investors didn’t want to stick around. Seeing a company with a lower near-term growth and profitability profile, they rushed to sell shares:

There are a few takeaways from Grubhub’s experience:

You need a moat — What unique advantage does your business have that others can’t replicate? What are you doing to widen your moat?

TAM won’t save you — In the absence of a strong moat, competition will tend to make things like customer acquisition and increasing LTV harder over time. This being the case, it’s important to regularly refresh your assumptions to make sure they reflect economic reality.

Smaller markets can still be valuable — While large markets are seductive they tend to be crowded. There are smaller, less crowded markets that we can turn into meaningful revenue streams.

👉 If you enjoyed reading this post, feel free to share it with friends!

For more like this once every weekend, consider subscribing 👇