Hi 👋 - After the pandemic’s wild swings, US e-commerce is normalizing, but financial performance remains uneven. Inflation-weary shoppers continue seeking value and prioritizing necessities, shying away from discretionary spending and big-ticket items. This shift favors companies like Amazon, which offer a wide range of everyday essentials at competitive prices, while those more reliant on discretionary purchases, like Etsy and Wayfair, lag behind. With spending consolidating at the top of the food chain, smaller companies are scrambling to keep up. As always, thanks for reading.

If you’re finding this content valuable, consider sharing it with friends or coworkers. 🛍️

For more like this, consider subscribing. 🛍️

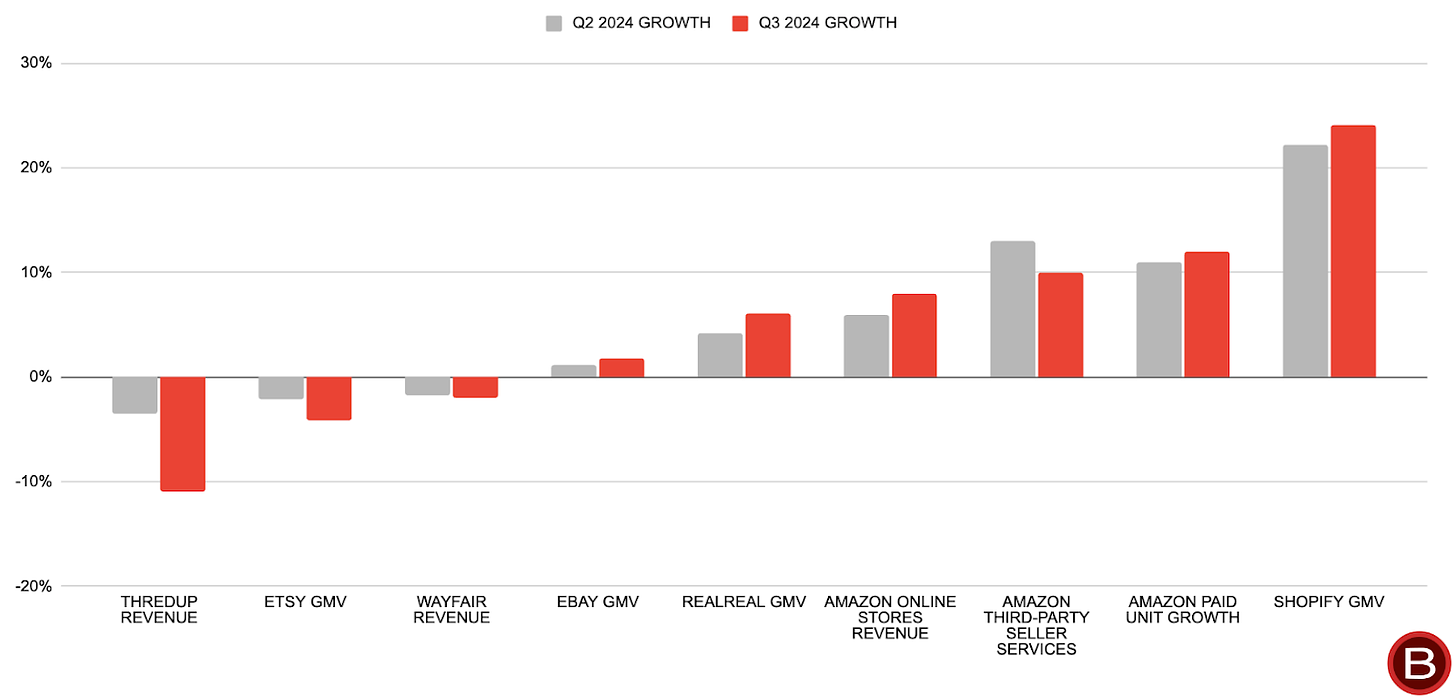

Q3 Results – Consolidation

The rich keep getting richer. E-commerce growth rates generally held steady in the third quarter but accelerated for Amazon and Shopify. Both grew double-digits, topping market growth of 7%1. With industry growth stable and market share consolidating at the top, smaller companies are being squeezed.

Share gains and category exposure are driving financial performance, similar to last quarter. Amazon is gaining share and has a strong position in everyday essentials, checking both boxes. While less exposed to essentials, Shopify’s GMV is well diversified. The company is seeing same-store-sales growth at existing merchants and strong new customer acquisition. In contrast, companies like Etsy and Wayfair with hefty exposure to discretionary spending in general, and home and living in particular, are sputtering.

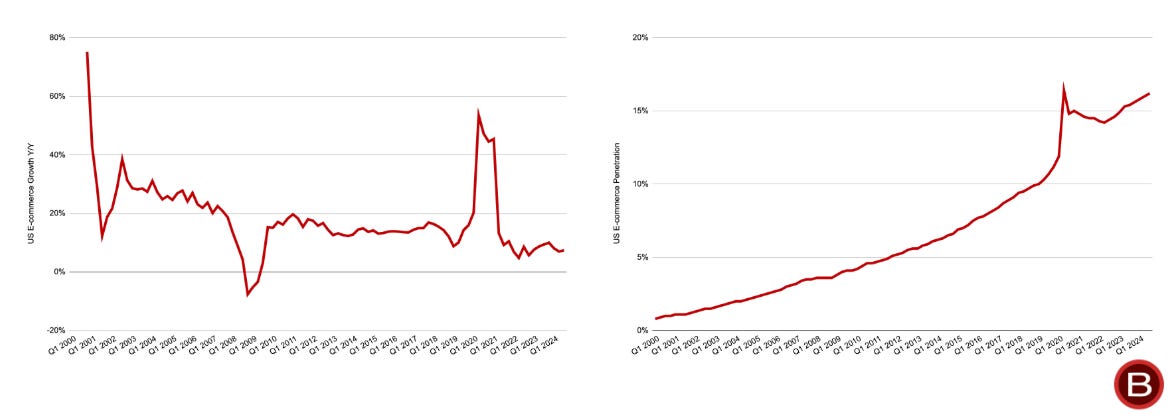

Zooming out, following the pandemic rollercoaster, e-commerce trends are normalizing. After growing 9% in 2023, the market is up 7% year-to-date. E-commerce penetration has also reverted to its pre-Covid trend: a slow but steady accent.

As e-commerce claims a larger slice of overall retail sales, growth will inevitably slow. While the structural shift online continues to provide a boost, the tide is weaker than before, magnifying the importance of market share gains looking forward.

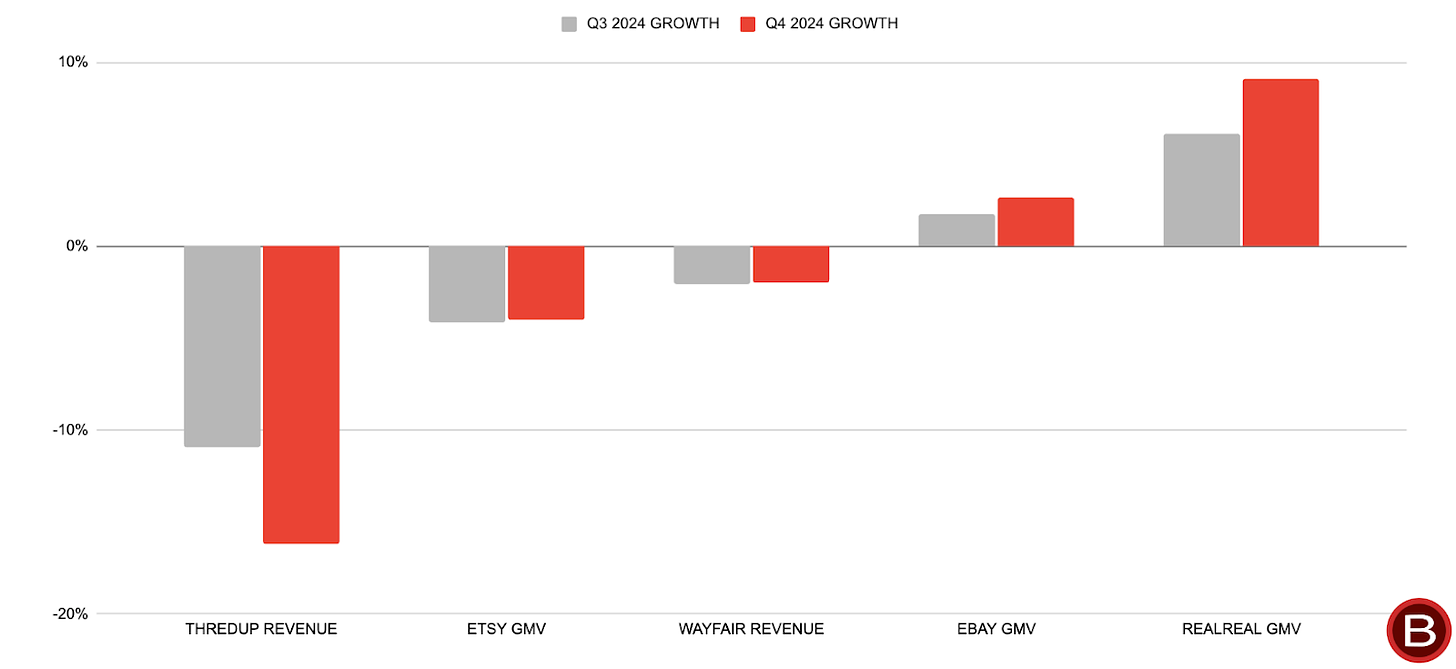

Q4 Outlook – Normalizing

Fourth quarter guidance reflects a stable-to-improving environment. Etsy and Wayfair anticipate fourth quarter growth will mirror the third quarter, while eBay and The RealReal forecast improvement. ThredUp is an outlier, expecting deterioration. This is due in part to the company’s floundering European business, which it recently divested. (This was an issue for ThredUp in the third quarter too.)

In addition to an uneven macro environment, two wild cards could impact fourth quarter results: the US presidential election (when you’re doomscrolling, you’re not shopping) and a shorter holiday shopping season due to a late Thanksgiving.

Encouragingly, eBay anticipates stabilizing trends beyond the fourth quarter. The company underscored this by providing a preliminary 2025 outlook2– its first since Covid-era uncertainty curbed annual guidance. The fact that eBay feels confident enough to provide an annual outlook now (it didn’t a year ago) suggests improving visibility.

Groundhog Day for Consumers

Consumers relived Groundhog Day in the third quarter. Inflation-weary shoppers focused on prices, prioritized value, traded down, and pulled back on discretionary purchases. They continued to favor everyday essentials while deferring big-ticket items. Here’s Amazon CFO Brian Olsavsky doing his best Bill Murray impression3:

We've seen a continuation of many of the things we've discussed over the last few quarters. Customers are looking for deals and are price conscious.

Despite this, Amazon’s macro commentary was shorter and more upbeat, a shift in tone from earlier this year. Still, the broader industry implications are unclear – this could signal market share gains rather than improving demand.

People are responding to a tough economic environment by prioritizing value and necessity, creating winners and losers. Because it sells everything, Amazon remains a winner. Once again, the company saw strength in everyday essentials – products like Advil, bars of soap, and cosmetics. Amazon’s paid units4 growth accelerated to 12% in the third quarter from 11% in the second quarter, outpacing first-party and third-party revenue growth of 8% and 10%. The company is selling more products at lower prices, as CEO Andy Jassy noted5:

At a time when consumers are being careful about how much they spend, we're continuing to lower prices and ship even more quickly, and we can see this resonating with customers as our unit growth continues to be strong and outpace our revenue growth.

Similarly, Shopify saw “notable growth” in health and beauty, food and beverage, and apparel and accessories which skew lower ASP. Second-hand goods are also gaining traction with price sensitive shoppers. eBay benefited as value-seeking increased demand for refurbished goods. Additionally, The RealReal accelerated GMV growth in part by highlighting the value of second-hand luxury in its marketing. (Strong supply growth also helped.)

In contrast, with spending on home out of favor, Wayfair saw a shift toward lower-priced, lower-consideration purchases, moving away from its core big-ticket items. It also noted heightened price sensitivity and leaned more into promotions. (Etsy and ThredUp called out high promotional intensity too.) Here’s Wayfair CEO Niraj Shah digging deep into the dictionary6:

Consumers remain trepidatious7 in their spending patterns and are demonstrating more price elasticity than we saw in the early months of the year.

Etsy struggled too, flagging a challenging environment for consumer discretionary spending and noting that value and promotions are what’s winning right now (as opposed to Etsy’s focus on special and unique items). Here’s Etsy CFO Rachel Glaser8:

We also know there is a lot of pressure on the consumer in our core markets, and they appear to be prioritizing deep discounts and value within tight budgets.

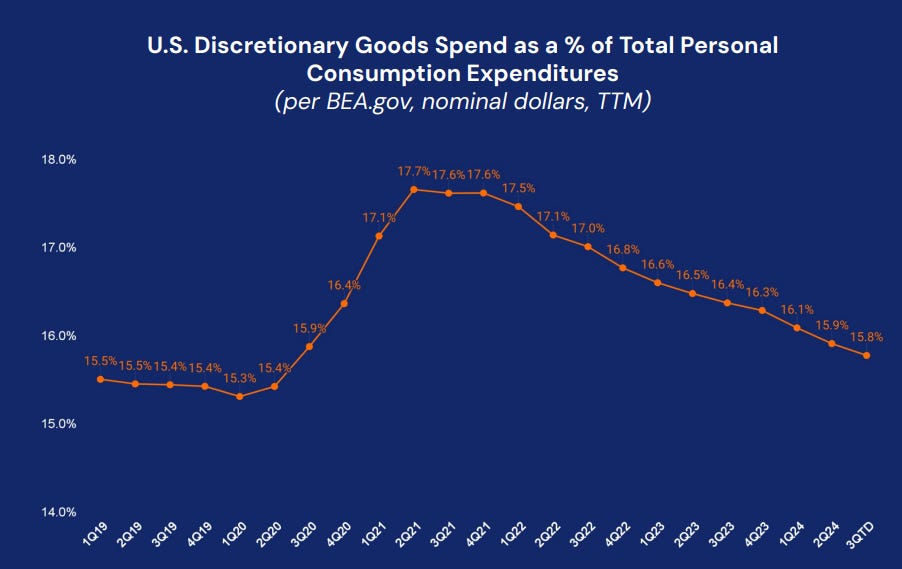

One common denominator between the losers is a high reliance on home and living, which is sagging alongside a slumping housing market. Home and living accounts for approximately one-third of Etsy’s GMV and the bulk of Wayfair’s revenue. This is a cyclical issue. Another is high exposure to discretionary spending, which peaked in the first quarter of 2021 and has been reverting to its pre-pandemic baseline since. As the chart below shows, this is still playing out.

Keeping The Main Thing The Main Thing

E-commerce firms responded to slowing growth in 2022 and 2023 by cutting costs, honing unit economics, and doubling down on their core businesses. These moves are now yielding results.

Amazon scored a hat-trick. Investments made over the past few years in regionalizing fulfillment, reducing cost to serve, and increasing shipping speeds have improved unit economics and heighted its value proposition. This is driving deeper engagement and more value customer relationships, as Amazon CFO Brian Olsavsky explained9:

Though all these items often have a lower average selling price, the strength in everyday essential's revenue is a positive indicator that customers are turning to us for more of their daily needs. We see that when customers purchase these types of items from us, they build bigger baskets, shop more frequently and spend more on Amazon. We remain focused on keeping prices sharp and offering broad selection that gives customers options when making purchase decisions.

The company’s double flywheel is spinning faster. What’s more, Amazon is pressing its advantage by investing more in increasing shipping speeds and lowering the cost to serve. Its maniacal focus on speed, selection, and cost is a clear example of keeping the main thing the main thing.

Amazon’s not the only one making hay. eBay’s multi-year investments in focus categories like car parts, collectables, and luxury goods and market-specific investments in the UK and Germany have helped GMV turn the corner. In the third quarter, eBay’s focus categories grew five percentage points faster than the rest of the marketplace. Similarly, Wayfair’s focus on availability, speed, and price paired with cost reductions has improved margins and healed its creaky balance sheet. Lastly, The RealReal underwent business model surgery in 2022 by changing commission structures, trading off lower growth for higher margins, cutting costs, and deemphasizing its first-party (owned inventory) business. As a result, GMV is growing and margins are improving.

Etsy and ThredUp are laggards, but both are playing catch-up. Culling ThredUp’s European operation and shifting the US business to a consignment model should result in a smaller business, but one with juicier margins and better growth prospects.

The solution for Etsy is more of an enigma, but the company deserves kudos for shaking up the status quo. In 2024, it shifted its product development philosophy from grinding out incremental gains to larger investments in foundational areas like app, gifting, and search quality. On the third quarter call, management acknowledged that growth would have been higher this year if it maintained the grind-it-out mentality, but that the focus on larger projects sets up the company best long-term. Here’s Etsy CEO Josh Silverman10:

While the rest of the world is obsessed with discounts and promotions, we're obsessed with making our customer experience even better with making Etsy even more Etsy. In doing so, we make good on our promise to keep commerce human. While the tide is out right now for discretionary products, we're hard at work ensuring our boat is large and strong, ready to sail even further and faster as the tide comes in.

In addition to revamping its product roadmap, Etsy also overhauled its management team.

As growth stabilizes and visibility improves, companies are starting to ramp up investments in growth initiatives11. However, in contrast to the ZIRP era, these are being made selectively with a heightened focus on ROI. Thankfully, the “year of efficiency” mentality is sticking. Better late than never.

If you’re finding this content valuable, consider sharing it with friends or coworkers. 🛍️

For more like this, consider subscribing. 🛍️

More Good Reads and Listens

Past quarterly e-commerce reviews from Below the Line: 2024 Q2 - A Knife Fight In Mud, 2024 Q1 – Keep It Simple, 2023 Q3 – Back to Basics, 2023 Q2 – Harvest Season, 2023 Q1 – Nature is Healing, 2022 Q3 – Naughty or Nice? (Part 1), 2022 Q3 – Naughty or Nice? (Part 2), 2022 Q2 – Slimming Down (Part 1), 2022 Q2 – Slimming Down (Part 2), 2022 Q1 – An E-commerce Recession (Part 1), 2022 Q1 – An E-commerce Recession (Part 2).

Disclosure: The author owns shares of Shopify.

Unless otherwise noted, all growth rates referenced in this note are year-over-year.

Here’s eBay’s preliminary 2025 outlook: “We plan to balance the need to reinvest for long-term growth against the near-term top and bottom line performance. Assuming an unchanged macro environment, we are planning our business to run positive FX-neutral GMV and revenue growth. Non-GAAP operating income dollar growth modestly ahead of GMV and high single-digit growth in non-GAAP earnings per share year-over-year.“

Amazon, Q3 2024 Earnings Call, October 31, 2024.

Amazon defines this as physical and digital units sold (net of returns and cancellations) by us and sellers in our stores as well as Amazon-owned items sold in other stores.

Amazon, Q3 2024 Earnings Call, October 31, 2024.

Wayfair, Q3 2024 Earnings Call, November 1, 2024.

I had to look this up. Trepidatious is an adjective meaning apprehensive or nervous; filled with trepidation.

Etsy, Q3 2024 Earnings Call, October 30, 2024.

Amazon, Q3 2024 Earnings Call, October 31, 2024.

Etsy, Q3 2024 Earnings Call, October 30, 2024.

You can see this more broadly in AWS, which saw revenue accelerate as companies are shifting from cost cutting to investments in moving from on-premises to the cloud and experimenting with AI.