Hi 👋 - Like e-commerce companies, consumers are retrenching. They’re becoming more discerning, more value-conscious, and thriftier. Today, a look at recent shifts in consumer behavior and how the e-commerce industry is responding. Thanks for reading.

If you’re finding this content valuable, consider sharing it with friends or coworkers.🙏

For more like this once a week, consider subscribing. 🙏

Stocking Stuffers

Over the past two quarters e-commerce companies took out the hatchet as online spending normalized from pandemic peaks. Consumers are cutting back too.

Today’s economic environment is as confusing as a stocking with a lump of coal next to a Rolex. It’s sending lots of mixed signals. Much to the Fed’s chagrin, wage growth is strong, unemployment is near record lows, and there are over 1.5 job openings for every unemployed person looking for work1. Though cracks are emerging, especially in tech – cue the world’s smallest violin – the US labor market is on solid footing. Despite this, folks are in a glum mood, with consumer confidence at generational lows.

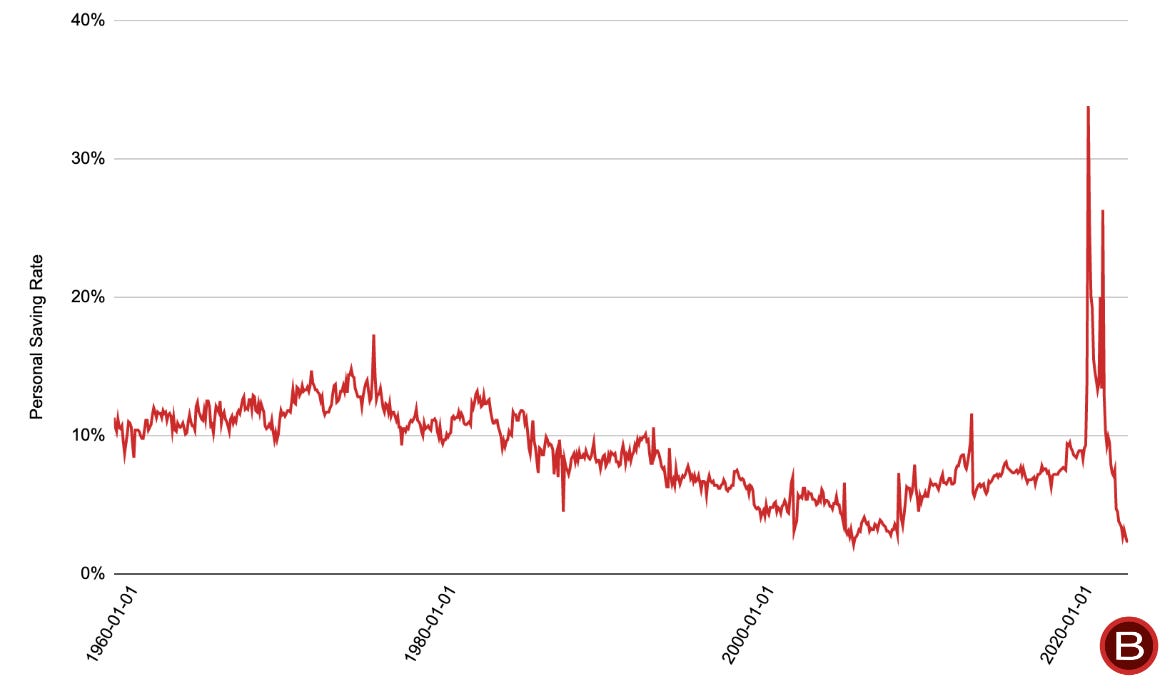

Helped by stimulus checks, Americans are sitting on over $1.5 trillion in savings accumulated during the pandemic2. However, this buffer is evaporating as consumers have more options for where to spend – restaurants, travel, karaoke bars – and inflation makes everything more expensive. In October, Americans saved just 2.3% of their post-tax earnings, the lowest level since July 20053. This compares to savings rates of 6-8% before Covid and over 20% during the pandemic.

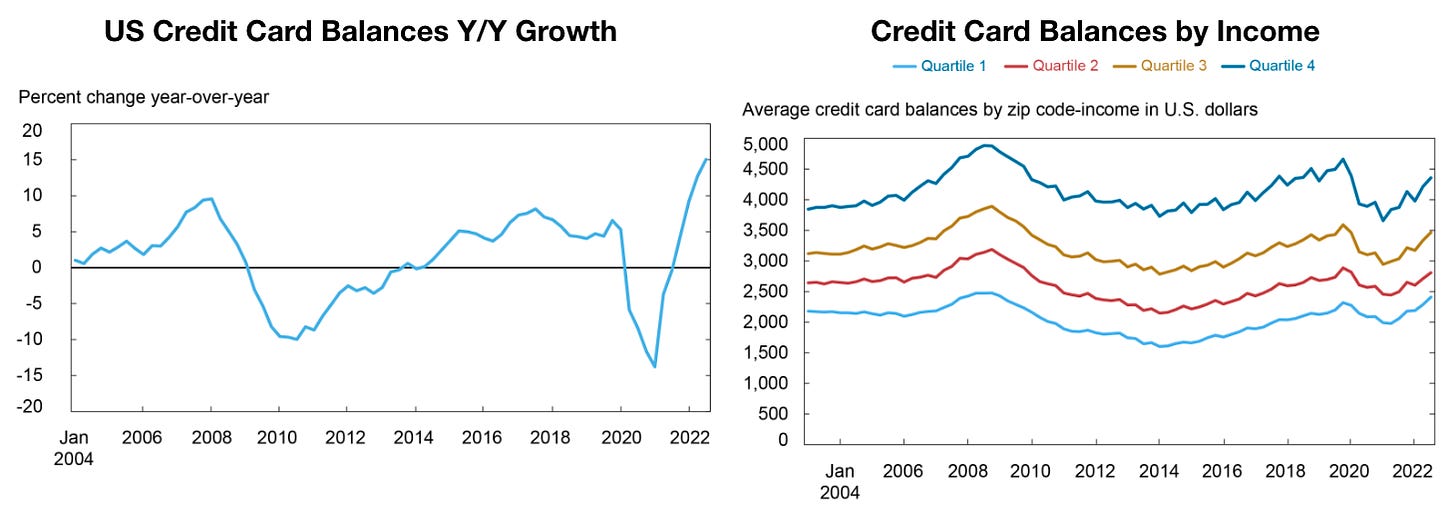

As savings rates decline, credit card balances are mushrooming. In the third quarter, US credit card balances increased by $38 billion sequentially, or $115 per capita4. This includes new consumption and balances carried over from previous quarters. Year-over-year growth of 15% was the highest in over twenty years (though helped by a low base). Like most US economic statistics, trends are not evenly distributed. Outstanding balances for low income borrowers (quartile four below) are above December 2019 levels, while balances for high income borrowers remain lower. Like credit card balances, delinquency rates are creeping up as well, though remain skimpy by historical standards.

Parsimonious Presents

You don’t need to be John von Neumann to see that people are in a more precarious position relative to a few quarters ago. Facing economic crosscurrents, consumers are being patient and thrifty.

Amazon noted that both consumers and businesses (AWS, advertising) are tightening their belts5. Similarly, eBay is seeing value resonate with buyers. As such, the company is pushing value in its marketing. For buyers, preowned, refurbished, open box, and vintage goods provide cheaper alternatives to brand new items, helping to stretch budgets. For sellers, eBay provides supplemental income, helping to mitigate the rising cost of living. Preowned and refurbished goods account for one-third of the company’s GMV and are growing faster than new items6, which is to say that they’re declining at a slower rate (eBay’s GMV declined 11% year-on-year in the third quarter).

Shoppers are also trading down. People are still buying, they're just purchasing fewer or less expensive items. Here’s Rati Sahi Levesque, Co-Interim CEO, President, and COO (say that three times fast!) at second-hard luxury fashion marketplace The RealReal7:

What we are seeing is a trade down effect, and I'm sure you've heard this from other companies, but we are seeing people may be deciding instead of a top-tier luxury item, they're maybe trading one down for like a mid-tier item, or in order for the item to sell, you'll see us reduce an item by 5% or 10%.

(The RealReal controls pricing and uses it as a sell-through lever.)

With an average order value of $460, The RealReal focuses on affluent shoppers, but this trend was prevalent across categories and budgets8. ThredUp, an online thrift shop, caters to shoppers on a budget. Its third quarter revenue grew 7% year-over-year, while orders grew 25%, suggesting a steep decline in average order value. ThredUp also saw an uptick in return rates, suggesting consumers are becoming more discerning about spending.

We’re Having A Fire…Sale

Another running theme across e-commerce earnings calls was that promotional activity is intensifying. Two factors are at play here. First, many brick-and-mortar retailers are sitting on excess stock. With supply chains and logistics normalizing from Covid snarls, Amazon flagged high seller in-stock rates and improved delivery speeds9. Similarly, online furniture-monger Wayfair noted supply chain and transit times are normalizing, freight rates for ocean and trucking are declining, and that there’s excess inventory relative to demand10. Like e-commerce penetration trends, the supply chain pendulum is swinging from overwhelmed to excess capacity. Second, with inflation stretching budgets, people must be coaxed to spend11. Although consumers are becoming more deliberate with discretionary purchases, they’re still responding to value. Here’s Wayfair CEO Niraj Shah:

Inflation persists quite broadly and with spending pressure across the spectrum of discretionary goods, we continue to see shoppers being very discerning about where their next dollars are going. For much of the summer months, that discretionary spend shifted from goods to services, with pressure felt across a wide array of retail sectors, including ours. While interest in the broad home category remains, we are seeing shoppers being more deliberate with their spending patterns as they seek out great value and wait for promotions. As a result, promotional activity across the industry remains high and customers are responding very positively.

A heavily promotional environment is hammering ThredUp, with deep discounts at retailers crowding out its message of everyday value. Here’s ThredUp CEO James Reinhart12:

So what we're seeing is a combination of demand pullback at a time when retail inventories are overflowing with apparel, which is resulting in significant price compression in the apparel market. And while we don't have the same inventory risks that other retailers have, we're not immune to the pressure on prices.

Luxury fashion marketplace Farfetch is seeing the same trend at the opposite end of the price spectrum, as CFO Elliot Jordan noted13:

What we started to see across Q3 was a heightened level of promotional activity from the competitive set…What we're seeing and would expect now is that Q4 is going to get worse. There's lots of stock out there at the moment in terms of inventory of product. And that only has to be cleared across the next quarter.

Unit Economic Tradeoffs

E-commerce companies spent much of 2022 responding to an anemic growth environment. This work will continue in the fourth quarter and likely beyond. With profitability back in vogue in tech, companies are scrutinizing their unit economics and culling unprofitable business.

For example, to reaccelerate its time to breakeven, The RealReal is deemphasizing low price point listings and nascent categories like Home and Kids that require a lot of overhead but don’t produce a lot of revenue. These items generated revenue and orders, but little (or sometimes negative) contribution margin14. It's a good example of addition by subtraction. You get stronger by eliminating things that make you weak. Additionally, the company revamped its commission structure to improve profitability at the expense of GMV growth. Similarly, to protect gross margins, Farfetch isn’t leaning into the heavily promotional environment and ThredUp is throttling back its supply processing capacity to reduce costs.

This is a far cry from the go-go days of 2020 and early 2021, when growth was the focus. Trade-off calculus is shifting in favor of margins. Nothing sharpens the mind like a shrinking cash balance.

If you’re finding this content valuable, consider sharing it with friends or coworkers.🙏

For more like this once a week, consider subscribing. 🙏

More Good Reads and Listens

E-commerce is a Bear by Bonobos founder Adam Dunn. Liberty Street Economics, the New York Fed’s blog, on US credit card balances. Slimming Down, Below the Line’s Q2 2022 e-commerce recap: part one and part two.

The New York Times, Why Retailers Are Trying Extra Hard to Woo Holiday Shoppers, November 27, 2022.

The New York Times, Why Retailers Are Trying Extra Hard to Woo Holiday Shoppers, November 27, 2022.

Andrew Haughwout, Donghoon Lee, Daniel Mangrum, Joelle Scally, and Wilbert van der Klaauw, “Balances Are on the Rise—So Who Is Taking on More Credit Card Debt?,” Federal Reserve Bank of New York Liberty Street Economics, November 15, 2022, https://libertystreeteconomics.newyorkfed.org/2022/11/balances-are-on-the-rise-so-who-is-taking-on-more-credit-card-debt/.

Andrew Haughwout, Donghoon Lee, Daniel Mangrum, Joelle Scally, and Wilbert van der Klaauw, “Balances Are on the Rise—So Who Is Taking on More Credit Card Debt?,” Federal Reserve Bank of New York Liberty Street Economics, November 15, 2022, https://libertystreeteconomics.newyorkfed.org/2022/11/balances-are-on-the-rise-so-who-is-taking-on-more-credit-card-debt/.

Amazon, Q3 2022 Earnings Call, October 27, 2022.

eBay, Q3 2022 Earnings Call, November 3, 2022.

The Real Real, Q3 2022 Earnings Call, November 8, 2022.

This is happening offline as well. Per the WSJ:

On Tuesday Walmart said U.S. comparable sales rose 8.2% in the quarter. Walmart executives said the retailer is attracting more higher-income shoppers as many shift spending away from discretionary categories to food and look for value.

Amazon, Q3 2022 Earnings Call, October 27, 2022.

Wayfair, Q3 2022 Earnings Call, November 3, 2022.

This is happening offline as well 2.0. Per the WSJ:

Target executives said consumers are waiting to purchase items until they spot a deal, buying smaller pack sizes and giving priority to family needs. Sales of food, beverage, beauty products and seasonal items were strong, they said.

ThredUp, Q3 2022 Earnings Call, November 14, 2022.

Farfetch, Q3 2022 Earnings Call, November 17, 2022.

Gross profit less acquisition cost.