Hi 👋 - After a year in the wilderness, things are looking up in e-commerce. Below, key themes and trends from second quarter e-commerce earnings. As always, thanks for reading.

🛍 If you’re finding this content valuable, consider sharing it with friends or coworkers.

🛍 For more like this, consider subscribing.

Q2 Results – Feeling Better

The Covid hangover is finally over. After over a year in the doldrums, the e-commerce industry exited the second quarter on sounder footing and with a brighter outlook.

Quarterly results benefitted from leaner cost structures, improving demand, and dissipating macro headwinds. After working hard to realign cost structures, firms are harvesting gains.

Relative to the first quarter, growth rates accelerated broadly. The lone exception was The Real Real which is intentionally trading-off lower growth for higher margins as it hones its unit economics and contemplates its debt-laden balance sheet and heady cash burn. Although companies including eBay, Etsy, and Wayfair are still seeing revenue shrink year on year, declines are moderating.

While growth trends are generally upward, there’s significant variation between categories. For example, Etsy continues seeing softness in furniture and home-related categories, while gifting categories and listings for occasions like birthdays, bridal showers, and weddings are growing nicely. Similarly, eBay is seeing pockets of strength like motors, parts, and accessories and refurbished goods, while other areas remain soft.

Consistent with the first quarter, the rich keep getting richer. Amazon, Shopify, and Walmart – three of the largest e-commerce players in the US – grew faster than industry average, suggesting they’re gobbling up market share. Wayfair CEO Niraj Shah sees scale as a winning trait1:

We're excited that we're taking share and we're taking share very broadly…But I think the big thing in the landscape of what you see in e-commerce is that – it's primarily the larger platforms are the ones that are able to really compete…because those folks have a scale to participate in offering advanced logistics, they have the scale to reach the customers. And these are things that, if you're much smaller as we've talked about having around about 3,000 engineers, product managers, data scientists or you talking about the 25-ish million square feet of logistics space we have and all the different types of specialized operations we run, including our own proprietary large parcel delivery. These are things that you just can't do without scale. And I think these are things that offer the customer experience that they are increasingly getting accustomed to and require or desire in order to buy from.

Another consideration is that amid a frosty venture funding environment unprofitable e-commerce startups – which is to say most of them – are likely cutting back more aggressively than their public peers. If you have a weak balance sheet and lack access to capital, it’s a very uncomfortable time to be burning cash.

Q3 Outlook – Looking Up

These improvements should continue. With the exception of The Real Real, which is undergoing business model surgery, companies expect improving growth rates in the third quarter.

Consumer Behavior – Seeking Value

Consumers remain thrifty. While US unemployment is low and wages are growing, inflation is stubborn, pressuring household budgets. Additionally there’s much more competition for spending. Whereas e-commerce was the only game in town during pandemic lockdowns, that’s no longer the case. Today, travel and entertainment spending is booming. Furthermore, factors like lackluster consumer confidence, dwindling pandemic savings, and the coming resumption of student loan payments are driving consumers to eschew big-ticket items and discretionary purchases (a trend many offline retailers flagged as well2). Lastly, offline retailers sitting on excess inventory are increasingly turning to promotions, a point mentioned by Etsy, Farfetch, ThredUp, and Wayfair. Growth in this market needs to be earned.

Amazon is seeing shoppers trading down, searching for value, and focusing on basics. While discretionary spending is under pressure, demand is healthy for everyday essentials and categories like health and beauty. Amazon is leaning into this by emphasizing deals that help shoppers stretch their dollar.

ThredUp and Wayfair also saw evidence of trading down. Indeed, ThredUp attributed its accelerating revenue growth to more affluent customers looking for deals. (ThredUp is leaning into this idea in customer acquisition.) Similarly, eBay saw strong demand for refurbished items. Here’s eBay CEO Jamie Iannone3:

Clearly, inflation and rising interest rates are impacting discretionary demand. I think what makes our platform more resilient is that consumers can come here and find amazing values. So if you think about the refurbished category, which has been a focus category of ours, that grew double digits year-over-year and was the second largest contributor towards our focus category outperformance.

(For context, eBay’s GMV overall was down 2% year on year.)

Expenses: Hatchets Down, Scalpels Up

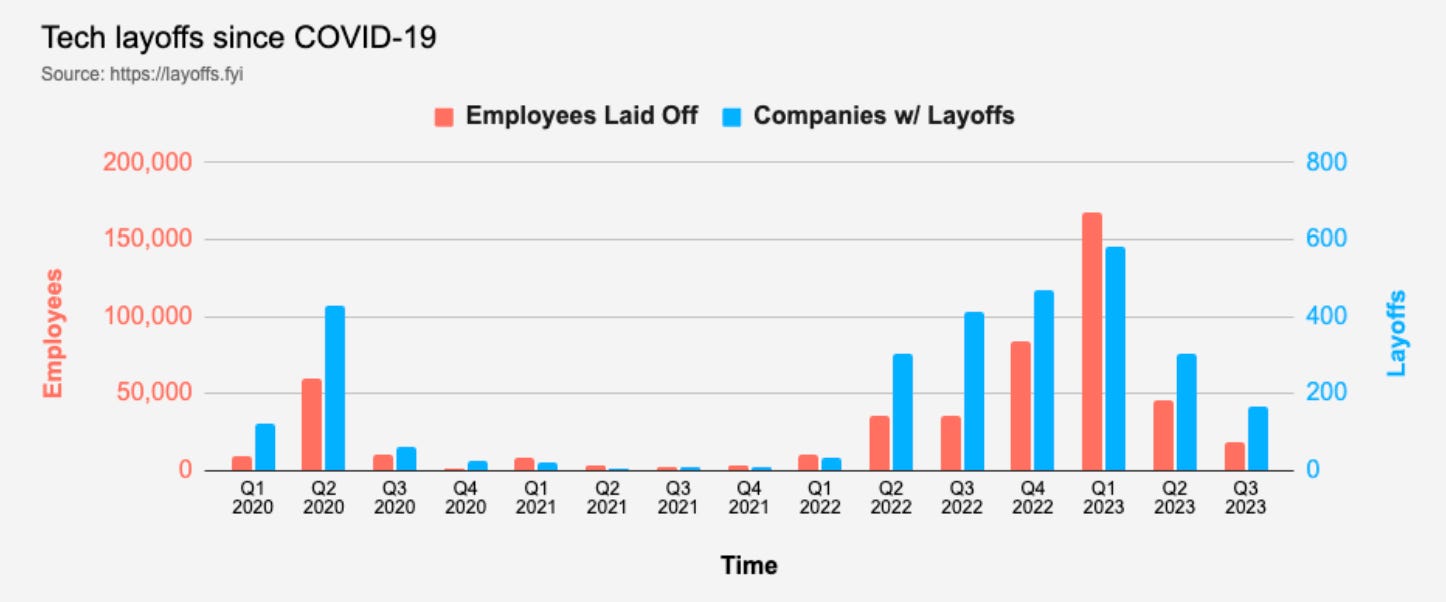

After a decade-long party fueled by cheap money, the clock finally struck midnight in 2022, turning unprofitable companies into pumpkins. Surging interest rates meant higher opportunity costs and the need for companies to deliver profitability and cash flow today. CFOs responded by reaching for the ax. The metaverse was out and the year of efficiency was in. Cost cutting reached a crescendo in the first quarter of 2023, with tech companies laying off over 150,000 employees.

E-commerce was no exception, with layoffs and cost cutting pervasive throughout the industry, from Amazon to Wayfair. Etsy is an outlier in having not conducted a layoff.

In the second quarter, CFOs replaced the hatchet with a scalpel. With the exception of Farfetch, which reduced headcount by 11% and jettisoned $150 million in operating expense, recent expense management has been smaller and more surgical. For example, Amazon and Wayfair optimized logistics and reduced last mile delivery costs, while increasing shipping speeds. By reorganizing its fulfillment and distribution network regionally, Amazon cut the number of touches and the number of miles traveled per delivery by about 20%. This resulted in faster and cheaper delivery, a win-win for Amazon and its customers4, including this new dad who often needs diapers or more burp cloths stat. Furthermore, speedier delivery spurred more orders, another indication that intelligent cost cutting can improve the customer experience.

Amazon and Wayfair weren’t alone. Etsy offloaded Elo7, a Brazilian marketplace acquired during the pandemic, as anticipated growth never materialized. Similarly, Farfetch discontinued its Beauty vertical and announced plans to divest Violet Gray, which it acquired in 20225.

Commentary from Amazon suggests that this change in posture towards expenses is broad-based. AWS, the company’s cloud computing offering, is a bellwether for tech trends. After seeing customers focus on cost optimization in the fourth quarter of 2022 and the first quarter of 2023, AWS saw a more balanced mix of cost optimizations and new workloads in the second quarter. Here’s Amazon CFO Brian Olsavsky6:

What we're seeing in the quarter is that those cost optimizations, while still going on, are moderating and maybe behind us in some of our large customers. And now we're seeing more progression into new workloads, new business. So those balanced out in Q2. We're not going to give segment guidance for Q3. But what I would add is that we saw Q2 trends continue into July. So generally feel the business has stabilized, and we're looking forward to the back end of the year.

After a year of heavy expense management, many companies seem to have the cost structure they need given current demand. But with visibility low and the economic picture still uncertain, expect CFOs to keep the ax sharp, just in case.

Harvest Season

Sometimes you need to take a step or two back in order to move forward. Over the past year e-commerce companies have slashed costs, reorganized, and gotten themselves into fighting shape. With demand improving, inflation moderating, and supply chains normalizing, leaner cost structures and more nimble businesses provide an attractive setup for expanding margins looking forward.

Shopify is a good case study. Over the past year, it has reduced headcount by over 30%, tightened marketing payback periods, reigned in operating expense growth, and divested its logistics business, a non-core money pit cobbled together through M&A. (In a move applauded by Below the Line, the company is also at war with empty calorie meetings, a fine example of addition by subtraction.) Shopify is now executing with greater speed and agility according to President Harley Finkelstein7:

The new shape of Shopify is enabling us to make faster decisions, flex with the rapid pace of technology and deliver innovative solutions that increase our merchants' odds of success.

Higher product velocity translates into more shots on goal and more incremental gains. Aggregating marginal gains drives compounding for product-led companies.

Wayfair is harvesting gains too. Since August 2022, it has removed over $1 billion in expenses, resulting in structurally higher gross margins. What’s important here is that there were no silver bullets, just lots and lots of lead, as CEO Niraj Shah noted8:

The second quarter saw gross margins exceed 30%, a milestone we've only previously accomplished during the peak pandemic period of 2020. Unlike three years ago, the improvement in gross margin and its impact on our unit economics is durable, driven by the considerable work our team has done to execute across the set of more than 70 operational cost savings initiatives that we've talked about in recent quarters.

When you save a penny here and a fraction of a penny there, and you multiply that across millions of orders, it adds up.

Though its prospects remain shaky due to a troublesome combination of high cash burn, debt, and a weak balance sheet, The Real Real deserves credit for making difficult tradeoffs to transform its P&L. The company has gone through a reset focused on improving consignment unit economics including a focus on higher-value (and higher-margin) sales, reducing owned-inventory, and intentionally throttling back on low-value orders which were empty calories producing a lot of GMV, but no margin. This is probably the starkest tradeoff of growth for profitability in e-commerce, with the company realizing higher gross margins, higher average order volumes, and improving margins, but seeing growth move from steadily positive to sharply negative. (The midpoint of third quarter guidance implies that revenue will be down 9% year on year compared to up 4% in the first quarter.) These moves exemplify how the pendulum has swung from growth-at-all-costs to sustainable growth, profitability, and free cash flow generation.

After being a headwind for the past year, macro is starting to help, amplifying self-help actions. To be clear, the economic environment isn’t all rainbows and unicorns, but headwinds are dissipating. For example, Amazon and Wayfair mentioned that inflationary and supply chain pressures are easing. Fuel, freight, and rail rates are coming down. As supply chains normalize, firms need to hold less inventory, improving working capital efficiency and potentially ROIC. After a long Covid hangover, this feels like a good place to be.

The Robots Are Coming: AI Everywhere

It wouldn’t be a 2023 e-commerce earnings call – or any 2023 earnings call for that matter – without a mention of AI. Companies were quick to tout how AI applications are already improving operations. For example, Wayfair is using generative AI to provide customer service reps with draft scripts to answer customer questions, reducing the cost per answer and increasing responsiveness. eBay is using AI to populate metadata and item descriptions based on uploaded photos. Amazon expects the AI gold rush to benefit AWS. These features often have cringeworthy names like eBay Magic Listing or Shopify Magic.

While a magician never reveals his secrets, behind the magic there are two clear areas where AI can help e-commerce companies: customer support (a major cost center) and supply growth (reducing the drudgery for sellers of nuts and bolts tasks like writing item descriptions and touching up photos). There’s potential to reduce costs and build supply by reducing friction thereby improving marketplace liquidity. But it’s still early and business buzzwords come and go. Remember NFTs? For now, it's best to pair all the AI buzz with a review of the Gartner Hype Cycle. So far the talk seems to surpass the results.

🛍 If you’re finding this content valuable, consider sharing it with friends or coworkers.

🛍 For more like this, consider subscribing.

More Good Reads and Listens

Past quarterly e-commerce reviews from Below the Line: Q1 2023 – Nature is Healing, Q3 2022 – Naughty or Nice? (Part 1), Q3 2022 – Naughty or Nice? (Part 2), Q2 2022 – Slimming Down (Part 1), Q2 2022 – Slimming Down (Part 2), Q1 2022 – An E-commerce Recession (Part 1), Q1 2022 – An E-commerce Recession (Part 2).

Disclosure: The author owns shares in Shopify.

Wayfair, Q2 2023 Earnings Call, August 4, 2023.

For example, Walmart said this on their Q2 2023 earnings call:

Sales of general merchandise kitchen tools like hand blenders and stand mixers have inflected higher as customers are preparing more food at home. They're also buying more necessities and focusing on lower-priced items and brands.

eBay, Q2 2023 Call, July 26 2023.

Amazon, Q2 2023 Call, August 3, 2023.

Connecting a few loose threads: one takeaway from Etsy (Depop and Elo7), Farfetch (Violet Gray), and Shopify (Deliverr and 6 River Systems) is that M&A is hard to pull off successfully. Many of these acquisitions were made in the go-go market of 2021 and 2022. Frothy markets can boost executives confidence in shelling out for M&A, but they also increase the risk of overpaying.

Amazon, Q2 2023 Call, August 3, 2023.

Shopify, Q2 2023 Earnings Call, August 2, 2023.

Wayfair, Q2 2023 Earnings Call, August 4, 2023.