Hi 👋 - The pandemic saw a rising-tide-lifts-all-boats environment for e-commerce. As lockdowns eased, this turned into an industry-wide hangover as people shifted spending from couches and sourdough starter kits to flights and meals out. Today, there’s increasing differentiation between winners and losers. Below, key themes and trends from first quarter e-commerce earnings sprinkled with a few Amazon puns. As always, thanks for reading.

If you’re finding this content valuable, consider sharing it with friends or coworkers.❤️

For more like this, consider subscribing.❤️

Simple But Not Easy

Take a simple idea and take it seriously. Charlie Munger’s aphorism frames quarter e-commerce earnings well. Businesses honing core attributes like saving people time and money gained market share and improved profitability. Meanwhile, businesses with less clear value propositions muddled along.

Amazon is a prime1 example. It continues winning market share2 by focusing on price, selection, and convenience. During the first quarter, it emphasized value by launching new sales, grew selection, and increased delivery speeds. For example, 60% of orders are now delivered same-day or next-day across its top 60 US markets. Consumers – especially Prime members – responded by increasing purchase frequency, a core driver of lifetime value. Amazon’s relentless focus on improving the consumer experience has been a hallmark since day one and continues to serve it well.

Furniture seller Wayfair fits this mold too. While sales dipped 2% year-on-year, they significantly outperformed double-digit declines in the broader online furniture market. Like Amazon, Wayfair is doubling down on its winning recipe of availability, speed, and price. Indeed, “nailing the basics” has become a rallying cry on quarterly calls. After several rounds of cost cutting, Wayfair is leaner, focused, and moving faster.

Similarly, luxury fashion marketplace The RealReal deserves credit for taking a simple idea seriously3. Since defenestrating its founder in mid-2022, the new management team has focused on growing its core consignment business and improving operational efficiency. This includes consciously trading off lower growth for better unit economics and higher margins. The strategy is delivering results, with the first quarter seeing a return to GMV growth and record gross margins.

But simple isn’t easy. How often do you eat broccoli?

After going on a tear during the pandemic, Etsy now finds itself in the doghouse. Growth slowed versus the fourth quarter and management’s 2024 outlook deteriorated. Some investors question if the company is becoming eBay 2.04. Others fear market share losses to Temu. Etsy’s management team is more sanguine, believing that a challenging environment for discretionary goods – the heart of Etsy’s marketplace – is temporarily depressing secular growth. Many online and offline retailers flagged discretionary softness over the past year, so this explanation holds water. Still, it feels like something’s amiss in Dumbo. While Amazon and Wayfair get tighter on price, selection, and convenience, Etsy is running super bowl ads about cheese boards.

To revitalize growth the company has been leaning hard into gifting. This feels like a return to Etsy’s pre-2017 playbook, which focused on taking big swings like reimaging manufacturing or building a separate market for craft supplies. Under CEO Josh Silverman, prioritization shifted from big projects to incremental wins and A/B tests focused on areas like search and discovery and performance marketing optimization. (In other words, taking simple ideas seriously.) I experienced this transition firsthand as a member of the strategic finance team in 2016 and 2017. It’s unclear if the foray into gifting signals that the low hanging fruit of the incremental approach has been exhausted. The Below the Line house view is that the funk is temporary. Etsy has the team and the resources to rebound. But on Wall Street where narrative follows performance and management has its work cut out for it.

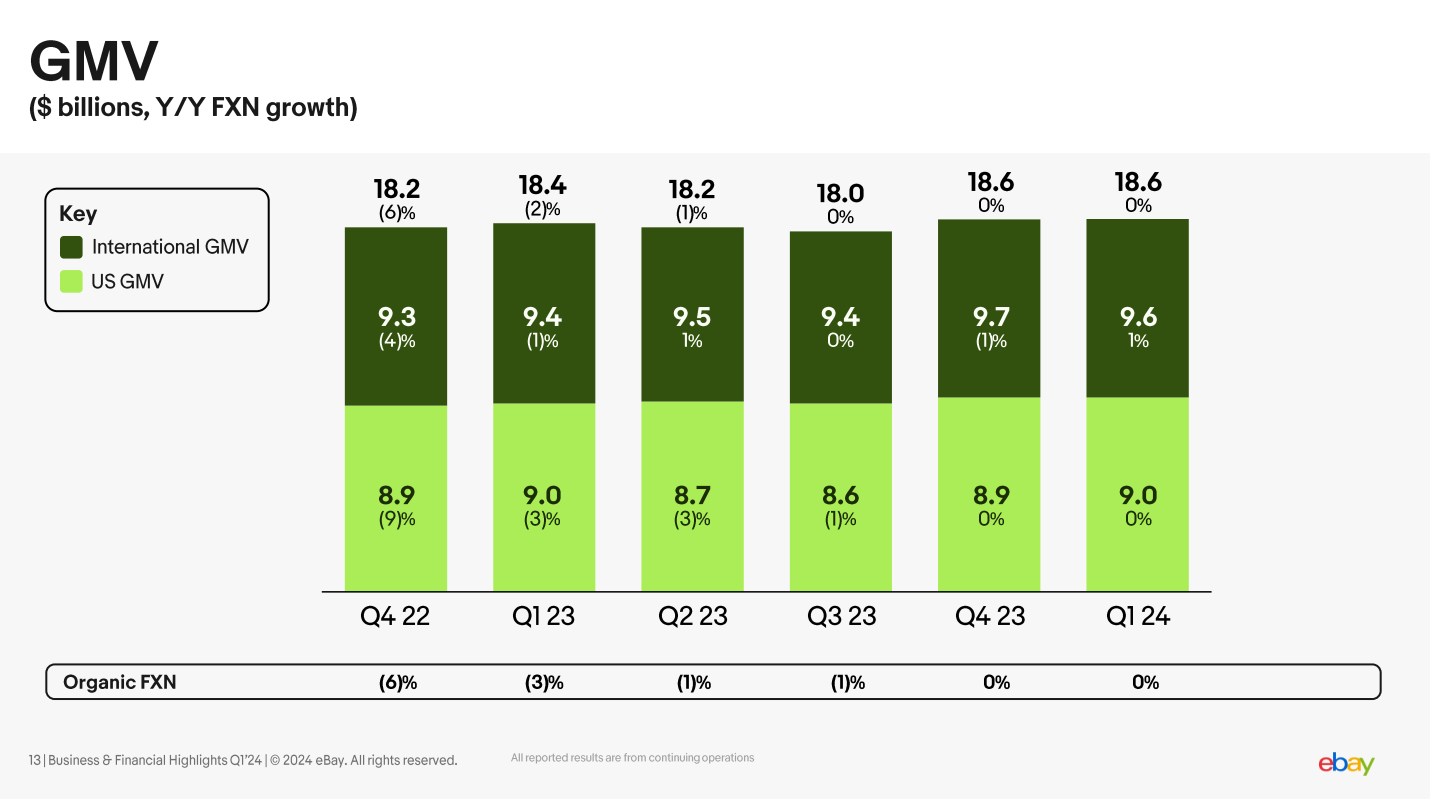

eBay 1.0 is also struggling to grow too. Focus categories like motor parts and accessories, trading cards, and luxury goods are growing, but the overall business is treading water, with GMV flat to down for the past six quarters.

Q2 Outlook – More Of The Same

Munger’s simple and serious framework also holds for second quarter guidance. While Amazon and Shopify don’t guide for e-commerce revenue or GMV respectively, Wayfair and The RealReal foresee continued growth. In contrast, Etsy and eBay expect piddling results. However, both predict growth will improve in the second half 2024. Lastly, ThredUp is transitioning its European business from owned inventory to consignment, so their revenue drop is largely being driven by accounting policy changes. (Yawn.)

Consumer Behavior – Staying Frugal

Consumer behavior mirrored the second half of 2023. Frugal shoppers are demanding value and deferring discretionary purchases. Big ticket items are out of favor. Everyday essentials are in. Pressure is most acute on low income households.

Amazon saw shoppers focus on value. People are still shopping, but they’re being cautious, trading down on price when they can, and are seeking deals. Everyday essentials once again stood out as a growth category, helped by Amazon’s value bent and faster shipping.

In contrast, Etsy called out a difficult environment for discretionary spending, similar to the fourth quarter. Here’s CEO Josh Silverman assessing the consumer landscape5:

While U.S. unemployment is low and inflation data is mixed, consumer sentiment remains depressed, which some speculate can be attributed to the very high cost of money. Consumer wallets remain squeezed so there's often a little left after paying for food, gas, rent and child care. And there's significant data indicating that the largest e-commerce platforms have primarily been able to grow by selling everyday essentials at very low prices.

Given its predominantly discretionary mix, Etsy is more exposed than Amazon to a slowdown in elective purchases. (eBay too.) Silverman elaborated on this point during Q&A, when asked about competitive pressures from Chinese competitors like Temu6:

I think what we're observing again and again, both at Etsy and what we read in the commentary from so many others in our space, is that consumers feel really pressured in spite of what we're seeing about a generally healthy economy. Consumers feel really pressured and so they are seeking value in deep discounts and deep promotions. And so yes, the Chinese competitors are offering that, but Amazon and Walmart are, too. And it looks like the people that are driving most of the growth in e-commerce are people that are able to offer everyday essentials at very low prices.

This softness was concentrated on lower household incomes, with GMV from high income households growing. This trend was evident elsewhere. For example, luxury secondhand fashion site The RealReal is seeing a healthy buyer, jiving with Etsy’s commentary. In contrast, online thrift store ThredUp flagged a difficult backdrop for discretionary apparel and that budget shoppers remain on the sideline. (However, the company is seeing some benefit from higher income consumers trading down.) Lastly, eBay noted positive trends in pre-owned and refurbished sales which are value orientated.

Geographic Trends – US > Europe

European softness was another emerging theme. Amazon, eBay, and Etsy all called out weaker consumer spending in Europe relative to the US. Germany and the UK were signaled out in particular. Shopify bucked the trend, with GMV in Europe growing 38% year-on-year, 15 percentage points faster than overall growth, though it anticipates this to soften in the second quarter.

P&L Trends – Cosmetic Surgery

After two years of heavy cost cutting, the e-commerce industry is settling into an optimize and harvest mode. The sledgehammer of 2022 and 2023 has been replaced by a scalpel. This transition appears to be broader than e-commerce, with Amazon noting that in AWS companies have largely completed their cost optimization work (a recurring theme of 2023 calls). They are now focused on modernizing their technology and experimenting with Gen AI.

While Amazon reported record operating income helped by cost controls and a lower cost structure, it continues to hunt for new efficiencies. For example, it sees headroom to improve inbound logistics at its distribution centers and consolidate the number of items per box. Good things happen when you worry about pennies.

Shopify has kept headcount flat for three consecutive quarters, but is leaning into performance marketing due to strong paybacks. Here’s Shopify’s President Harley Finkelstein7:

Because of the structure and the automation we have worked to put in place, we think we can continue to operate against very limited headcount growth while achieving a continued combination of consistent top line growth and profitability.

This is emblematic of the broader industry. With expenses reset in 2022 and 2023, most companies are aiming to keep a tight lid on expenses and invest opportunistically where there’s compelling ROI.

Alphabet Soup du Jour

As much as I’d like to just ignore it, AI was a major theme of first quarter calls. Amazon CEO Andy Jassey sets the mood8:

Yes, I think there are really unbelievable growth opportunities in front of us. And I think what people sometimes forget on the AWS side, it's a $100 billion revenue run rate business, that we're still 85-plus percent of the global IT spend is on premises. And if you believe that equation is going to flip, which we do, it means we have a lot of growth in front of us, and that's before the generative AI opportunity, which I don't know if any of us have seen a possibility like this in technology in a really long time, for sure, since the cloud, perhaps since the Internet.

While the comment is about AWS and not Amazon’s e-commerce business, it's indicative of the zeitgeist. Each quarter there are more AI features and more AI data points. For example:

Amazon has had over 100,000 sellers use a Gen AI tool.

At Shopify, 50% of merchant support interactions were supported by AI. Additionally, AI enabled Shopify to provide 24/7 merchant support in eight additional language.

AI tools are helping eBay reduce the time required for code migration by as much as 20%.

To date, AI features typically center on improving CS or developer productivity and reducing seller friction (making it easier to post a listing, for intstance). In terms of impact, they seem more like platitudes than drivers of meaningful P&L change. That AI tools reduced the time required for code migration by as much as 20% is a stat that’s as vague as it is meaningless. (Reading Below The Line will make you up to 20% smarter!) A counter argument here is Klarna’s blog post about AI doing the work of 700 CS reps. However, since their financials aren’t public, it's hard to validate the impact.

One area worth monitoring is Google’s efforts to embed more AI results in the SERP. E-commerce businesses ride or die on their CAC to LTV ratios and changes at Google could upset the apple cart of organic traffic.

Perhaps the true function of AI commentary is throwing investors some red meat. To paraphrase former Citigroup CEO Chuck Prince, as long as the music is playing, you've got to get up and dance.

If you’re finding this content valuable, consider sharing it with friends or coworkers. ❤️

For more like this, consider subscribing. ❤️

More Good Reads and Listens

Past quarterly e-commerce reviews from Below the Line: 2023 Q3 – Back to Basics, 2023 Q2 – Harvest Season, 2023 Q1 – Nature is Healing, 2022 Q3 – Naughty or Nice? (Part 1), 2022 Q3 – Naughty or Nice? (Part 2), 2022 Q2 – Slimming Down (Part 1), 2022 Q2 – Slimming Down (Part 2), 2022 Q1 – An E-commerce Recession (Part 1), 2022 Q1 – An E-commerce Recession (Part 2).

Disclosure: The author owns shares in Alphabet and Shopify.

See what I did there?

This trend has been prevalent for the past year plus. In the US, top players like Amazon, Shopify, and Walmart continue to grow well above market. The rich are getting richer.

Nothing sharpens the focus like a creaky balance sheet.

That is, massively profitable and generating boat loads of free cash flow, but unable to grow.

Etsy, 2024 Q1 Earnings Call, May 1, 2024.

Etsy, 2024 Q1 Earnings Call, May 1, 2024.

Shopify, 2024 Q1 Earnings, May 8, 2024.

Amazon, 2024 Q1 Earnings Call, April 30, 2024.