Hi 👋 - Is this thing still on? In early March my wife and I welcomed a daughter into our home. Between the lack of sleep, ceaseless laundry, and wanting to hang out with her, there’s less time to research and write. Looking ahead, posting will be sporadic. With the sentimental stuff out of the way, today’s post digs into first quarter e-commerce trends.

🛍 If you’re finding this content valuable, consider sharing it with friends or coworkers.

🛍 For more like this, consider subscribing.

Thawing Out

When the tide goes out, you see who’s swimming naked1. As e-commerce demand begins to thaw, it’s clear that not everyone is ready for beach season.

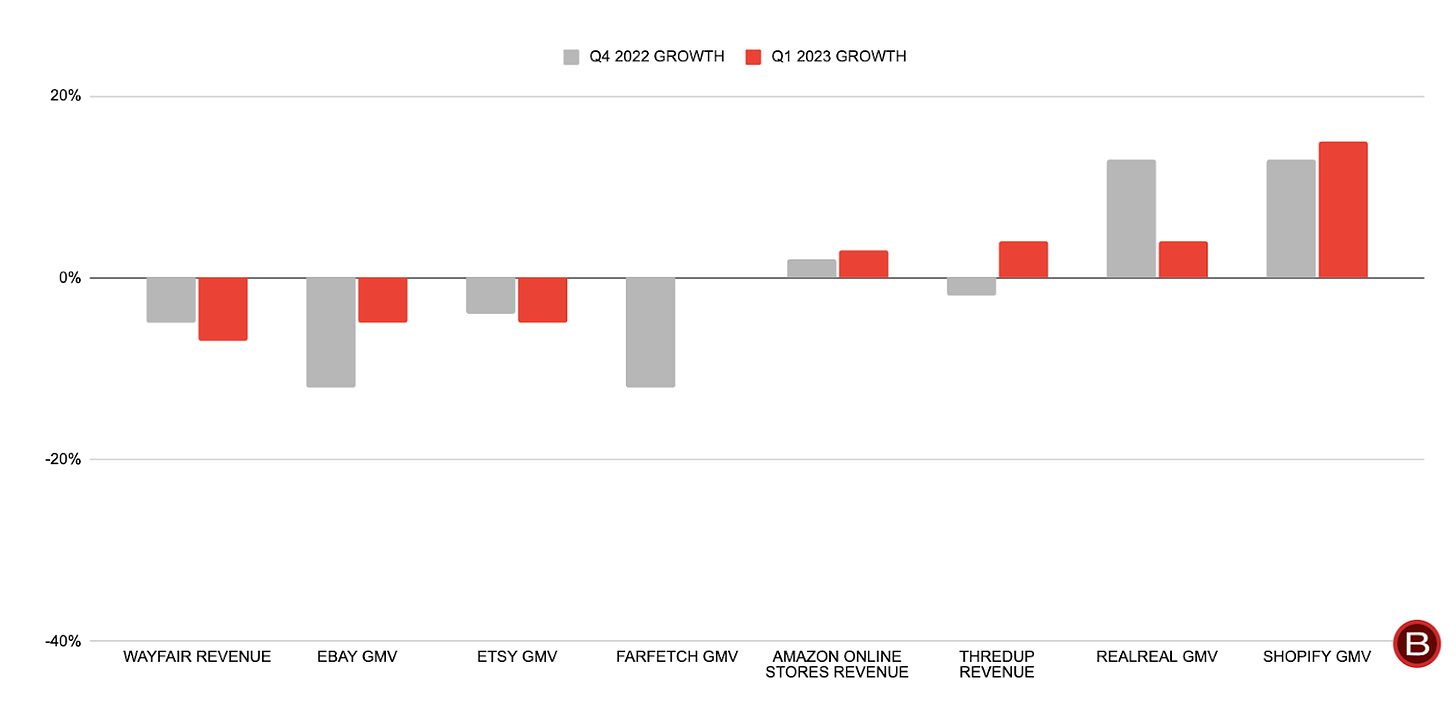

The Covid hangover is abating unevenly. While the pandemic raised all boats in e-commerce, the post-pandemic period has been choppy. Although the industry returned to growth in the first quarter, you wouldn’t know it from looking at most companies.

Like so many other areas of the American economy, the rich are getting richer. Market share leaders like Amazon, Shopify, and Walmart2 all posted growth, while results were shakier for smaller companies, particularly those geared towards highly discretionary categories like home goods and luxury fashion.

Q2 Outlook – Green Shoots

While no one is expecting a rapid return to heady growth, the thaw should continue in the second quarter. Like Punxsutawney Phil, the hackneyed phrase “green shoots” reemerged from hiding on first quarter calls. For example, eBay and Etsy both saw new buyer growth for the first time in over a year, while Thredup expects to see buyers growth return in the second quarter. Similarly, Wayfair returned to positive order growth in the second quarter (as of early May) and flagged improving revenue growth in early June3.

Encouraging data points aside, the environment remains too unpredictable for many companies to provide full-year guidance. Most are sticking with guiding only one quarter out. It will be a positive indication that the operating environment has normalized when full-year guidance returns, though this is unlikely before 2024.

Consumer Behavior – Trading Down

Although consumers are still spending, they're being parsimonious. As Amazon CFO Brian Olsavsky mentioned, consumers are trading down and pulling back on discretionary categories4:

The uncertain economic environment and ongoing inflationary pressures continue to be a factor, and we believe it's continuing to drive cautious spending across consumers. This means our customers are looking to stretch their budgets further and are focused on value. We saw moderated spending on discretionary categories as well as shifts to lower-priced items and healthy demand in everyday essentials, such as consumables and beauty5.

With persistent inflation pressuring budgets, household income was another factor driving performance. Value resonated. In contrast, discretionary purchases are being deferred. Etsy saw a pullback from lower-income households while consumers searching for value bought more refurbished goods from eBay. The trade down dynamic was most evident with Thredup, a marketplace for mass-market fashion resale, as CEO James Reinhart noted6:

We're also continuing to see a clear bifurcation of Thredup customer purchasing behavior. With more premium shoppers leaning in and more value shoppers leaning out.

At the opposite end of the spectrum, luxury fashion site Farfetch saw average order value (AOV) decline 10% versus the prior year as customers shifted purchases to lower priced items.

Expenses – Shedding the Covid 15, Part I

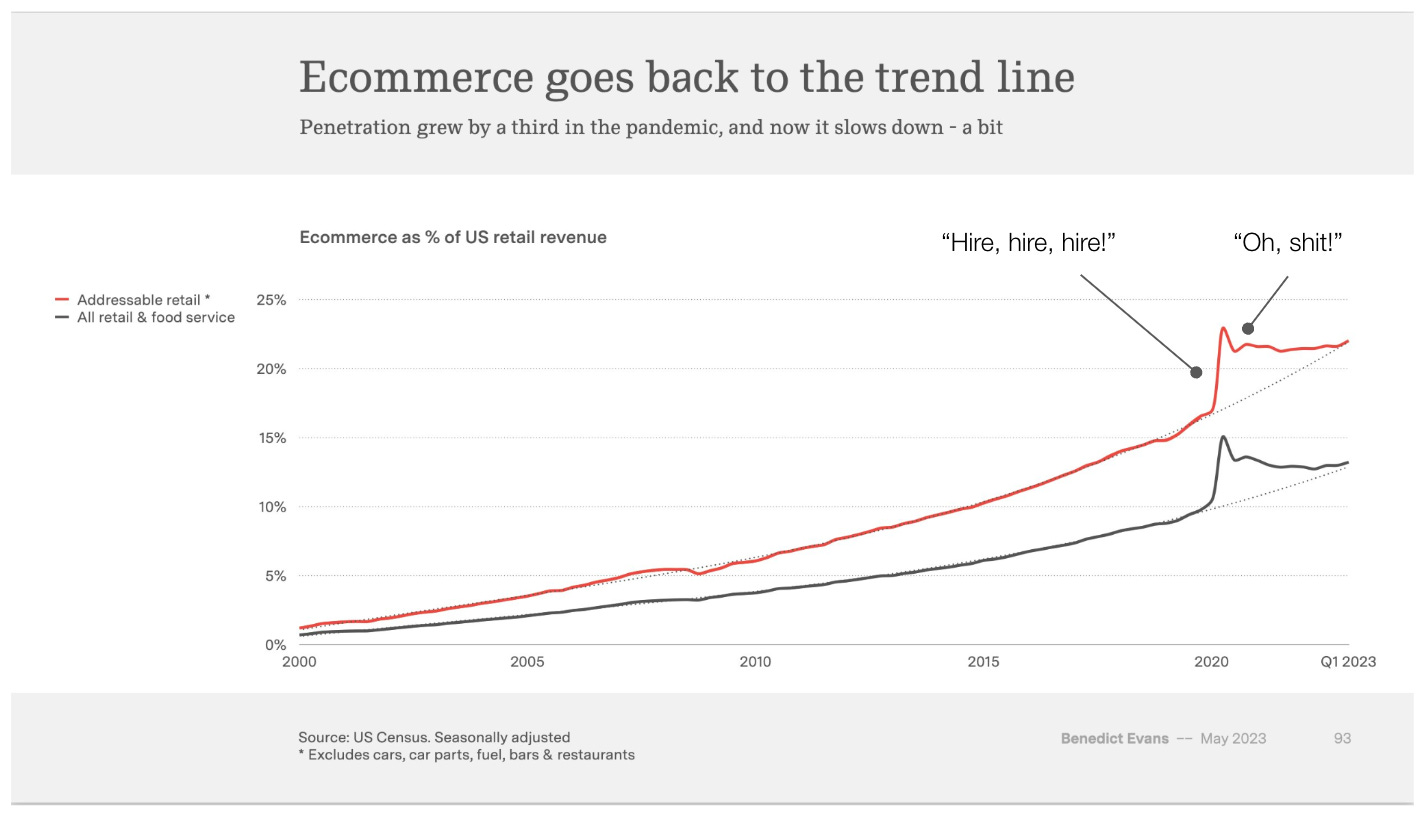

The US e-commerce penetration chart remains the best way to understand industry trends over the past few years. In 2020 and 2021, growth came easy, capital came easier (thanks, ZIRP), and tech was riding high. For operators, this intoxicating mix was hard to resist. Expectations that elevated demand was the new normal led to go-go hiring and mushrooming costs. With the luxury of hindsight, the pandemic e-commerce boom was more of a pull-forward than a structural shift. As vaccination rates increased and the world reopened, people changed out of their gym shorts and ventured back outside. Consumer spending shifted from goods to services and from online to offline. Crowded bars, flights, and restaurants translated into fewer online purchases. The result was an “oh, shit!” moment when e-commerce growth stopped.

In the first quarter of 2023, US e-commerce penetration reverted to its pre-pandemic trend line. While demand has normalized, expenses remain elevated due to the pandemic binge. As a result, the industry is on a diet. Since the second half of 2022, companies have been realigning expenses to this more sober growth profile, work that continued in the first quarter.

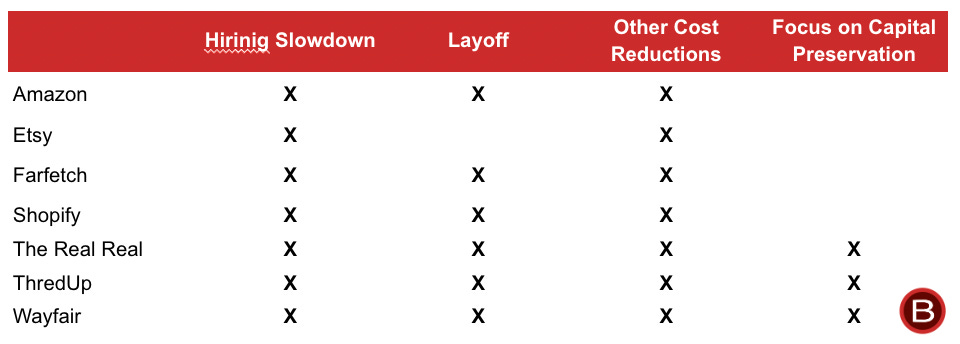

Over the past two quarters, Amazon has eliminated 27,000 positions, including 9,000 roles in March 2023 across AWS, advertising, devices, human resources, and Twitch. At the end of the first quarter, its headcount was down 10% year-over-year. (Given its prodigious turnover across its fulfillment network, simply not backfilling all attrition yields significant headcount reduction.) Managing expenses was a theme woven throughout Amazon’s earnings call, with a particular focus on improving the productivity of its fulfillment networks, which doubled its footprint during the pandemic.

While Amazon took a gradual approach, Shopify went cold turkey. In conjunction with earnings, it announced a 20% layoff as it narrowed its focus to building world-class software for merchants and aimed to move with greater speed and efficiency. Since July 2022, Shopify has reduced headcount by over 30%. Additionally, the company sold its logistics business to Flexport, unwinding a big strategic bet. Over the past few years, Shopify has invested billions of dollars building a logistics business, including the acquisitions Deliverr for $2.1 billion in May 2022 and 6 River Systems for $450 million in September 2019. Investors eyed these deals with skepticism given the questionable economics of logistics (compared to software) and the even more questionable prospect of Shopify ever beating Amazon at its own game. (You can’t out-Amazon Amazon.) The fear was that logistics was a money pit without a clear strategy. Cutting scope and increasing focus was the meta theme of Shopify’s earnings call. The fewer but better mantra underpinned the decision to sell logistics. Here’s President Harley Finkelstein7:

Partnering with Flexport will allow us to focus on the areas where we as a team have the highest impact and had the most value for our merchants, helping them on some of their most critical challenges, including running and managing the business, selling wherever consumers are, discovering new customers and thriving at any stage in any market.

As the old joke goes, the two best days in a boat owner's life are the day they buy a boat and the day they sell it. That might be the case for logistics businesses as well.

While most companies didn’t move as drastically as Shopify, directionally they’re all getting leaner. For example, Farfetch and The Real Real restructured and reduced headcount, while Wayfair worked to realize $1.4 billion in cost savings opportunities, about half of which are headcount-related. With headcount up 11% year-over-year, Etsy has an outlier. However, it showed restraint on hiring during the pandemic and has done a good job retaining its pandemic gains.

Unit Economics – Shedding the Covid 15, Part II

E-commerce is just online retail and retail is famously an industry where companies that count pennies like Costco and Walmart come out on top. To bastardize Logan Roy, e-commerce is also a knife fight in the mud. Solid unit economics are a necessary but not sufficient condition for enterprise success. Honing unit economics sharpens the knife. With growth (and capital) harder to come by, many companies are whetting their unit economics.

These projects aren’t sexy, but they’re important. They’re the bread and butter, friction removing stuff that compounds to move the needle. For example, Wayfair started reducing the visibility of suppliers with high damage rates in search results. (The best place to hide a dead body is on page two of search results.) It’s also working with those suppliers to identify weak points and improve packaging. This project resulted in fewer customer service cases, lower expenses, improved customer satisfaction, and a higher likelihood of generating a repeat order8. It’s also a good reminder that cost savings initiatives can even enhance the user experience, an example of addition by subtraction. When you’re processing tens of millions of orders a year, a fraction of a cent here or there adds up, as Wayfair CEO Niraj Shah notes9:

These are durable process-oriented savings that we expect will create improved economics and efficiency on every single order placed and which we believe will lead to higher savings when the volume growth returns.

Wayfair wasn’t alone in twisting knobs and dials to improve unit economics. The Real Real revised its commission structure to attract more high-value supply (items above $750) and discourage low-value items (items under $100), which are typically unprofitable. The company is consciously trading-off lower growth for better margins. Similarly, Thredup is experimenting to drive more desirable supply and is contemplating introducing fees for suppliers. On the demand side, both Farfetch and Shopify tightened their performance marketing spend. In an indication of how profitability has usurped growth as the primary focus for management teams, Shopify even mentioned that the company will talk more about free cash flow in the future.

Heading into second quarter earnings, the e-commerce industry looks better in a bathing suit than it did a few months ago, but it’s too soon to don the Speedo with confidence.

🛍 If you’re finding this content valuable, consider sharing it with friends or coworkers.

🛍 For more like this, consider subscribing.

More Good Reads and Listens

Jeff Jordan on “Oh, Shit!” moments when growth stops. Shopify CEO Tobi Lütke on side quests versus main quests. Below the Line quarterly e-commerce recaps: Q3 2022, Q2 2022, and Q1 2022.

Disclosure: The author owns shares in Shopify.

Thanks, Warren Buffett.

This is a little apples-to-oranges as Walmart includes omnichannel orders (order online, pick-up at the store) and online advertising in their e-commerce revenue calculations.

Wayfair, Wayfair Shares Business Update, June 7, 2023.

Amazon, Q1 2023 Earnings, April 27, 2023.

Though not germane to e-commerce, Amazon is seeing customers of all sizes pulling back on AWS as well. Here’s CFO Brian Olsavsky:

Given the ongoing economic uncertainty, customers of all sizes in all industries continue to look for cost savings across their businesses, similar to what you've seen us doing at Amazon. As expected, customers continue to evaluate ways to optimize their cloud spending in response to these tough economic conditions in the first quarter. And we are seeing these optimizations continue into the second quarter with April revenue growth rates about 500 basis points lower than what we saw in Q1.

Thredup, Q1 2023 Call, May 9, 2023.

Shopify, Q1 2023 Earnings Call, May 4, 2023.

Wayfair, Q1 2023 Earnings Call, May 16, 2023.

Wayfair, Q1 2023 Earnings Call, May 16, 2023.

Missed these posts. Congratulations on the birth of your daughter!

Congrats on the new addition to your family!!