#110 - Jokr

Surely You’re Jorking, Mr. Wenzel

Hi👋 - Over the past year, ultrafast grocery delivery startups like Getir, GoPuff, and Jokr have raised billions of dollars. Mini-fulfillment centers have mushroomed across cities in Europe, Latin America, and the US. Today, a look at Jokr and the challenges of ultrafast delivery business models. Thanks for reading.

🛒 If you’re finding this content valuable, consider sharing it with friends or coworkers.

🛒 For more like this once a week, consider subscribing.

7-Eleven Meets Toyota Production System

Have you ever wanted a pint of ice cream, but not wanted to put on pants? No need to worry, Jokr has your back. Jokr is an instant delivery startup based in New York and operating throughout the Americas. Launched in March 2021 by Ralf Wenzel, a serial entrepreneur who founded and ran FoodPanda and later served as Chief Strategy Officer of Delivery Hero, Jokr aims to replace supermarkets by offering speedy delivery of groceries and convenience items. That’s a tall order.

Jokr's fundraising has been as fast as its delivery. The company raised a $170 million Series A in July 2021 in a deal led by Balderton, GGV Capital, and Tiger Global. Lightning struck again in December 2021, with a $260 million Series B valuing Jokr at a $1.2 billion1. Between a crowded and well-funded competitive set and an unprofitable and unproven business model, Jokr will need the war chest. In New York City alone, Buyk, Fridge No More, Getir, GoPuff, Gorillas, and Jokr all compete in 15 minute delivery. Since 2020, they’ve raised a combined $5.5 billion2.

This isn’t SaaS. Instant delivery is capital intensive and reliant on scale. For it to have a snowball's chance in hell of working, supply needs to be close to demand. Similar to other instant delivery models, micro-fulfillment centers (MFCs) are the core of Jokr's business, acting as nodes in their delivery network. Jokr peppers cities with MFCs, each serving a roughly one-mile delivery radius. MFCs are usually located in dense, urban neighborhoods. They don’t need to have curb appeal or be in areas with high footfall, saving on leases, but they do need to accommodate lots of e-bikes. The Getir MFC in my neighborhood is housed in a former car garage and looks like a place you’d find a body on Law & Order. Jokr's MFCs are 3,000-4,000 square feet and house 2,000-3,000 SKUs (a supermarket has 20,000-30,000). Small footprints bring supply close to demand, but the tradeoff is selection. In December 2021, the company operated 200 MFCs in 15 cities3 and was adding 10 per week4. Most cities have a large distribution center for stocking the MFCs.

Supply chain capabilities and catalog management are also prerequisites for cracking quick delivery. Jokr executives talk about lean inventory levels and leveraging data science for dynamic inventory selection and refreshing MFCs from distribution centers several times per day5. For example, stocking bagels in the morning and beer at night. The goal is procuring what is needed, when it’s needed6. It’s 7-Eleven meets the Toyota Production System. Yet strip away the buzzwords and data science and another way of saying this is that “merchandising matters for retailers,” hardly an insight.

Jokr is vertically integrated. The company’s strategy is to cut out the middleman through direct procurement whenever possible. For example, when it noticed an uptick in searches for challah bread in New York City, it signed a partnership with Breads Bakery7. Through vertical integration, it aims to open up a larger profit pool versus third-party delivery marketplaces like DoorDash and Uber8. In January 2022, its direct procurement mix was 40%9. Increasing this should improve gross margins.

Direct procurement, MFCs, and vertical integration are standard practice for ultrafast delivery, but Jokr differentiates in a few ways. One is its emphasis on local products and local sourcing. Listen to an executive talk, and you’ll hear “local” a lot. Local merchandising. Local preferences. Local suppliers. Assortment at the Williamsburg MFC is different from the Union Square MFC10. Another is Jokr's large presence in Latin America. Additionally, the company’s delivery and fulfillment workers are full time employees, something it deserves kudos for. Lastly, Jokr trumpets hyper-personalization as its key differentiator. Management talks about understanding what customers want, when they want it, and delivering the right product at the right time. From the cheap seats, there’s a contradiction between a limited SKU count and the ability to personalize. Broader selection enabled better personalization. Where’s my organic turmeric root?

Snowball Meets Hell

While Jokr’s aspirations are clear, its path forward is murky. Like many young startups, it’s banking on scale driving healthy long-term results. However, the unit economics of ultrafast delivery are challenging and competition is intense. Evidence is mounting that industry economics are under stress.

Jokr doesn’t charge a delivery fee and has no minimum order size. That’s a generous consumer value proposition, but a shaky economic foundation. For Jokr to succeed, it needs to efficiently acquire customers that order frequently (at least once per week) and stick around for a long time. And it’s going to need a lot of them.

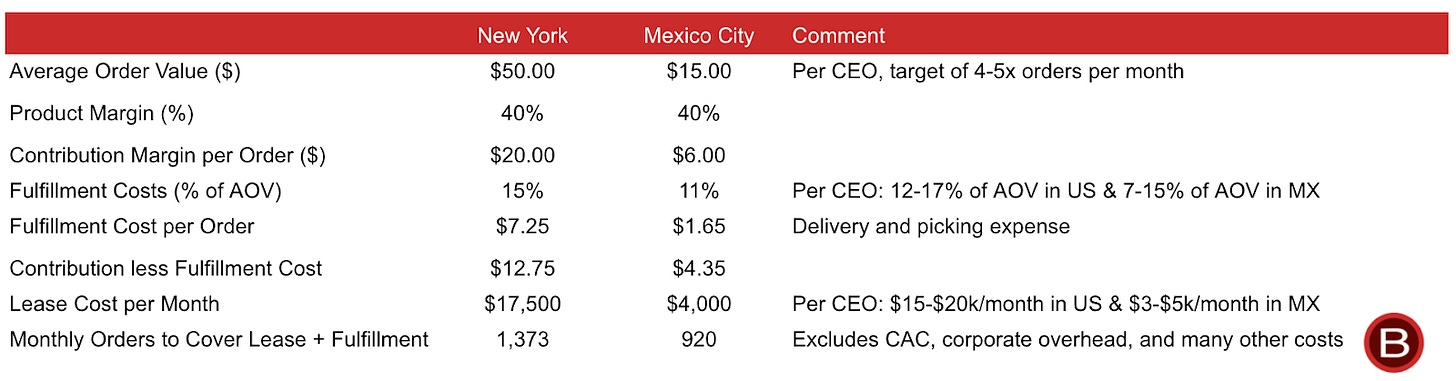

If all goes to plan, the typical customer in the US will order weekly, with an average order value of $50, at a 40% gross margin. Here’s what Jokr's long-term unit economics could look like in New York City, a proxy for developed markets, and Mexico City, a proxy for developing markets11:

Crucially, this analysis excludes customer acquisition cost (CAC), which can make or break a business. Jokr’s new markets start with significant marketing spend for activation and acquisition. This tapers off after three to six months at which point about half of new customers are organic12. However, half of customers are still paid, a fairly high dependence. When factoring in the cost of advertising, some ultrafast delivery companies are losing $20 per order, according to The Wall Street Journal13.

Jokr hasn’t disclosed its CAC, but the Journal uncovered that New York competitor Fridge No More spends $70 to acquire a customer14. If CAC were similar for Jokr, it would take 5.5 orders to recoup CAC at its long-term target margins. Because Jokr is operating below this level today, order frequency needs to be much higher to cover acquisition costs. If Jokr is performing at Fridge No More’s AOV, product margin, and CAC, over 11 orders are needed. That’s no walk in the park. Additionally, this doesn’t factor in any technology and development investment (apps and cloud services aren’t free), G&A, or other corporate overhead. High customer retention and repeat rates are required for the business to have a shot. If customers don’t use the service habitually, it’s hard to see a viable model.

In addition to cost effective CAC, strong retention, and high purchase frequency, here are the levers in Jokr’s business model:

Fulfillment Network Utilization Rate. Jokr needs to maximize the amount of time that delivery drivers are fulfilling orders and minimize idle time. This is a function of demand generation, CAC, retention, and operational efficiency. Based on a limited delivery radius, demand needs to be built neighborhood by neighborhood, an additional constraint. In mature cities, riders are making 3.5-3.7x drops per hour15.

Direct Procurement Mix: Cutting out the middleman and working with local suppliers improves product margins. If successful, long-term gross margins could be 50%16. While local procurement is billed as improving sustainability, Jokr has more negotiating leverage against a small, local supplier like Breads Bakery than a global CPG like Procter & Gamble.

Private Label: Retail 101. Private label brands have better economics and provide unique supply.

Ads: On a long enough timeline, everyone sells ads. If Jokr aggregates enough demand, advertising could become a high-margin secondary revenue stream. GoPuff, Instacart, and Uber have all gone down this path. Jokr’s local procurement strategy may make this more difficult (Procter & Gamble has more marketing budget and wherewithal than Breads Bakery).

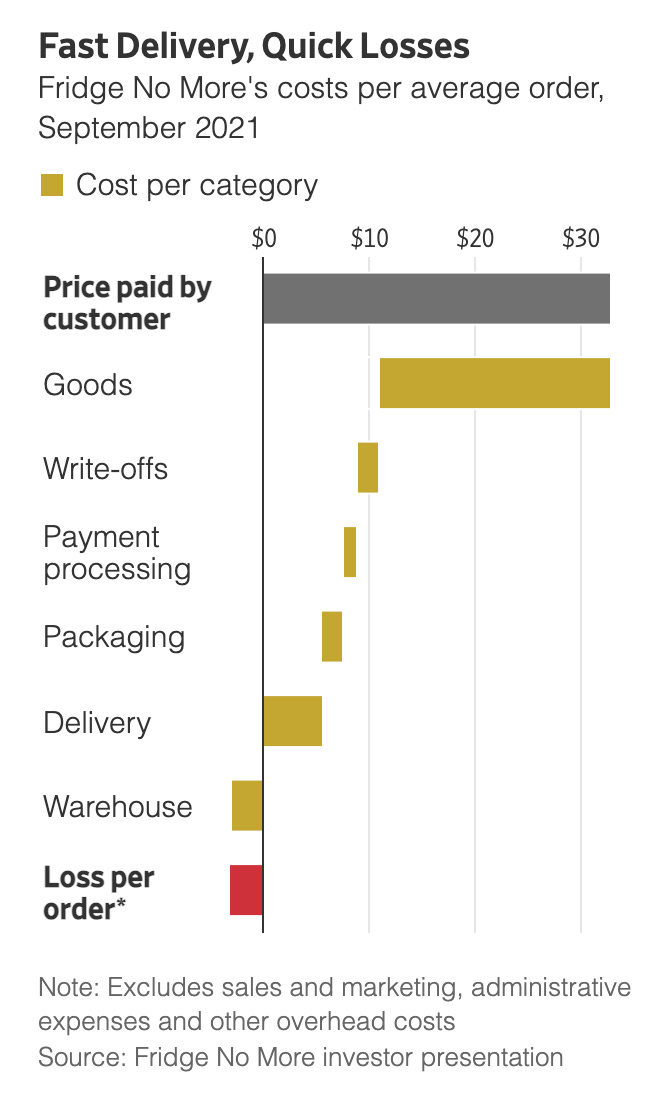

Pulling these levers takes time and the clock is ticking. The Wall Street Journal reports that Fridge No More is losing money on every order in New York City:

Jokr isn’t Fridge No More, but the comparison seems directionally accurate. In late January 2022, The Information scooped that Jokr was looking to sell its New York operations amid heavy losses:

Value Creation vs. Value Capture

Food is a high purchase frequency category. Everyone has to eat. Additionally, Wenzel believes Jokr benefits from five secular trends: the shift from offline to online, personalization, the desire for speed, consumer interest in local brands and local products, and sustainability. However, large TAMs and secular trends don't guarantee good business or investment outcomes. Big markets attract heaps of competition. In New York City, six venture backed startups are competing in ultrafast delivery, making customer acquisition competitive. The only ads I see in my Twitter feed these days are for sports gambling and instant grocery delivery apps. There’s also a race to lease MFCs, according to Gino Coradini, Retail Managing Director at commercial real estate services company JLL17.

To be successful, a business needs to both create and capture value. Jokr has done the first, but not the second. The biggest beneficiaries of ultrafast delivery are likely Google, Facebook, Twitter and savvy consumers like Hayoung Park who hasn’t paid for toilet paper or dish soap in over a year18, thanks to the benevolence of companies like Jokr and their investors.

🛒 If you’re finding this content valuable, consider sharing it with friends or coworkers.

🛒 For more like this once a week, consider subscribing.

More Good Reads

Jokr CEO Ralf Wenzel on the company's unit economics. The Wall Street Journal on mounting losses at instant delivery startups. Morning Brew visits a Jokr MFC. Below the Line on GoPuff.

The author owns shares of Facebook.

TechCrunch, Instant grocery delivery startup JOKR bags another huge round to enter unicorn status, December 2, 2021.

The Wall Street Journal, Losses Mount for Startups Racing to Deliver Groceries Fast and Cheap, January 30, 2022.

TechCrunch, Instant grocery delivery startup JOKR bags another huge round to enter unicorn status, December 2, 2021.

Evolving for the Next Billion by GGV Capital, Ralf Wenzel of JOKR: Return of Lifetime is much more important than Return of Investment, November 2021.

Evolving for the Next Billion by GGV Capital, Ralf Wenzel of JOKR: Return of Lifetime is much more important than Return of Investment, November 2021.

Retail Brew, A look inside JOKR, the rapid grocery delivery company, September 3, 2021.

Evolving for the Next Billion by GGV Capital, Ralf Wenzel of JOKR: Return of Lifetime is much more important than Return of Investment, November 2021.

Retail Brew, A look inside JOKR, the rapid grocery delivery company, September 3, 2021.

The Wall Street Journal, Losses Mount for Startups Racing to Deliver Groceries Fast and Cheap, January 30, 2022.

The Wall Street Journal, Losses Mount for Startups Racing to Deliver Groceries Fast and Cheap, January 30, 2022.

Where We Buy, How JOKR Delivers Groceries Instantly, December 2021.

The Wall Street Journal, Losses Mount for Startups Racing to Deliver Groceries Fast and Cheap, January 30, 2022.

Just recently discovered this newsletter and read through several older posts. Really appreciate the direct and concise analyses with your focus on providing supporting data.